April 16, 2014

Unlicensed Real Estate Agent Costs Brokerage $6.6 Million Commission

What tasks can real estate brokerages assign to employees lacking a real estate license? What risks does a brokerage run from allowing unlicensed agents to manage relationships with clients and other parties to the transaction? On April 4, 2014, Judge Anthony Trenga decided that a prominent commercial broker forfeited a $6.6 million dollar commission because a leading member of its team lacked a Virginia salesperson’s license. This blog post discusses how the brokerage lost the commission on account of the unlicensed manager.

The Hoffman Town Center is a 56 acre mixed-use development in Alexandria, Virginia. (Yours truly lived in Alexandria for 9 years. AMC Hoffman was my local movie theater. I ran across the finish line in the George Washington’s Birthday 10K race at the Town Center.)

The Landlord, Hoffman Family, LLC, sought office tenants for the development. In August 2007, Hoffman retained Jones Lang LaSalle Americas, Inc. (“JLL”) as its leasing agent. JLL itself has a valid Virginia broker’s license.

In October 2007, Arthur M. Turowski retired from the U.S. General Services Administration. JLL hired him as a Senior Vice President and assigned him to manage the Hoffman account. Torowski saw an opportunity to lease the property to the National Science Foundation. He marketed the property to the GSA, who successfully bid on behalf of the NSF. Turowski negotiated with GSA and city officials. He signed documents on behalf of JLL. In May 2013, Turowski achieved a $330 million lease for his client from the federal government. The NSF will be an anchor tenant in the development. See Jonathan O’Connell, Wash. Post, Judge Rules for Developer in $6.6 million National Science Foundation Suit.

Mr. Turowski helped Hoffman outshine other suitors and land a sought-after tenant. Unfortunately JLL made one oversight: Turowski lacked a real estate agent’s license while performing the work. Hoffman discovered this fact while defending a lawsuit brought by JLL for payment of the $6.6 million dollar commission (JLL rejected Hoffman’s offer of $1 million).

In its ruling, the U.S. District Court for the Eastern District of Virginia discussed the broad scope of activities for which Virginia law requires a license:

1. Activities Requiring a Licence. The legal definition of “real estate salesperson” is “clearly intended to capture the realities and breadth of activities that make up the leasing process.” This strengthens the real estate sales profession by recognizing business realities and restricting the scope of activities unlicensed persons may engage in. Va. Code Sect. 54.1-2101 “Negotiation” is a broad professional activity not limited to agreeing to a property and a price and signing documents.

2. Activities Not Requiring a License. The Virginia Code provides for a narrow set of activities an employee of a broker may do without a license, such as (a) showing apartments if the employee also works on the premises (b) providing prospective tenants with information about properties, (c) accepting applications to lease and (d) accepting security deposits and rents. Va. Code Sect. 54.1-2103(C). These do not include relationship management and negotiation on behalf of a client. JLL’s lawyers argued that Turowski did not engage in activities requiring a license. If that was the case, what licensee-level work earned the commission? The opinion notes that GSA opted to deal with some matters with Hoffman directly because JLL represented other landlords competing for the NSF tenant.

Judge Trenga found that Virginia law required Turowski to hold a license to work under JLL’s agreement with the Hoffman Family. Since he did not, the Court denied JLL’s request for any portion of the commission. The Court observed that a realtor agreement between an unlicensed agent and a client is void. JLL did have a broker’s license and Hoffman’s contract was with JLL. However, Virginia law does not allow brokers to use unlicensed employees as sales persons. The Court decided that JLL’s use of Turowski voided its commission. Even if a listing agreement is valid at the time it was signed, if the brokerage performs under it through an unlicensed salesperson, that performance violates public policy and voids the commission.

The opinion does not discuss whether any other JLL personnel worked on the Hoffman account. I wonder whether JLL would have received a monetary award if licensed sales persons performed some of the work? Perhaps the outcome would have been less harsh if Turowski was not the leader?

Could a licensed real estate sales persons have achieved a greater result for Hoffman? The opinion does not discuss specific damages that arose out of JLL’s failure to use licensed sales persons in performance of the agreement. The underlying agreement was not per se void. In the end, Hoffman got a $330 million lease negotiated by an (unlicensed) agent with deep familiarity with the agency he negotiated with. Unless the verdict is disturbed on appeal, Hoffman does not have to pay anything except its attorney’s fees defending this suit.

Daniel Sernovitz of the Washington Business Journal observes that this litigation gave both the developer and the broker black eyes. Sernovitz points out that JLL’s lawsuit cast a cloud over the project. The possibility of reversal on appeal keeps a shadow of doubt on whether Hoffman will have an extra $6.6 million to help finance the next phase in the development. Lastly, the Hoffman-JLL relationship was mutually beneficial prior to this fee dispute. JLL’s relationships could procure additional tenants. Hoffman may have to rely upon other brokerages moving forward.

Do you think that use of an unlicensed real estate agent presents the same risk to residential brokers?

case cite: Jones Lang LaSalle Americas, Inc. v. Hoffman Family, LLC, No. 1:13-cv-01011-AJT, 2014 WestLaw 1365793 (E.D. Va. Apr. 4, 2014)(Trenga, J.).

April 10, 2014

Landlord Strategies for Avoiding Security Deposit Disputes

The departure of a tenant leaves the landlord with long to-do list, including listing the property for rent, evaluating applicants, repairing or remodeling the property and preparing a new lease agreement. Wrapping-up the relationship with the previous tenant can inadvertently fall to the bottom of the list of priorities. A lawsuit over the prior tenant’s security deposit can create a big distraction to the landlord after the old tenant leaves and the new one moves in. Proving damages can be a time intensive activity. Fortunately, many of these disputes are avoidable. This blog post explores seven strategies landlords may employ to avoid tenant security deposit disputes.

1. Use a Lease Appropriate to the Jurisdiction and the Property:

In urban areas of Virginia, landlords leasing out 4 or more properties must follow the Virginia Residential Landlord & Tenant Act (“VRLTA”). Similarly, District of Columbia landlords must follow the D.C. Housing Code. These sets of rules contain different provisions regarding what terms a landlord may put in a lease. They also show how the courts would interpret the lease. If the property is a condominium unit, the community will have rules and regulations governing leases in the development. Confusion is fertile grounds for conflict. Wise landlords use lease agreements adapted to their jurisdiction’s laws and the property unique situation.

2. Calculate Realtor Commissions and Routine Repairs into the Rent:

When the tenant moves out, the landlord may need a realtor to promptly market the property to a good replacement tenant. The realtor will require a commission on the rental. Even with fastidious tenants, features of the property will wear out with the passage of time. Most landlords want the property to “pay for itself” out of funds from tenants. During a transition, the previous tenant’s security deposit appears as low-hanging fruit. However, the landlord’s interests are best served by having the property pay for these expenses over the term of the lease out of ordinary rent. Landlords should account for more than mortgage payments, insurance, association fees and real estate taxes in the rent. The decision to rent the property requires a full cost analysis in addition to review of what the market will bear. The security deposit is for damage that exceeds ordinary wear over the period of the tenancy.

3. Conduct an Inspection of the Property Prior to the Tenant’s Move-In:

If the landlord and tenant end up litigating over the security deposit, the Court will hear evidence of the difference in the condition of the property between the move-in and the move-out. Whenever a property is in transition or dispute, a thorough, documented inspection is invaluable. I have previously blogged about property inspections in my “Navigating the Walk Through” post series. Before the tenant moves in, the landlord should conduct an inspection, take photos and provide a simple report to the tenant. The VRLTA requires the landlord to provide the tenant with a move-in inspection report. This can save the landlord tremendous time later on.

