May 6, 2014

Mortgage Fraud Shifts Risk of Decrease in Value of Collateral in Sentencing

On March 5, 2014, I blogged about the oral argument before the U.S. Supreme Court in U.S. v. Benjamin Robers, a criminal mortgage fraud sentencing appeal. At stake was how Courts should credit the sale of distressed property in calculating restitution awards. The U.S. Court of Appeals for the Seventh Circuit interpreted the Mandatory Victims Restitution Act to apply the sales price obtained by the bank selling the property post foreclosure as a partial “return” of the defrauded loan proceeds. Robers appealed, arguing that he was entitled to the Fair Market Value of the property at the time of the foreclosure auction. According to Robers, the mortgage investors should bear the risk of market fluctuations post-foreclosure because they control the disposition of the collateral. See Mar. 5, 2014, How Should Courts Determine Mortgage Fraud Restitution?

Yesterday, the Supreme Court affirmed the re-sale price approach in a unanimous decision. The Court observed that the perpetrators defrauded the victim banks out of the purchase money, not the real estate. The foreclosure process did not restore the “property” to the mortgage investors until liquidation at re-sale.

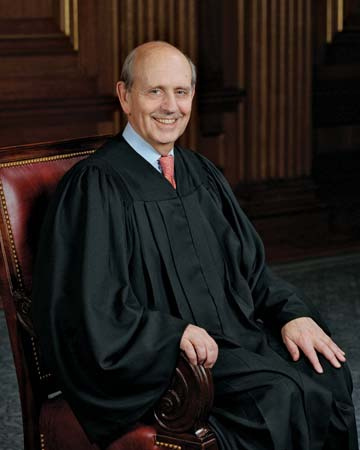

The Court focused on defense arguments that the real estate market, not Robers, caused the decrease in value of collateral between the time of the foreclosures and the subsequent bank sales. Justice Stephen Breyer wrote that:

Fluctuations in property values are common. Their existence (through not direction or amount) are foreseeable. And losses in part incurred through a decline in the value of collateral sold are directly related to an offender’s having obtained collateralized property through fraud.

Breyer distinguished “market fluctuations” from actions that could break the causal chain, such as a natural disaster or decision by the victim to gift the property or sell it to an affiliate for a nominal sum. See Lance Rogers, May 6, 2014, BNA U.S. Law Week, “Justices Clarify that Restitution ‘Offset’ is Gauged at Time Lender Sells Collateral.”

Falsified mortgage applications cause a lender to make a loan that it would not otherwise extend. A restitution award mirroring what the lender would receive in a civil deficiency judgment is inadequate. The defendant’s conduct opened the door for the Court to shift the risk of post-foreclosure market fluctuation from the bank to the borrower. Robers did not single-handedly render the local real estate market illiquid. However, as Justice Sonia Sotomayor mentions in her concurrence, real estate takes time to liquidate. These banks did not unreasonably delay the liquidation process. The Court opinion did not mention the prominent role of origination fraud in the subprime mortgage crisis. The Supreme Court’s unanimous decision strongly rejected defense arguments that downward “market fluctuations” severed the causal connection between the origination fraud and the depressed sales prices obtained by the lenders.

The Court did not discuss the original purchase prices for Robers’ two homes. In many mortgage fraud schemes, loan officers find “straw purchasers” such as Mr. Robers for sellers who agree to provide kickbacks on the inflated sales prices. See Mar. 15, 2009, Milwaukee Journal-Sentinel, “Amid Subprime Rush, Swindlers Snatched $4 Million.” The perpetrators do not disclose these kickbacks to the lenders. The mortgage originators also receive origination fees from the lenders on the fraudulent closings. Under this arrangement, the purchase price will naturally reflect the highest sales price the bank’s appraiser will support. The bank is defrauded both by the fictitious qualifications of the borrower and the exaggerated sales prices.

U.S. v. Robers may result in stricter, more consistent restitution awards in mortgage fraud cases. I wonder how it will be applied in cases where the defendant presents stronger evidence that the victims acted unreasonably in liquidating the property. The opinion seems to leave discretion to District Courts to determine whether a bank’s conduct or omissions breaks the connection between the mortgage fraud and the sales price.

February 5, 2014

They Might Be Mortgage Giants: Fannie & Freddie’s Tax Breaks

On January 3, 2014, the U.S. Consumer Financial Protection Bureau published a request for input from the public about the home mortgage closing process. 79 F.R. 386, Docket CFPB-2013-0036. The CRPB requested information about consumers’ “pain points” associated with the real estate settlement process and possible remedies. The agency asked about what aspects of closings are confusing or overwhelming and how the process could be improved.

The settlement statement is an explanatory document received by the parties at closing. The statement lists taxes along with other charges. The settlement agent sets aside funds for payment of both (a) the county or city’s property ownership taxes and (b) transfer taxes assessed at the land recording office. The property taxes are a part of a homeowner’s “carrying costs.” The recording taxes are part of the “transaction costs.” Typically, neither the buyer nor the seller qualify for a recording tax exemption.

The federal government advances policies designed to increase consumers’ access to affordable home loans. The Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”) provide a government-supported secondary market. They purchase some home mortgages from the lenders that originate them. The Federal Housing Finance Agency regulates these chartered corporations. In 2008, FHFA imposed a conservatorship over Fannie Mae & Freddie Mac.

