February 20, 2014

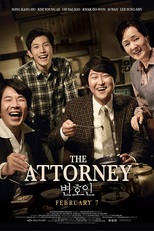

Reel Property: “The Attorney” (Korean, 2013)

Before Roh Moo-hyun became a human rights advocate and President of South Korea, he was a lawyer in private practice. Director Yang Woo-seok loosely based the 2013 Korean movie The Attorney (Byeon-ho-in) on Mr. Roh’s early career. After a blockbuster run in S. Korea, “The Attorney” now appears in American theaters. On Presidents Day, my wife and I watched this film, coincidentally featuring a foreign president. “The Attorney” has his weaknesses, but captures what it means to be an advisor, entrepreneur and advocate.

Song Kang-ho plays lawyer Song Woo-seok, a fictionalized, young Roh. Mark Jenkins observes that “The Attorney” begins as a comedy about a pioneer in land registration practice in Busan, Korea. Like a lawyer changing focus mid-trial, director Yang shifts gears in the middle of the film. Song accepts the defense of a young waiter who, after brutal torture, “confessed” to fomenting overthrow of the government. See Mark Jenkins, Feb. 6. 2014, Wash. Post, “‘The Attorney’ Movie Review: An Earnest and Instructive South Korean Box-Office Hit.”

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

1. Don’t Give Up – Re-calibrate and Move On:

Song pulls himself by his boot straps by maintaining a positive outlook. Before Song conducted legal settlements of homes, he literally built them. When I watched this film, I personally identified with the title character. After a day on the job, Song washes the construction site grime off his hands and starts to study. Your humble blogger worked as a laborer for a construction company during his college years. Song studied law in the evenings in neighborhood restaurants and unfinished buildings. I attended law school in an evening program while working a normal day job. A few years ago, I discovered culinary gems in Northern Virginia’s Korean restaurants. The restaurant scenes in the movie made me feel hungry!

After dinner at a restaurant managed by Choi Soon-ae, Song skips out on the bill. The dinner money goes to buy back his pawned law books. Song motivates himself by writing “Never Give Up” on the textblock of his books and into concrete facades at work sites. Song has little education or money to support his family or pay his debts. He uses “Never Give Up” to reinforce a positive outlook in the face of adversity. Writing or sharing a constructive affirmation can overcome self-doubt or the negativity of others.

2. Fearless Niching & Frequent Networking:

After passing the bar, Song receives a judgeship. Struggling to support his family, he resigns to found a real estate registration practice. This practice is similar to that performed by title companies and settlement agents in the U.S. Song capitalizes on a rule change authorizing attorneys to do work previously restricted to notaries public. Initially, his bar association colleagues scorn him for doing work they consider beneath them. At a bar meeting, he overhears them gossiping as they sit down to eat at his table. They complain that he is out meeting people and handing out business cards. Unperturbed, Song introduces himself and hands out his cards.

After Song finds financial success, his rivals follow him into this practice area, competing for the same customers. He reinvents himself again as a tax law advisor. Song’s vision and lack of pretension distinguish him from his colleagues. He fit his own background and talents with a high-volume consumer practice. Years after failing to pay the dinner bill, the new attorney returns to Mrs. Choi’s stew-house to repay his debt. She refuses, with motherly joy for a prodigal patron, insisting that he become a regular customer.

“The Attorney” features a foreign legal system and a different culture. I relied on the subtitles to follow along. In spite of cultural and linguistic barriers, the first half of the movie shows universal entrepreneurial strategies. Another WordPress blogger, Seongyong, has great photos from the film in his post.

In the first part of the film, the director develops Song’s character as worldly, warm & family-oriented. In the second half, Song puts his career, reputation and safety on the line to oppose anti-terrorism charges based on confessions procured by torture of the client. Stay tuned to the next blog post!

February 5, 2014

They Might Be Mortgage Giants: Fannie & Freddie’s Tax Breaks

On January 3, 2014, the U.S. Consumer Financial Protection Bureau published a request for input from the public about the home mortgage closing process. 79 F.R. 386, Docket CFPB-2013-0036. The CRPB requested information about consumers’ “pain points” associated with the real estate settlement process and possible remedies. The agency asked about what aspects of closings are confusing or overwhelming and how the process could be improved.