4. Provide the Tenant Notice and Inspect the Property Again at the End:

Both the VRLTA and the D.C. Housing Code require landlords to provide tenants notice of the final inspection. The close-out inspection should be conducted within three days of when the tenant returns possession. This requires the landlord and his agent to focus on the departing tenant, new renter, realtors and contractors simultaneously. Some inexperienced landlords put off focusing on the previous tenant’s security deposit until after any renovations are done and the new tenant is in. Savvy landlords recognize the significance of the condition of the premises at the time the previous tenant departs. After the property has been renovated and the new tenant has moved in, the condition of the property cannot be documented post-hoc.

5. Retain and Store Damaged Fixtures Replaced Between Tenants:

When contractors replace fixtures in a rental property, usually they throw the replaced ones away to clean the job site. If the landlord intends to deduct those damaged fixture from the security deposit for damaged fixtures, he should consider retaining them as real evidence. Some damages don’t photograph well. If the tenant later complains about the deduction, the landlord can then offer to let the tenant inspect the physical items. A tenant will think twice about filing suit knowing that the landlord will bring the disputed fixtures to court. Few landlords do this. Even if they tell the contractor, the manager may not remind the employees accustomed to cleaning up the site. This requires extra attention to detail, but may be convenient to some landlords. Some bulky or fragile items may not be suitable as trial exhibits.

6. Provide an Itemized List of Deductions Supported by the Inspection:

Under the VRLTA and the D.C. Housing Code, the landlord has 45 days to provide the tenant with the security deposit refund and the written list of deductions. If the tenant disputes the list, the landlord may desire to later add additional items not included on the list to aggressively respond to the lawsuit. However, the Court may deem any items not listed as waived. The deductions included on the list should be those supported by the final inspection documentation. Note that the landlord cannot deduct for ordinary wear and tear. The definition of “ordinary wear and tear” is flexible. I like to understand it as normal depreciation over the life of the item’s normal use. If any refund is made, the tenant may be entitled to interest.

7. Provide Strong Customer Service:

Whether a landlord is renting out a room to a summer intern or leasing a single family home for a year to a large family, he owes it to himself (and the tenants) to manage the property like a business, including a commitment to strong customer service. A happy tenant can save a landlord a realtor’s commission by referring a new tenant. Where the realtor may also get referrals by establishing rapport with the departing tenant.

Can you think of any other strategies for landlords to prevent or resolve legal disputes with departing tenants?

photo credit: Jem Yoshioka via photopin cc

April 3, 2014

Commercial Leasing: New Developments in Acceleration of Rents

How much unpaid rent can a landlord of a commercial property collect against a tenant who has fallen into default? Arlington attorney John G. Kelly explored this issue in his blog post, Acceleration of Rents: Part 1, How to Ensure It’s Enforceable? Acceleration of Rents provisions typically give the landlord the right, after default by the tenant, to demand the entire balance of the unpaid rent under the lease paid in one lump sum. Without such a term, a Virginia landlord is only entitled to possession of the premises or to collect each rent payment as they become due. The landlord has no duty to mitigate his damages by re-letting the premises unless such is required by the terms of the lease. Kelly’s post shows that although this is a significant issue, there haven’t been many Virginia case opinions guiding landlords, tenants and their advisors. Kelly discusses a 1996 Virginia Circuit Court opinion that acceleration of rents provisions are enforceable unless they constitute a “penalty.” This reflects a concern that a landlord may be unjustly enriched if it receives accelerated rents under the defaulted lease and rents from a new tenant for the same premises. In the country there is an expression, “Pigs get fat, hogs get slaughtered.” As we will see, this principle may carry weight even when there is no affirmative duty to mitigate damages.

In September 2013, a new federal court opinion illustrated how acceleration of rents provisions may be enforced against tenants. A Federal Judge sitting in Lynchburg, Virginia awarded accelerated rents as damages arising from default of a lease of a nursing home property. Landlord Elderberry owned a 90-bed nursing facility in Weber City in Southwest Virginia. Elderberry rented it to ContiniumCare of Weber City, LLC to operate the nursing home. Continium continued to pay rent until March 2012. Three months later, the Virginia Department of Health & Human Services terminated the nursing home’s Medicaid Provider Agreement. Elderberry terminated the lease by letter in August 2012. Continium then vacated the premises. The property required substantial repairs and renovations for further use as a Medicaid facility. In January 2013, Elderberry re-let the premises to Nova, a new nursing home tenant.

The parties litigated this case heavily through extensive motions practice, discovery and a multi-day trial. Today’s blog post focuses on the Court’s interpretation of the acceleration clause provisions in the nursing home lease. The tenant asserted that the acceleration of rent provision was not enforceable because it constituted an impermissible “penalty” above and beyond fair compensation for actual damages.

Elderberry did not have a legal obligation to mitigate its damages. The landlord nonetheless gave the tenant credit for rents already collected from the new tenant and scheduled to be paid in the future for the term of the prior tenant’s lease. In addition to other damages, the Federal District Court awarded Elderberry $278,228.58 in unpaid rent up until the replacement tenant began paying rent and $125,857.04 in shortfall between the two leases. The court observed that the landlord’s efforts to invest its own funds into repairing and remodeling the premises mitigated tenants’ damages and returned it to functional use to Medicaid patients faster.

To secure a new lease, the landlord provided to the new tenant $588,708.60 in working capital above and beyond renovations and replacement furnishings invested in the premises by Elderberry. The defaulting tenants complained that Elderberry would receive a windfall if awarded both this working capital and the rent shortfalls. The Court observed that the landlord is entitled to rent increases under the new lease based on the amount of working capital provided. However, the shortfall is adjusted accordingly to prevent any windfall. The Court found the working capital to be a necessary incentive to a new tenant to take over the space and begin making rent payments mitigating the damages.

Retail leasing attorney Ira Meislik observes in his blog that the modern trend is for courts to interpret leases less like land conveyances and increasingly like commercial contracts. See his 2012 post, How Much Can a Landlord Collect from an Evicted Tenant? Elderberry illustrates how even in “land conveyance” states like Virginia, reasonable efforts to mitigate damages can facilitate the collection of the balance of accelerated rents. Avoiding unnecessary windfalls is a principle that underlies both mitigation of damages and the prohibition against penalty provisions in leases. In this case, the landlord re-let the premises before trial but after filing suit against the tenants. Like in many cases, the facts continued to develop after the lawsuit began. By adjusting their trial strategy to give a re-letting credit, Elderberry avoided asking for damages that tenants could easily argue were a windfall and hence a penalty. It is not clear whether Elderberry will actually collect all or even some of this judgment, but they did avoid getting “slaughtered” at trial.

The Defendants appealed the Western District of Virginia’s award of damages, and as of this blog post the Elderberry case is now on appeal before the U.S. Court of Appeals for the Fourth Circuit.

photo credit: pcopros via photopin cc (photo of a Lodge in Scott County, Virginia [same county where Weber City is situated]. Does not depict premises discussed in blog post)

March 20, 2014

“Is This a Film?” Video Within Video in the Justin Bieber Deposition

How is technology used in deposition and trials? Last week I attended Technology in Fairfax Courtrooms: Come Kick Our Tires!, a Continuing Legal Education seminar sponsored by the Fairfax Bar Association. This program interested me because real estate and construction cases are rich in photographs, plats, large drawings, sample construction materials and other visual evidence. Courts across Virginia are installing high-tech equipment for use in presenting pictures, video, audio and other media in trials. This seminar is a useful overview of the technological sea change in trial practice, including presenting audio and visual recordings of depositions at trial.

The credibility of a party’s testimony is at the heart of any trial. Sometimes parties and other witnesses will change their testimony. Lawyers use deposition records to test credibility on cross-examination. A video or audio recording can recreate the deposition vividly for the jury. Impeachment by video is not a feature of most trials because of significant time and expense associated with use of the technology.