In the years leading up to the crisis of 2008, Fannie and Freddie used their government sponsorship to purchase some of the higher-rated mortgage-backed securities. See Fannie, Freddie and the Financial Crisis: Phil Angelides, Bloomberg.com. As the secondary-market purchaser of these home loans, Fannie and Freddie have foreclosure rights against defaulting borrowers and distressed properties. These corporations participate in the home mortgage process from origination, through purchase post-closing, and, in many cases, subsequent foreclosure-related sales.

Congress exempts Fannie Mae and Freddie Mac from state and local taxes, “except that any real property of [either Fannie Mae or Freddie Mac] shall be subject to State, territorial, county, municipal, or local taxation to the same extent as other real property is taxed.” 12 U.S.C. sections 1723a(c)(2) & 1452(e). Which local real estate taxes does this exception apply to? The ownership tax, transfer tax, or both? The statute does not specifically distinguish between the two. Fannie and Freddie concede that they are not exempt from the tax on property. However, they decline to pay the transfer taxes assessed for recording deeds and mortgage instruments in land records. This is one advantage they have over non-subsidized mortgage investors. Local governmental entities and officials from all over the U.S. challenge Fannie & Freddie’s interpretation of the exemption statute since it represents a substantial loss of tax revenue. This blog post focuses on two recent opinions of appellate courts having jurisdiction over trial courts sitting within the Commonwealth of Virginia.

Virginia:

Jeffrey Small, Clerk of Fredericksburg Circuit Court, attempted to file a class action against Fannie & Freddie in federal court on behalf of all Virginia Clerks of Court. Small v. Federal Nat. Mortg. Ass’n, 286 Va. 119 (2013). Mr. Small challenged their failure to pay the real estate transfer taxes. The Defendants argued that the Clerk lacked standing to bring the suit for collection of the tax. A Virginia Clerk of Court’s authority is limited by the state constitution as defined by statute. In the ordinary course of recording land instruments, the Clerk’s office collects the transfer tax at the time the document is filed. One half of the transfer taxes go to the state, and the other half goes to the local government.

To resolve the issue, the Supreme Court of Virginia found that if the taxes are not collected at the time of recordation, then the state government has the authority to bring suit for its half, and the local government to pursue the other half. The Virginia clerks do not have the statutory authority to bring a collection suit for unpaid transfer tax liability. Because they lack standing, the court dismissed the clerk’s attempted class action against Fannie and Freddie for the transfer taxes.

Maryland & South Carolina:

Montgomery County, Maryland and Registers of Deeds in South Carolina brought similar federal lawsuits challenging Fannie and Freddie’s non-payment of recording taxes. See Montgomery Co., Md. v. Federal Nat. Mortg. Ass’n, Nos. 13-1691 & 13-1752 (4th Cir. Jan. 27, 2014). The Fourth Circuit also hears appeals from federal Courts in Virginia. This case proceeded further than Mr. Small’s. The Appeals Court found that:

- Property taxes levy against the real estate itself. Recording taxes are imposed on the sale activity. The federal statute allows states to tax Fannie and Freddie’s ownership of real property. The statute exempts Fannie and Freddie from the transfer taxes.

- Congress acted within its constitutional powers when it exempted Fannie and Freddie from the transfer taxes, because this may help these mortgage giants to stabilize the interstate secondary mortgage market.

- The exemption does not “commandeer” state officials to record deeds “free of charge,” because the states are free to abandon their title recording systems. By this analysis, the exemption is not a federal unfunded mandate on state governments because the decision to include a land recording system as a feature of property law is not federally mandated.

Some federal courts in other parts of the country have reached analogous conclusions. e.g., Dekalb Co., IL v. FHFA (7th Cir. Dec. 23, 2013)(Posner, J.). This legal battle wages on in the federal court system, but the results so far favor Fannie and Freddie.

Discussion:

Is abandoning the land recording system a realistic option? In Greece and other countries lacking an effective land recording system, property rights are uncertain and frequently brought before the courts for hearing. See Suzanne Daily, Who Owns This Land? In Greece, Who Knows?, New York Times. Like Fannie & Freddie, land recording systems advance the policy interests of stabilizing private home ownership.

Fannie and Freddie aren’t required to pay locally collected recording taxes. Their “share” of the overhead for maintaining the land recording system come from other sources. This includes the recording fees paid by ordinary parties in real estate closings across the country. Does this give the mortgage giants an unfair competitive advantage over other institutional investors in the re-sale of foreclosed homes?

Are these differing tax treatments properly considered in the CFPB’s discussion about the “pain points” in closings? Settlement statements provide clarity regarding the charges listed. The transfer and property taxes assessed in real estate closings are confusing and overwhelming, in part because they represent hidden costs. These hidden costs include the exemptions afforded Fannie Mae and Freddie Mac. The purpose of these institutions is to help mortgage consumers. Should the tax loophole should be closed or the hidden costs be disclosed to consumers? Perhaps one of these change would advance the CFPB’s “Know Before You Owe” initiative.

photo credit: J.D. Thomas via photopin cc. (not particular to any of the cases discussed herein)