The settlement statement is an explanatory document received by the parties at closing. The statement lists taxes along with other charges. The settlement agent sets aside funds for payment of both (a) the county or city’s property ownership taxes and (b) transfer taxes assessed at the land recording office. The property taxes are a part of a homeowner’s “carrying costs.” The recording taxes are part of the “transaction costs.” Typically, neither the buyer nor the seller qualify for a recording tax exemption.

The federal government advances policies designed to increase consumers’ access to affordable home loans. The Federal National Mortgage Association (“Fannie Mae”) and Federal Home Loan Mortgage Corporation (“Freddie Mac”) provide a government-supported secondary market. They purchase some home mortgages from the lenders that originate them. The Federal Housing Finance Agency regulates these chartered corporations. In 2008, FHFA imposed a conservatorship over Fannie Mae & Freddie Mac.

In the years leading up to the crisis of 2008, Fannie and Freddie used their government sponsorship to purchase some of the higher-rated mortgage-backed securities. See Fannie, Freddie and the Financial Crisis: Phil Angelides, Bloomberg.com. As the secondary-market purchaser of these home loans, Fannie and Freddie have foreclosure rights against defaulting borrowers and distressed properties. These corporations participate in the home mortgage process from origination, through purchase post-closing, and, in many cases, subsequent foreclosure-related sales.

Congress exempts Fannie Mae and Freddie Mac from state and local taxes, “except that any real property of [either Fannie Mae or Freddie Mac] shall be subject to State, territorial, county, municipal, or local taxation to the same extent as other real property is taxed.” 12 U.S.C. sections 1723a(c)(2) & 1452(e). Which local real estate taxes does this exception apply to? The ownership tax, transfer tax, or both? The statute does not specifically distinguish between the two. Fannie and Freddie concede that they are not exempt from the tax on property. However, they decline to pay the transfer taxes assessed for recording deeds and mortgage instruments in land records. This is one advantage they have over non-subsidized mortgage investors. Local governmental entities and officials from all over the U.S. challenge Fannie & Freddie’s interpretation of the exemption statute since it represents a substantial loss of tax revenue. This blog post focuses on two recent opinions of appellate courts having jurisdiction over trial courts sitting within the Commonwealth of Virginia.

Virginia:

Jeffrey Small, Clerk of Fredericksburg Circuit Court, attempted to file a class action against Fannie & Freddie in federal court on behalf of all Virginia Clerks of Court. Small v. Federal Nat. Mortg. Ass’n, 286 Va. 119 (2013). Mr. Small challenged their failure to pay the real estate transfer taxes. The Defendants argued that the Clerk lacked standing to bring the suit for collection of the tax. A Virginia Clerk of Court’s authority is limited by the state constitution as defined by statute. In the ordinary course of recording land instruments, the Clerk’s office collects the transfer tax at the time the document is filed. One half of the transfer taxes go to the state, and the other half goes to the local government.

To resolve the issue, the Supreme Court of Virginia found that if the taxes are not collected at the time of recordation, then the state government has the authority to bring suit for its half, and the local government to pursue the other half. The Virginia clerks do not have the statutory authority to bring a collection suit for unpaid transfer tax liability. Because they lack standing, the court dismissed the clerk’s attempted class action against Fannie and Freddie for the transfer taxes.

Maryland & South Carolina:

Montgomery County, Maryland and Registers of Deeds in South Carolina brought similar federal lawsuits challenging Fannie and Freddie’s non-payment of recording taxes. See Montgomery Co., Md. v. Federal Nat. Mortg. Ass’n, Nos. 13-1691 & 13-1752 (4th Cir. Jan. 27, 2014). The Fourth Circuit also hears appeals from federal Courts in Virginia. This case proceeded further than Mr. Small’s. The Appeals Court found that:

- Property taxes levy against the real estate itself. Recording taxes are imposed on the sale activity. The federal statute allows states to tax Fannie and Freddie’s ownership of real property. The statute exempts Fannie and Freddie from the transfer taxes.

- Congress acted within its constitutional powers when it exempted Fannie and Freddie from the transfer taxes, because this may help these mortgage giants to stabilize the interstate secondary mortgage market.