At the courtroom technology seminar, someone mentioned pop music superstar Justin Bieber’s March 6th video deposition. This video leaked to the news media. The lawsuit alleges that Mr. Bieber’s entourage assaulted a photojournalist. I usually avoid following the news about celebrities’ depositions. I am familiar with the usual witness behavior. I’ve taken depositions of parties, experts and other witnesses. A celebrity may not be any more prepared for a deposition than an ordinary person. I watched excerpts of the Justin Bieber deposition on YouTube to see if it illustrated any new strategies.

In one excerpt, attorney Mark DiCowden shows a video of a crowd of people next to a limousine. Mr. Dicowden asked Bieber to look at the “film” on a screen behind the witness. The witness glances at the screen, turns back to DiCowden and evasively responds, “Is this a film?” DiCowden tried to focus Bieber on the video to establish a foundation for questions. As a viewer, I struggled watching the screen within a screen while following the examination. To capture Justin Bieber’s interaction with the video, the court reporter zoomed out, making both the video and Bieber smaller. If counsel tried to use this at trial, I imagine the jurors, sharing monitors, would struggle with this as well, with the added distraction of live court action. Justin Bieber’s evasive remarks and body language stand out here in what might otherwise be a disjointed use of technology. Since only excerpts are available, it is difficult to determine whether he went on to actually answer substantive questions about the video.

I wonder whether Plaintiff’s decision to incur the expense of this video deposition (and any related motions) will ultimately be useful for settlement or resolving the case in the courtroom. How will the deposition record look to the jury weighing the credibility of the witness? The Justin Bieber deposition provides some insight into use of video exhibits within a video recorded deposition. Getting an adverse witness to alternatively focus on questions and a video playing behind him is a challenge.

Even if your case does not involve celebrities, a practice run helps to prepare you for a video deposition. For example, the attorney taking the deposition could experiment with different layouts for the camera, people, screen and other visual exhibits to see how they look on replay. On the other side, the witness may learn something from viewing a video of himself answering practice deposition questions. Retain a lawyer with trial and deposition experience with evidence similar to your dispute.

featured image credit: Steven Wilke via photopin cc

March 6, 2014

How Should the Courts Determine Mortgage Fraud Restitution?

James Lytle and Martin Valadez ran a mortgage fraud operation. They submitted falsified applications and loan documents to mortgage lenders to finance the sale of real estate to straw purchasers. For procuring the purchasers and loans, Messrs. Lytle & Valadez obtained kickbacks from the sellers out of proceeds of the sales. See Mar. 15, 2009, “Amid Subprime Rush, Swindlers Snatch $4 Million.” Benjamin Robers was one of these “straw men.” Mr. Robers signed falsified mortgage loan documents for the purchase of two homes in Walworth County, Wisconsin. Lytle & Valadez paid Robers $500 per transaction.

Robers soon fell into default under the loans. A representative of the Mortgage Guarantee Insurance Corporation (“MGIC”) testified about its losses and those of Fannie Mae regarding one of the properties. American Portfolio held the lien on the other property. Robers pleaded guilty (as did Lytle & Valadez). In Robers’ sentencing, the Federal District Court based the offset value of the real estate on the prices obtained by the financial institutions in the post-foreclosure out-sales. The court ordered restitution of $166,000 to MGIC and $52,952 to American Portfolio.

What is restitution? Restitution is the restoration of the property to the victim. The term also encompasses substitute compensation when simply returning the defrauded property is not feasible. For mortgage fraud restitution, the outstanding balance on the loan is easy to calculate. More difficult is adjusting the loan balance for the foreclosure. In a criminal case, how much of an off-set is the defendant entitled for the home when the bank forecloses on it? On February 25, 2014, lawyers argued this question before the U.S. Supreme Court. Later this term, the Court will decide how to offset the foreclosure against the loan amount. Defendant Robers argues that the proper amount is the fair market value of the property on the date of the foreclosure. The government and the victim banks maintain that it should be the price that the bank actually sells the property to the next owner.

U.S. v. Benjamin Robers:

These questions came before the Court in Benjamin Robers’ an appeal from the Seventh Circuit Court of Appeals and the Eastern District of Wisconsin. Robers argued that the Court wrongfully held him responsible for the decline in value of the homes between the dates of the foreclosure and the out-sales. He wants the Fair Market Value (“FMV”) of the property on the date of the foreclosure to serve as the proper off-set amount in the restitution award.

U.S. Mandatory Victims Restitution Act:

Under the Federal Mandatory Victims Restitution Act, when return of the property to the victim is impractical, the monetary award shall be reduced by, “the value (as of the date the property is returned) of any part of the property that is returned.” 18 U.S.C. section 3663A(b)(1). In mortgage fraud, the real estate is collateral. Usually the lender does not convey real estate to the defendant in the original sale. Rather, the defendant defrauded the lender out of the purchase money. At what point during the foreclosure process is the “property” “returned” to the victim? In oral argument, some of the Justices didn’t seem entirely convinced that the statutory return of the property language even applies. Justice Scalia observed that the banks were not actually defrauded out of money; the money went to the sellers. The banks thought they were getting a borrower who was more likely to repay over the course of the loan than he actually was.

Robers argues that since title passes to the lender at the foreclosure, that is the “date the property is returned” for purposes of calculating restitution. He argues that Fair Market Value of the property at the time of the foreclosure is the proper off-set amount. This is consistent with decisions of some federal appellate courts.

Foreclosures in Virginia:

Note that in Virginia, and in some other states also practicing non-judicial foreclosure, formal title does not pass at the foreclosure sale. That is when the auction occurs and the bank or other purchaser acquires a contractual right to the auctioned property. The bank or other purchaser disposes of the property after obtaining a deed from the foreclosure trustee.

Government Sides with Victimized Lenders:

In Robers, the Seventh Circuit Court of Appeals agreed with the government and the financial institutions. The court pointed out that banks are in the money business, not the real estate investment business: “The two cannot be equated. Cash is liquid. Real estate is not.” Obtaining title to the real estate collateral at the foreclosure sale gives the bank something that it must take further steps to liquidate into cash that can be re-invested elsewhere. As the new owner of the property, the lender must cover management, taxes, utilities, insurance and other carrying costs. Any improvements to the property likely suffer depreciation during any unoccupied period.

The Seventh Circuit observed that the Courts which adopt a contrary position ignore, “the reality that real property is not liquid and, absent a huge price discount, cannot be sold immediately.” What is the relationship between the liquidity of real estate and a Fair Market Value appraisal? Federal law contains a definition of FMV:

‘The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.’ 26 C.F.R. Sect. 20.2031-1(b), cited in, U.S. v. Cartwright, 411 U.S. 546, 551 (1973).

The FMV of property, “. . . is not determined by a forced sale price.” 26 C.F.R. Sect. 20.2031-1(b) The price to liquidate property immediately would be a forced sale, and hence not represent FMV. An appraisal seeks to value real estate in cash terms. If the seller makes dramatic compromises on price to sell a property immediately, that same is not a good comparable sale in a FMV approach.

The Seventh Circuit decided that “Robers, not his victims, should bear the risks of market forces beyond his control.” A bank agrees to accept real estate as collateral for a loan on the premise that the loan application is not fraudulent. A bank is in the real estate investment business when it lends money under these circumstances. The risk that it may become saddled with a foreclosure property later is managed in its underwriting process. In the case of fraud, the “you asked for collateral, now you get collateral” defense is not appropriate. Participants in organized mortgage fraud will not be deterred if the restitution award includes no more than a deficiency judgment awarded in a civil case.

The Seventh Circuit equates “FMV at the foreclosure date” with “liquidation at the foreclosure date.” However, the FMV approach seeks to avoid the downward pressures on price associated with compelled liquidation. The Seventh Circuit does not discuss the FMV method in detail. They likely inferred that the financial institution lenders would incur carrying costs between the foreclosure and the future date when the market allows the property to be sold for near FMV. When a neighborhood suffers from a rash of foreclosures, appraisers may struggle finding useful comparable sales that aren’t short sales, deeds-in-lieu or foreclosures.

Daniel Colbert, blogger for the American Criminal Law Review, points out that the bank has greater control over how market changes affect the out-sale price than the defendant’s fraud. Nov. 26, 2013, Foreclosing Restitution: When Has a Lender’s Property Been Returned? If the victim still owns the foreclosed property at the time the court sentences restitution, does it get both the house and the full restitution award? Such a result seems unlikely with most institutional lenders. Justice Breyer suggested that in such a case, the court would require an appraisal if the lender doesn’t want to sell within 90 days after sentencing.

Interest of Mortgage Investors in U.S. v. Robers:

Unfortunately, mortgage fraud schemes like Lytle & Valadez’s occurred in Virginia as well. Financial institutions holding mortgages on distressed properties cannot wait upon the outcome of a mortgage fraud prosecution. They must timely represent the interests of their investors. When to foreclose and re-sell the property is a business decision. A Supreme Court decision in favor of the government would strengthen mortgages as an investment. Tougher restitution awards would deter perpetrators of mortgage fraud. Mortgage investors can mitigate their losses in mortgage fraud cases by documenting the expenses they incur as a result of the fraud. To the extent such a borrower has any ability to pay, he will heed a restitution sentence more than an ordinary deficiency judgment.

photo credit: Marxchivist via photopin cc

February 25, 2014

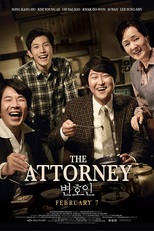

Reel Property: “The Attorney” and the Appearance of Justice

(This post is the second and final part in my blog series about the 2013 South Korean film “The Attorney.” Part I can be found HERE)

“The appearance of justice, I think, is more important than justice itself.”

Tom C. Clark explained in an interview why he resigned as a Justice of the U.S. Supreme Court. President Lyndon Johnson wanted to appoint Clark’s son, Ramsey, as U.S. Attorney General. The Constitution does not forbid a father from sitting on the Supreme Court while his son heads the Department of Justice. Tom Clark observed that although his son may not have anything to do with particular D.O.J. cases before the Supreme Court, the public would associate the outcome of the cases with the father-son relationship. The public develops its perceptions of the justice system more from news reports than personal experience. These perceptions help form the rule of law.

Tom C. Clark explained in an interview why he resigned as a Justice of the U.S. Supreme Court. President Lyndon Johnson wanted to appoint Clark’s son, Ramsey, as U.S. Attorney General. The Constitution does not forbid a father from sitting on the Supreme Court while his son heads the Department of Justice. Tom Clark observed that although his son may not have anything to do with particular D.O.J. cases before the Supreme Court, the public would associate the outcome of the cases with the father-son relationship. The public develops its perceptions of the justice system more from news reports than personal experience. These perceptions help form the rule of law.

The 2013 Korean film “The Attorney” reminded me of Justice Clark’s interview. This film is loosely based on the 1981 Busan Book Club Trial. In that case, attorney Roh Moo-hyun, the future President of S. Korea, defended a young man against terrorism charges supported by a written confession procured by torture of the defendants. A few days ago, I blogged about the first half of this film which focused on the attorney’s success building a real estate title registration practice. Today’s post explores the court drama at the climax of the movie.

The 2013 Korean film “The Attorney” reminded me of Justice Clark’s interview. This film is loosely based on the 1981 Busan Book Club Trial. In that case, attorney Roh Moo-hyun, the future President of S. Korea, defended a young man against terrorism charges supported by a written confession procured by torture of the defendants. A few days ago, I blogged about the first half of this film which focused on the attorney’s success building a real estate title registration practice. Today’s post explores the court drama at the climax of the movie.

One evening, lawyer Song Woo-seok (pseudonym for Mr. Roh, played by actor Song Kang-ho) entertains his high school classmate alumni at a restaurant managed by his old friend Choi Soon-ae (Kim Young-ae) and her teenage son, Park Jin-woo (Im Siwan). Song gets into a drunken argument with a journalist who defends the motives of student groups protesting the 1979 military coup. Song is a high school graduate who studied for the bar exam at night after working all day on construction sites. He struggles to understand the students’ idealism. Choi and Park are disappointed and angry about the property damage from the fight at their restaurant.

In a later scene, Park Jin-woo attends a book club meeting, where female students flirt with him about romantic content in a novel. The authorities raid the meeting and secretly take the students, including Park, into custody. Mrs. Choi searches for him all over Busan, even visiting the morgue. After many days, the authorities informed her of Park’s pending trial for crimes against national security. Choi begs Song to defend Park. Song’s loyalty to Choi and his journalist classmate overcome his reluctance to accept a perilous, politically-charged criminal case.

1. Personally Investigate the Real Property Before Trial

When attorney Song and Mrs. Choi visit Park in jail, his fatigued body is covered with bruises. Song interviews Park and his co-defendants about their arrest and detention. They describe the sounds of the street they heard from inside the interrogation location. Song locates and explores the mysterious building.

When I started litigating real estate cases, attorney Jim Autry explained to me the importance of a discreet first-hand view of the property at issue, including value comparables supporting an appraisal. Song’s risky investigation of the decrepit building where the police conducted the interrogations reflect his real estate and construction background. This on-site investigation allows him to interpret the documents and witness statements and try the case with confidence.

2. Verdict Preferences Develop Before Conclusion of the Evidence

This trial drama defies a conventional legal analysis because the verdict appears politically predestined. Attorneys going to the theater to see taut repartee under the rules of evidence will be disappointed.

The case is tried without a jury. Beforehand, the judge privately requests that defense counsel refrain from making a lot of objections and motions in front of the news media. The judge makes several early evidentiary rulings against Song and the defendants. Everyone anticipates a show trial imposing the political will of the military junta.

Song bravely transforms the case into more than a show of power. In interrogation, the defendants signed confessions that they read British historian E.W. Carr’s “What is History?” in their book club. The prosecution presents an expert who testifies that this book is revolutionary propaganda. On cross-examination, Song shows that this is required reading in the leading universities in South Korea. Song also tricks the prosecution into admitting that the expert’s offices are in the same building as the government’s intelligence service. This challenges the independence of the expert’s opinions.

3. False Confessions

Song calls Defendant Park to testify. Park explains that he signed the confession after many days of torture by the police. When Song presents photographs supporting the witness’s testimony, the prosecution argues that the wounds were self-inflicted.

Even without torture, false confessions are a common problem in criminal justice. Virginia Lawyers Weekly recently reported that 1/4 of all convicted defendants later exonerated by DNA made false confessions. Feb. 17, 2014, “Untruth or Consequences: Why False Confessions Happen and What To Do.” “Good cop/ bad cop” routines intimidating young, vulnerable defendants often lead to “confession” of details introduced by law enforcement during interrogation. Id.

4. Effect of Visceral Reactions of Courtroom Observers on the Trial Proceedings

Park’s testimony about the torture techniques brings the courtroom audience of family members and local media to tears. The authorities replace the families on the next day with a mob seeking a guilty verdict. Song’s examination of the police detective is a failure. The officer evades Song’s questions and lectures him about the threat of terrorism.

Just as the defense seems to peter out, Song and Park get a big break. Song meets the army medic used by the interrogators to keep Park alive during the interrogation. The medic courageously resolves to testify for the defendants about the nature and extent of the injuries. Song’s journalist classmate agrees to contact international media organizations in a desperate attempt to put pressure on the authorities about the medic’s testimony. The outcome hinges on the admission and credibility of the medic’s testimony.

5. Conclusion

Hollywood court dramas indulge their audiences with conclusive vindication. “The Attorney” reminded me that a system of justice is always a work in progress. Song evolves from construction laborer to moneymaking genius to litigator. Finally he becomes a civil rights leader motivated and tempered by his training and experience.