- The exemption does not “commandeer” state officials to record deeds “free of charge,” because the states are free to abandon their title recording systems. By this analysis, the exemption is not a federal unfunded mandate on state governments because the decision to include a land recording system as a feature of property law is not federally mandated.

Some federal courts in other parts of the country have reached analogous conclusions. e.g., Dekalb Co., IL v. FHFA (7th Cir. Dec. 23, 2013)(Posner, J.). This legal battle wages on in the federal court system, but the results so far favor Fannie and Freddie.

Discussion:

Is abandoning the land recording system a realistic option? In Greece and other countries lacking an effective land recording system, property rights are uncertain and frequently brought before the courts for hearing. See Suzanne Daily, Who Owns This Land? In Greece, Who Knows?, New York Times. Like Fannie & Freddie, land recording systems advance the policy interests of stabilizing private home ownership.

Fannie and Freddie aren’t required to pay locally collected recording taxes. Their “share” of the overhead for maintaining the land recording system come from other sources. This includes the recording fees paid by ordinary parties in real estate closings across the country. Does this give the mortgage giants an unfair competitive advantage over other institutional investors in the re-sale of foreclosed homes?

Are these differing tax treatments properly considered in the CFPB’s discussion about the “pain points” in closings? Settlement statements provide clarity regarding the charges listed. The transfer and property taxes assessed in real estate closings are confusing and overwhelming, in part because they represent hidden costs. These hidden costs include the exemptions afforded Fannie Mae and Freddie Mac. The purpose of these institutions is to help mortgage consumers. Should the tax loophole should be closed or the hidden costs be disclosed to consumers? Perhaps one of these change would advance the CFPB’s “Know Before You Owe” initiative.

photo credit: J.D. Thomas via photopin cc. (not particular to any of the cases discussed herein)

December 27, 2013

Client Relationships for the Custom Home Builder in 2014

In the past year or so, demand outpaced supply in the Northern Virginia real estate market. Many home builders and tradesmen went out of business in 2008-2009, creating a shortage of home builders. For home buyers, a custom home offers the prospect of owning a made-to-order dream home. For the builder, the custom home business brings rewards as well. These include the pricing of a premium product and working closely with buyers to help them fulfill their dreams. These dreams bear the legal complexity of contracting for the sale of something that does not yet exist. For the buyer, this is the biggest consumer purchase of their life. They rightly take pride of ownership in the project. This blog post identifies a few key issues from the perspective of the custom builder for the New Year:

- Liability Shield. You stand behind your work and want to keep your customers happy. This is how business grows. At the same time, you owe it to yourself and your family to protect your personal assets and credit. Customers expect that they will be doing business with a company. By incorporating or forming an LLC prior to making contracts, custom builders can exercise reasonable control of the exposure of their own credit and assets. Communications and agreements with customers should clarify the seller’s identity.

- Choosing the Customer. Prospective customers are likely talking to other builders or realtors. If a prospect reminds you too much of a previous problem customer, she may not be a good fit for your business. The wrong customer may distract you away from your more deserving customers and prospects. Consult with legal counsel if anti-discrimination or fair credit laws may apply.

- Written Agreements. Use an attorney-prepared written contract prepared for the particular type of project and state law. It may not be necessary to have a “new” form for each job. However, a realtor form for the sale of homes in Maryland won’t work well for a custom home in Virginia.

- Customer Service. Always have someone available to handle customer inquiries, at least during normal business hours. Buyers of custom homes tend to visit the site frequently and have questions. They feel a tremendous amount of financial and emotional investment in the project.

- Project Control. Don’t allow the consumer to directly supervise your subcontractors on the job site. An excited buyer may want to go outside his contract with you and hire his own tradesman to install items on property they don’t yet own. No car dealer would allow a shopper to take an auto to a body shop for a custom paint job during an extended test drive. The custom home builders do themselves and the customer a favor by anointing a manager or site supervisor to “face” with the client.

- Happy Endings. Take walk through inspections, punch lists and closings as an opportunity to communicate with the buyer and wrap things up effectively.

Home builders unfairly have a reputation for being unresponsive or inflexible with their customers. More often, custom builders struggle with being too accommodating with the demands of buyers. Most of all, custom home buyers expect the builder to provide them with personal leadership and advice. Attention to the legal aspects of your customer relationships is a critical element of entrepreneurial creativity and leadership.