Song voice seemed frequently shrill during the trial. Perhaps a Korean speaker can comment on whether this was persuasive or detracting.

When a case turns into an uphill battle, attorneys sometimes rationalize that, “This could be worse.” The defense counsels’ role in the 1981 Burim trial must have been one of these worst-case scenarios. Average trial lawyers succeed for their clients when they can marshal favorable law and facts through in a legal system that works well. “The Attorney” presents an extreme case showing how courage, intelligence, loyalty and tenacity can earn the respect of colleagues, and in rare cases, a nation.

Perhaps Justice Clark would have respected Roh’s commitment. The villains in “The Attorney” see the criminal justice system as a blunt weapon and propaganda medium for use against critics of the military coup. This ultimately undermines the credibility of the legal system and weakens the rule of law. Attorney Song’s courtroom theatrics aren’t to make money or to cloak his personal insecurities. He takes risks out of deep loyalty to his client. Truth, not bullying, enhances the “appearance of justice.”

February 20, 2014

Reel Property: “The Attorney” (Korean, 2013)

Before Roh Moo-hyun became a human rights advocate and President of South Korea, he was a lawyer in private practice. Director Yang Woo-seok loosely based the 2013 Korean movie The Attorney (Byeon-ho-in) on Mr. Roh’s early career. After a blockbuster run in S. Korea, “The Attorney” now appears in American theaters. On Presidents Day, my wife and I watched this film, coincidentally featuring a foreign president. “The Attorney” has his weaknesses, but captures what it means to be an advisor, entrepreneur and advocate.

Song Kang-ho plays lawyer Song Woo-seok, a fictionalized, young Roh. Mark Jenkins observes that “The Attorney” begins as a comedy about a pioneer in land registration practice in Busan, Korea. Like a lawyer changing focus mid-trial, director Yang shifts gears in the middle of the film. Song accepts the defense of a young waiter who, after brutal torture, “confessed” to fomenting overthrow of the government. See Mark Jenkins, Feb. 6. 2014, Wash. Post, “‘The Attorney’ Movie Review: An Earnest and Instructive South Korean Box-Office Hit.”

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

1. Don’t Give Up – Re-calibrate and Move On:

Song pulls himself by his boot straps by maintaining a positive outlook. Before Song conducted legal settlements of homes, he literally built them. When I watched this film, I personally identified with the title character. After a day on the job, Song washes the construction site grime off his hands and starts to study. Your humble blogger worked as a laborer for a construction company during his college years. Song studied law in the evenings in neighborhood restaurants and unfinished buildings. I attended law school in an evening program while working a normal day job. A few years ago, I discovered culinary gems in Northern Virginia’s Korean restaurants. The restaurant scenes in the movie made me feel hungry!

After dinner at a restaurant managed by Choi Soon-ae, Song skips out on the bill. The dinner money goes to buy back his pawned law books. Song motivates himself by writing “Never Give Up” on the textblock of his books and into concrete facades at work sites. Song has little education or money to support his family or pay his debts. He uses “Never Give Up” to reinforce a positive outlook in the face of adversity. Writing or sharing a constructive affirmation can overcome self-doubt or the negativity of others.

2. Fearless Niching & Frequent Networking:

After passing the bar, Song receives a judgeship. Struggling to support his family, he resigns to found a real estate registration practice. This practice is similar to that performed by title companies and settlement agents in the U.S. Song capitalizes on a rule change authorizing attorneys to do work previously restricted to notaries public. Initially, his bar association colleagues scorn him for doing work they consider beneath them. At a bar meeting, he overhears them gossiping as they sit down to eat at his table. They complain that he is out meeting people and handing out business cards. Unperturbed, Song introduces himself and hands out his cards.

After Song finds financial success, his rivals follow him into this practice area, competing for the same customers. He reinvents himself again as a tax law advisor. Song’s vision and lack of pretension distinguish him from his colleagues. He fit his own background and talents with a high-volume consumer practice. Years after failing to pay the dinner bill, the new attorney returns to Mrs. Choi’s stew-house to repay his debt. She refuses, with motherly joy for a prodigal patron, insisting that he become a regular customer.

“The Attorney” features a foreign legal system and a different culture. I relied on the subtitles to follow along. In spite of cultural and linguistic barriers, the first half of the movie shows universal entrepreneurial strategies. Another WordPress blogger, Seongyong, has great photos from the film in his post.

In the first part of the film, the director develops Song’s character as worldly, warm & family-oriented. In the second half, Song puts his career, reputation and safety on the line to oppose anti-terrorism charges based on confessions procured by torture of the client. Stay tuned to the next blog post!

February 14, 2014

George Clooney, Ken Shigley & Legal Case Selection

“Accept only cases you would be willing to take to trial.” Ken Shigley, past president of the Georgia Bar, included this in his 10 Resolutions for Trial Lawyers in 2014. There are millions of ways that lawyers convince themselves to accept a questionable case:

- “The case might lead to larger, stronger cases in the future.”

- “I’ll settle it if it seems weaker when I learn more of the details.”

- “The client seems to have an ability to pay.”

- “I don’t normally take these types of cases, but any generalist could handle it.”

- “I’ll withdraw if the client relationship deteriorates.”

Every client with a meritorious case deserves a lawyer committed to zealous advocacy. To the lawyer, the case represents an investment of time, reputation and firm resources. The larger the case, the greater the professional investment. Unfortunately, in a competitive marketplace, lawyers frequently feel pressure to accept cases that aren’t a good fit for them. However, it might be easier to agree to take a weak case than to favorably withdraw or settle it later.

In many ways, Shigley’s #1 Resolution applies to clients as well. A client may go to a lawyer with a problem. The lawyer may respond with questions, insights and a litigation proposal not anticipated by the client. Moving forward with a real estate lawsuit is usually a major decision, requiring substantial investment of time and resources that tends to escalate over the months or years prior to resolution. An expert faces the same challenges.

How does a client, lawyer or expert know whether she is willing to commit to take a case through trial (and beyond, if necessary)? This is particularly important in real estate cases where the remedy may involve more than an award of damages to one side or the other. Present and future property interests may be at stake.

In the movie theater, lawyers like fixer “Michael Clayton” or divorce attorney Miles Massey from “Intolerable Cruelty” have glib answers. George Clooney, the actor portraying both of these fictional attorneys, recently gave an interview with the Washington Post to promote his latest film, “The Monuments Men.” Ann Hornaday, February 6, 2014, “George Clooney Uses His Star Power to Keep Part of Old Hollywood Alive.” Although Ms. Hornaday seems too glowing at times in praise of Clooney, I agree with her basic assessment:

“There might not be another actor alive who so thoroughly personifies movie stardom, or deploys it so adroitly — as commodity, means of production and public trust.”

In the interview, Clooney describes how he learned the hard way which movie roles to accept or decline.

1. Choose the “Screenplay,” Not Just a Role:

In 1997, Clooney starred in “Batman & Robin,” an admittedly disastrous installment in an otherwise successful franchise: “Until [Batman & Robin], I had just been an actor . . . I had only been an actor in a TV series, and then I got ‘E.R.'” E.R. made Clooney a household name. Batman set his reputation back:

“And after I got killed for ‘Batman & Robin,’ I realized I’m not going to be held responsible just for the part anymore, I’m going to be held responsible for the movie. And literally, I just stopped. And I said, It now has to be only screenplay. Because you cannot make a good film from a bad screenplay.”

Prior to Batman, he simply looked at the part offered to him in a film. Batman taught him how being a leader or a star requires a larger commitment.

A lawyer must present his client’s case compellingly for the jury at trial. Preparing for trial requires roles: client representative, witnesses, testifying experts, jury consultants, first-chair litigator, second-chair litigator, legal assistant, general counsel, insurance counsel, and so on. The litigation equivalent to a screenplay is the outline containing all of the arguments, statements and examination questions. Unlike movies and T.V., a lawyer cannot script the behavior of any actor in the drama other than himself. Neither the lawyer or the client have a complete trial outline to go over in the initial client interview. At that point, the lawyer may receive some anticipated witness testimony and exhibit documents, but probably not all of the facts and issues. The initial case evaluation is extremely important. There is no better way to make a preliminary evaluation than in an opening memorandum.

The challenges of initial case evaluation illustrate the value of a specialized litigator to the client. Preparing a detailed proposal or opening memorandum is a feasible time investment to a professional in a niche. Reducing the initial case evaluation to a written summary allows the lawyer and client to visualize the proposed role within the larger “screenplay” and the likelihood of a win-win. BIind acceptance of larger roles in big budget matters may lead to a “Batman & Robin” result.

2. Leading a Team Through the Darkness:

Law schools do not focus on leadership and management in the core curriculum. Law firms typically structure around collegial authority, originations and billable hours. How can lawyers become great leaders and team-builders?

In addition to choosing films based on the screenplay, Clooney forged relationships with great directors such as the Coen brothers and Steven Soderbergh. In 2006, Clooney and his partners formed Smokehouse Pictures for the purpose of making movies missing from Hollywood’s contemporary repertoire. “We want it to be low-budget, dark, screwy…..We like that world a lot.” These personnel decisions may not be based on the easiest way to fill roles. Nor are they dependent upon celebrity and institutional relationships. Creative partnerships and budgets lay the groundwork for success.

3. The Lawyer’s Niche and Initial Assessment:

What can be learned from Ken Shipley and George Clooney’s resolutions? Neither of them say, “Only accept roles that guarantee or promise success.” The decision to accept or decline a role hinges on commitment to the project and others, especially the client. A litigator niched in a particular jurisdiction and practice area is best positioned to make this commitment. He is more prepared to develop a preliminary “screenplay” and draw from a network of other professionals.

photo credit: Josh Jensen via photopin cc

February 12, 2014

Court Sentences Son for Storing Inoperable Vehicles at Mom’s House in Harrisonburg

I grew up in a rural county in Virginia. Seeing broken-down cars parked in front of a house was part of the landscape. The perfect backdrop for the Blue Collar Comedy Tour. If you are waiting to get the money to fix it, where else would you store a car that doesn’t work?

In college, a friend of mine lent me his car. A tire went flat in a church parking lot. The church got tired of having a broken down car out front, week after week. The priest and I tried to change the tire. No matter how hard we pried, we just couldn’t get the wheel off. Later I learned from the owner that the wheels were welded on! I then felt like less of a wimp.

A car can be the apple of the owner’s eye. But when vehicles break down, they become an eyesore to the community. Many local governments have zoning ordinances against storing multiple inoperable vehicles outside homes without a covering screen or wall. Harrisonburg, Virginia, a college town in the Shenandoah Valley, has one of these ordinances.

The City of Harrisonburg convicted Terry Wayne Turner of violating a zoning ordinance by storing four inoperable vehicles on property owned by his mother. Terry owned the four vehicles. Although he lived with his mother, he did not own or lease her property. Harrisonburg cited him with a zoning violation for storing the four inoperable vehicles. Terry Wayne Turner v. City of Harrisonburg, No. 1197-12-3 (Va. Ct. App. Oct. 8, 2013)

At trial in the Circuit Court of Rockingham County, Terry argued that he was not liable under the zoning ordinances because he did not have title or lease to the property where he stored the cars. He argued that he was not a proper defendant in a land use case because the regulations apply to real property and their owners, not personal property like automobiles. The Court convicted Turner of a misdemeanor, ordered him to remove the vehicles and sentencing him to jail time and probation.

Mr. Turner appealed this conviction to the Court of Appeals of Virginia. He conceded that the storage of the vehicles rendered the property non-compliant with the land use restrictions. Turner focused on the fact that he was an invitee, and not an owner or tenant of his mother’s home. He argued that the scope of the zoning ordinances cannot extend to the ownership of personal property like automobiles. The Court of Appeals noted that zoning laws regulate the use and occupancy of land, not merely its lease or ownership. The ordinances do not contain specific limitations to owners or lessees of real estate. “Any person…found in violation of this chapter… shall be guilty of a class 1 misdemeanor.” The Court observed that if someone conducts a zoning violation on the property of another, that could thwart the purposes of land use restrictions.

On appeal, Mr. Turner brought up a new argument that his mother, not him, is the proper defendant in this case. She was the one who properly held a duty to make the property conform to the zoning regulations. The Court refused to consider this argument because Turner did not preserve it for appeal by presenting it to the trial judge. It is difficult from the text of the opinion to determine what role, if any, his mother played in this dispute. The Court may have found a belated attempt to shift the blame onto a family member unsavory.

Turner provides some food for thought:

- What renders a car “inoperable” for purposes of a zoning inspection? A road test? A log of how long it as been since it was moved? Removal of license plates or certain parts? Signs of wear?

- If buying a functioning car, paying for storage or taking the inoperable car for extensive repairs is outside a family’s budget, how can they maintain ownership of an automobile until they have the ability to repair it?

- Which is a greater eyesore in a residential neighborhood: (a) inoperable vehicles, or (b) walls or screens covering the area where they are parked?

- Can similar ordinances provide leverage against owners who abandon inoperable vehicles on commercial property?

- Generally, how far can zoning laws reach beyond the owners and improvements of the property to non-real estate matters before they infringe on civil liberties?

Terry Turner filed a Petition for Appeal with the Supreme Court of Virginia. As of this blog post, the Supreme Court has not yet decided whether to allow further appeal.

photo credit: lewsviews via photopin cc (Does not depict Mr. Turner’s vehicle – apparently this photo was taken in Rappahannock County)

February 5, 2014

They Might Be Mortgage Giants: Fannie & Freddie’s Tax Breaks

On January 3, 2014, the U.S. Consumer Financial Protection Bureau published a request for input from the public about the home mortgage closing process. 79 F.R. 386, Docket CFPB-2013-0036. The CRPB requested information about consumers’ “pain points” associated with the real estate settlement process and possible remedies. The agency asked about what aspects of closings are confusing or overwhelming and how the process could be improved.

The settlement statement is an explanatory document received by the parties at closing. The statement lists taxes along with other charges. The settlement agent sets aside funds for payment of both (a) the county or city’s property ownership taxes and (b) transfer taxes assessed at the land recording office. The property taxes are a part of a homeowner’s “carrying costs.” The recording taxes are part of the “transaction costs.” Typically, neither the buyer nor the seller qualify for a recording tax exemption.

The federal government advances policies designed to increase consumers’ access to affordable home loans. The Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”) provide a government-supported secondary market. They purchase some home mortgages from the lenders that originate them. The Federal Housing Finance Agency regulates these chartered corporations. In 2008, FHFA imposed a conservatorship over Fannie Mae & Freddie Mac.

In the years leading up to the crisis of 2008, Fannie and Freddie used their government sponsorship to purchase some of the higher-rated mortgage-backed securities. See Fannie, Freddie and the Financial Crisis: Phil Angelides, Bloomberg.com. As the secondary-market purchaser of these home loans, Fannie and Freddie have foreclosure rights against defaulting borrowers and distressed properties. These corporations participate in the home mortgage process from origination, through purchase post-closing, and, in many cases, subsequent foreclosure-related sales.

Congress exempts Fannie Mae and Freddie Mac from state and local taxes, “except that any real property of [either Fannie Mae or Freddie Mac] shall be subject to State, territorial, county, municipal, or local taxation to the same extent as other real property is taxed.” 12 U.S.C. sections 1723a(c)(2) & 1452(e). Which local real estate taxes does this exception apply to? The ownership tax, transfer tax, or both? The statute does not specifically distinguish between the two. Fannie and Freddie concede that they are not exempt from the tax on property. However, they decline to pay the transfer taxes assessed for recording deeds and mortgage instruments in land records. This is one advantage they have over non-subsidized mortgage investors. Local governmental entities and officials from all over the U.S. challenge Fannie & Freddie’s interpretation of the exemption statute since it represents a substantial loss of tax revenue. This blog post focuses on two recent opinions of appellate courts having jurisdiction over trial courts sitting within the Commonwealth of Virginia.

Virginia:

Jeffrey Small, Clerk of Fredericksburg Circuit Court, attempted to file a class action against Fannie & Freddie in federal court on behalf of all Virginia Clerks of Court. Small v. Federal Nat. Mortg. Ass’n, 286 Va. 119 (2013). Mr. Small challenged their failure to pay the real estate transfer taxes. The Defendants argued that the Clerk lacked standing to bring the suit for collection of the tax. A Virginia Clerk of Court’s authority is limited by the state constitution as defined by statute. In the ordinary course of recording land instruments, the Clerk’s office collects the transfer tax at the time the document is filed. One half of the transfer taxes go to the state, and the other half goes to the local government.

To resolve the issue, the Supreme Court of Virginia found that if the taxes are not collected at the time of recordation, then the state government has the authority to bring suit for its half, and the local government to pursue the other half. The Virginia clerks do not have the statutory authority to bring a collection suit for unpaid transfer tax liability. Because they lack standing, the court dismissed the clerk’s attempted class action against Fannie and Freddie for the transfer taxes.

Maryland & South Carolina:

Montgomery County, Maryland and Registers of Deeds in South Carolina brought similar federal lawsuits challenging Fannie and Freddie’s non-payment of recording taxes. See Montgomery Co., Md. v. Federal Nat. Mortg. Ass’n, Nos. 13-1691 & 13-1752 (4th Cir. Jan. 27, 2014). The Fourth Circuit also hears appeals from federal Courts in Virginia. This case proceeded further than Mr. Small’s. The Appeals Court found that:

- Property taxes levy against the real estate itself. Recording taxes are imposed on the sale activity. The federal statute allows states to tax Fannie and Freddie’s ownership of real property. The statute exempts Fannie and Freddie from the transfer taxes.

- Congress acted within its constitutional powers when it exempted Fannie and Freddie from the transfer taxes, because this may help these mortgage giants to stabilize the interstate secondary mortgage market.

- The exemption does not “commandeer” state officials to record deeds “free of charge,” because the states are free to abandon their title recording systems. By this analysis, the exemption is not a federal unfunded mandate on state governments because the decision to include a land recording system as a feature of property law is not federally mandated.

Some federal courts in other parts of the country have reached analogous conclusions. e.g., Dekalb Co., IL v. FHFA (7th Cir. Dec. 23, 2013)(Posner, J.). This legal battle wages on in the federal court system, but the results so far favor Fannie and Freddie.

Discussion:

Is abandoning the land recording system a realistic option? In Greece and other countries lacking an effective land recording system, property rights are uncertain and frequently brought before the courts for hearing. See Suzanne Daily, Who Owns This Land? In Greece, Who Knows?, New York Times. Like Fannie & Freddie, land recording systems advance the policy interests of stabilizing private home ownership.

Fannie and Freddie aren’t required to pay locally collected recording taxes. Their “share” of the overhead for maintaining the land recording system come from other sources. This includes the recording fees paid by ordinary parties in real estate closings across the country. Does this give the mortgage giants an unfair competitive advantage over other institutional investors in the re-sale of foreclosed homes?

Are these differing tax treatments properly considered in the CFPB’s discussion about the “pain points” in closings? Settlement statements provide clarity regarding the charges listed. The transfer and property taxes assessed in real estate closings are confusing and overwhelming, in part because they represent hidden costs. These hidden costs include the exemptions afforded Fannie Mae and Freddie Mac. The purpose of these institutions is to help mortgage consumers. Should the tax loophole should be closed or the hidden costs be disclosed to consumers? Perhaps one of these change would advance the CFPB’s “Know Before You Owe” initiative.

photo credit: J.D. Thomas via photopin cc. (not particular to any of the cases discussed herein)

January 31, 2014

Cold Temperatures in a Slow Economy: Insurance Claims from Frozen Pipes in Unoccupied Buildings

NBC News reported Wednesday that home insurance claims for damage resulting from frozen pipes are so high that insurers are hiring temporary adjusters to handle increased claims:

“We anticipate a large spike in frozen pipe claims,” said Peter Foley, the [American Insurance Association’s] vice president for claims. “In Washington, D.C., some of my colleagues have already had them in their own homes.”

What State Farm describes as a “catastrophe” comes while many families & communities struggle to make ends meet under the current economic conditions. These insurance claims can run as high as $15,000 in residential dwellings. A commercial property or multi-family housing can sustain even greater damages.

In many communities in Virginia, homes and commercial buildings remain vacant this winter because the local real estate market has not yet come back or the properties are only used seasonally. Frozen pipe damage is compounded in vacant buildings because:

- Few occupants take precautions to protect pipes from bursting before they move out of a building.

- Usually no one checks up on an unoccupied building when it is extremely cold. If there is a landlord, property manager, bank or other institutional investor, they aren’t likely to give a vacant building individual attention.

- No one is there to observe the damage as it develops, so greater drywall, carpet, mold, and other damage can occur.

These types of problems tend to result in litigation between the owners, banks, neighbors and insurance companies. This blog post explores three recent cases:

Hiring a Property Manager: Panda East Restaurant, Massachusetts

From 1987-2006, Issac Chow owned and operated the Panda East restaurant in Northampton, MA. Mr. Chow also purchased a house in Hadley, MA, for his employees to live in. While the restaurant was in business, Richard Lau managed both the restaurant and the house. When Panda East went out of business, all of its employees moved out of the house. Chow instructed Lau to keep the heat on in the Hadley house during the winter of 2006-07. Unfortunately, that winter the house suffered damage from burst frozen pipes. An inspector determined that the heat had been turned off. The flooding ruined carpets, furniture and drywall throughout the house.

Mr. Chow brought suit against Merrimack Mutual Fire Insurance Company in Massachusetts. On appeal, the Court could not determine what Chow did, if anything, to engage Lau as property manager for the house after the restaurant closed down. Since the employment relationship between Chow and Lau was unclear, the Court could not determine who was negligent. Chow v. Merrimack Mut. Fire Ins. Co., 83 Mass. App. Ct. 622 (2013). The Panda East case shows that:

- Cold winters are a time bomb to an unoccupied house (or other building) not winterized to prevent frozen pipes.

- Owners must consider retaining a manager or house-sitter for properties that “go dark.”

- Written property management agreements work better than verbal directions. A contract document can clearly define the scope of the manager’s responsibility.

Homeowner’s Negligence: Potomac, Maryland

In addition to suing the insurance company, some lawyers try to sue public utilities for damages arising from frozen pipes in an abandoned home. Izatullo Khosmukhamedov and Zoulfia Issaeva brought a lawsuit against Potomac Electric Power Co. (PEPCO) for leaving the electricity on in their unoccupied house, which later suffered damage from burst frozen pipes.

These Plaintiffs primarily lived in Moscow, Russia. This couple owned a second home in Potomac, Maryland. Apparently, they grew tired of paying the heating and electric bills. After a stay in October 2008, they sought to turn all of these services off. In the following winter, the pipes in the house froze, burst and caused extensive damage. They made no effort to winterize, heat the property, turn off the water main or drain the pipes. In their lawsuit, they argued that PEPCO failed to completely turn-off the electricity, thus allowing the well water pump to push water into the house, intensifying the damage.

The Federal judge in Maryland dismissed their claims on summary judgment before trial, observing that:

It is well-settled, both in Maryland and other jurisdictions, that a property owner can reasonably foresee the danger that water pipes may freeze in the winter and breaches the duty of ordinary care by failing to adequately heat and/or drain them.

Koshmukhamedov v. PEPCO, No. 8:11-cv-00449-AW (D. Md. Feb. 19, 2013)

Judge Williams dismissed Plaintiffs’ claim against PEPCO. This case illustrates skepticism shown to Plaintiffs in frozen pipe cases where they failed to take reasonable precautions.

Most residential property insurance policies specifically exclude coverage if the property goes unoccupied. In a related case, this couple also sued their property insurer, State Farm. The same judge decided that the home was “unoccupied” and thus excluded from coverage by the terms of the policy. Koshmukhamedov v. State Farm Fire & Cas. Co., 946 F. Supp. 2d 443 (D. Md. May 28. 2013)

Insurance Claims in Foreclosure: Holiday Inn Express, Burnet, Texas

On our road trip, dear reader, we first warmed ourselves up with an a la carte dim sum brunch in Massachusetts. For lunch, we had a backfin crabcake in Maryland. The last stop on our trip takes us to a beef brisket dinner in central Texas. Our final case study shows how cashflow and property damage can compound problems for a business owner facing foreclosure. This double whammy presents special challenges to the bank and property insurer as well.

In late 2009, a Holiday Inn Express franchisee stopped making its mortgage payments to the bank that had lent the money for the purchase of the hotel building in Burnet, Texas. On January 9, 2010, the hotel suffered extensive damage from frozen pipes. On January 28, 2010, the bank sent the owner a foreclosure notice. A few days later, the property insurer sent the owner and bank a payment check. This was not cashed due to the disputes between the bank and owner. The owner and the insurance company could not agree on a proper estimate for the damage from the frozen pipes.

On March 2, 2010, the bank foreclosed on the property and purchased it at the sale. The hotelier then sued the bank, insurance company and the subsequent purchaser. The former owner sued the insurance company for not fully compensating for the damage he alleged to be $133,681.62. The Court of Appeals of Texas focused on relevant language in the insurance company’s contract with the owner and the Bank’s loan documents for the hotel. Lenders typically require borrowers to maintain adequate insurance on the property. That way, the loan is adequately secured in the event that damage and default occur around the same time. Usually, a lender’s rights to the security under the loan documents are limited to the principal, interest and other indebtedness owed. A claim for insurance proceeds comes into play to the extent the foreclosure sale price does not satisfy the sums of money owed to the bank.

In Virginia, the foreclosure trustee must file an accounting with the commissioner of accounts that reconciles the indebtedness, sale price and other credits and debits that the bank is entitled to under the loan documents and law. Each state has its own foreclosure procedures.

The Texas Court of Appeals explained that the Bank was only entitled to any portion of the insurance claim proceeds necessary to satisfy any deficiency after the foreclosure. It appears that the Court sought to avoid a windfall to any party seeking to muscle the proceeds during the chaotic foreclosure period. Peacock Hospitality, Inc. d/b/a Holiday Inn Express-Burnet, 419 S.W.3d 649 (Ct. App. Tex. Nov. 27, 2013)

Neither foreclosures nor frozen pipe damage occur in a vacuum. An exceptionally focused owner might take measures to prevent catastrophic damage to a distressed property in an attempt to fetch the highest possible foreclosure sale price. When a property is in financial distress, its owners and lenders must also attend to any signficant insurance claims that may become an element of the foreclosure accounting.

Conclusion:

These three cases illustrate why, as attorney Jim Autry says, “An abandoned building is more of a liability than an asset.” Frozen pipes present a serious threat to the value and habitability of unoccupied homes and commercial buildings. Except for a few “hot” areas, much of Virginia (and the country at large) has a significant inventory of uninhabited homes and commercial properties. This winter’s cold spells present unique challenges to property managers, water utilities, banks, owners and insurance companies. When a family or business must negotiate with more than one of these parties to resolve legal issues surrounding a distressed property, an experienced attorney can provide critical counseling and representation.

photo credit:

Ryan D Riley via photopin cc (for demonstrative purposes only and does not depict any of the actual properties described in this article)

January 28, 2014

Divorce, Family Homes and Elliot in the Morning

On my Friday morning commute, I heard a guest on the radio show, Elliot in the Morning talking about his parents’ divorce, marriages and the legal fate of a family home. I rarely partake of EITM, but this time I stopped to listen (relevant portions of recording between minute marks 8:20-16:30 on YouTube).

Tommy Johnagin on Elliot in the Morning: Comedian Tommy Johnagin explained that when he was seven, his mother divorced his previous stepfather and married Johnagin’s current stepfather (none of this takes place in Virginia). The families lived in a small town. The current stepfather previously built a home with his own hands for himself and his ex-wife. When the current stepfather and his ex-wife divorced, the ex-wife got the house. Johnagin’s mother’s previous husband then married her current husband’s ex-wife (confused yet?). So Johnagin’s previous stepfather is now living in the home built with the sweat of the current stepfather’s brow. Johnagin commented to Elliot Segal: “I don’t even understand how this works.” In this portion of the interview, I was impressed with how Johnagin weaved some earthy insights into family life with funny personal narrative, such a recent chance encounter with the previous stepfather in the checkout line at the local Wal-mart.

What are the ways a family home can possibly reach this kind of outcome in divorce? Although the facts are different, the Supreme Court of Virginia published a January 10, 2014 opinion, Shebelskie vs. Brown, that discusses a possible route.

Betty & Larry Brown in the Virginia Court System: Betty and Larry Brown completed a divorce in Florida. One of their homes was Windemere, a landmark Tudor mansion in Richmond. (V.L.W. subscribers see July 22, 2013, “A Partition Suit Blows Up,” Virginia Lawyers Weekly) Sometimes, when an out-of-state divorce requires divvying up Virginia property, the parties will file an Equitable Distribution action in Virginia and the house matter will be referred to a court-appointed Commissioner. For reasons not discussed in the court opinion, this phase of the Brown divorce did not proceed this way. Instead, Larry filed a partition suit in Richmond, seeking an order that Windemere be sold.

In Virginia, when co-owners of real estate cannot agree on what to do with real estate, one party may file with the court a request for Partition and a Judicial Sale. See, Va. Code section 8.01-81, et sec. Partition traditionally involves dividing the parcel equitably into smaller parcels. When the land cannot conveniently be divided into smaller chunks because that would destroy the value of any improvements, the Court will usually grant a sale of the entire property. The monetary proceeds of the sale are then divided. Lawyers try to use partition suits as a last resort because they are a very expensive way to sell a house and more likely to lead to further title litigation. The deputy clerk called the Browns’ names week after week on the Richmond Circuit Court motions’ docket. The Court ordered a Judicial Sale. Finally, Betty obtained confirmation from the Court that she could go to closing on the house to buy-out Larry. The facts suggest that spousal support owed by Larry would end up helping to pay for the buy-out.

In the trial court, the parties litigated over attorneys’ fees and awards of sanctions issued by the judge against some of the attorneys. On appeal, the Supreme Court of Virginia reversed the sanctions award. (I invite my trial lawyer readers to take a look at the Court’s interpretation of the term, “motion” in the sanctions statute)

The Stepfather’s House, Revisited: How does the house that one man built for himself and his family end up in the possession of his ex-wife and his current wife’s ex-husband? Most likely, the home was part of the marital estate in the divorce and went to the ex-wife either in a settlement or by court order.

In a way, Tommy Johnagin’s current stepfather should be flattered that both his ex-wife and her subsequent husband desired the house he built. As a builder, he can construct another one.

In the interview, Johnagin commented that he felt content with the stepfather he got in the step-parent “lottery.” In the end, a good stepfather makes a bigger difference in someone’s life than title to a mansion or an appellate court victory.

photo credit: » Zitona « via photopin cc