September 4, 2017

Show and Tell

September is when students go back to school. My daughter recently started at a new daycare. I feel like I have gone back to school too. Her school’s daily procedures are as new to me as they are to my daughter. One back-to-school activity is “Show and Tell.” Show and Tell is a great introductory public speaking educational activity for kids. The student might bring in something they acquired over their summer vacation. Her turn comes, she stands before the class, shows the item and explains its story. My daughter is not old enough for Show and Tell yet. At her age, the other kids want to grab any interesting new item that a classmate brings. I’ve learned not to let her bring her own toys to school because of the tendency for items to be disputed, damaged or lost. Home toys stay at home, daycare toys stay at school. Peace on earth.

When we become adults, our property we tell friends about has more complex stories than finding a horseshoe crab shell on the beach. I work with property owners who find themselves in various disputes over land, homes or major renovations. With a child, possession of a toy is often enough to justify shouts of “mine, mine, mine” to a classmate who wants it. With property, there is a maze of land records, contracts, statutes, rules, etc. that affect the respective rights of the parties. Adults see analytical thinking as important to deciding property and contract disputes. However, there is a deep emotional connection between owners and their property rights. At stake is one’s livelihood, sense of home, financial future, interpersonal relationships and a host of other matters that touch upon someone’s identity. All professionals who have experience in the residential property sector learn to accept the very real emotional dimension to all of this. Disputes in residential construction and property matters are emotional for the participants.

When anyone feels that their property rights are under attack, or they are accused of attacking someone else’s property rights discussions quickly acquire a moral quality. Right versus wrong. Us versus Them. When property owners reach a certain point in disputes with mortgage companies, buyers, sellers, tenants, contractors, HOAs or neighbors it often seems like their requests or explanations are not being heard. Angry people tend to “tell” things and struggle to also “show” key points. I frequently see how escalating stress in property disputes leads otherwise smart, good people to “over-moralize” their perception of a dispute and possibly miss opportunities to resolve it without any more delays, headaches and expenses than are necessary. I will describe how a “show AND tell” approach can be a powerful tool to getting things going in the right direction.

First, I would like to provide a hypothetical so that you can understand what I am talking about. Ted and Julianna hired Claude to build an addition on their house. They signed a contract. Claude started working on the project. Claude repeatedly requested that Ted and Julianna provide advance payments so that he would have funds to proceed. Wanting him to get done quickly, they did. Things progressed to the point that Claude got paid 90% on the job at a time when he was only 70% done on the project. Claude became less interested in the work once he got paid almost everything he was supposed to be paid. Ted and Julianna had a list of items that were not correctly built or not finished. One of the items was a leak into their house. They believed flashing around a window was not properly installed. Ted and Julianna grew weary of sending Claude multiple voicemails and emails about this and other defects. Claude sent someone to repair it. This required Ted and Julianna to cancel their annual garden party to accommodate the worker’s schedule. The “repairs” did not stop the leak. Realizing that they paid more than they received and were being given the runaround, Ted decided to fully document everything. Ted and Julianna had good reason to be upset at what Claude did. Ted took a video of the water coming into his house on his smartphone during a rainstorm and spoke during the video, adding a few choice words for Claude and his crew. One text message later, Claude received the video. All Claude could see was a close up of drops of water around what seemed to be the corner of the window of the interior of a house. He heard Ted’s upset voice. Claude forwarded the video to his lawyer Sean. Claude and Sean could tell that Ted was not happy. They did not know what to make of the video because it was unclear what house it was in, which window it was, what date it had been made. It was just a close up of a leak. Claude and Sean decided to just lie low and see what Ted and Julianna did next. Ted and Julianna became even more upset because their proof of the defect had been ignored by the contractor. They went online and noticed that a subcontractor filed a small claims case against Claude on another case. Several years ago someone left a zero star review about Claude on a website. They began to think about what they could do to force Claude to do something or at least get his attention. During a subsequent telephone call between Julianna and Claude, the discussion escalated further.

As you can see, Ted and Julianna have legitimate grievances about Claude’s work. They know that they need to do something. They decide that Claude isn’t hearing them, so they decide to tell Claude what is happening a little louder with the video with the angry voiceover. However, this does not “show” what is happening. The video is a closeup which lacks adequate context for someone unconnected to the dispute, like a judge, arbitrator or professional to understand the meaning of what they are being “told.” Claude and Sean decided to wait and see what Ted and Julianna do because so far they have not shown that they know how to explain their case. What often happens in these situations is the consumer who feels they are being ignored does not try to “show and tell” but merely to “tell” louder and louder.

When real estate and construction disputes escalate, eventually they are heard by regulatory officials, judges, arbitrators or juries. These “neutrals” are the audience for numerous complaints. If the complaining party is over-moralizing the dispute and only “telling” the story of how their opponent is a bad person instead of also “showing” through an accurate and engaging narrative, the neutrals are likely to side with the defendant. All the neutral knows is that an angry person is pointing fingers and is not prepared to explain how rules, contract documents and/or evidence support their claims. The aggrieved party does not understand why others cannot see what they know and feel. Disputes that escalate like this can become difficult to settle because of the attenuation of the circumstances and the “right and wrong” focus of the parties. If the opposing party feels that they cannot negotiate with the consumer they may be inclined to simply fight fire with fire. Sometimes angry people have a difficult time even coming up with a demand letter because the truth is something they live with every day. Explaining and proffering evidence seems unnecessary. But that is what is needed.

What is the answer to avoiding or resolving these kinds of disputes? I have a few ideas:

- Focus on “Show and Tell,” not just “Tell.” Consider how the narrative presents itself to the intended audience.

- Use qualified professionals such as attorneys, estimators, inspectors and engineers to provide an independent evaluation of the circumstances.

- Take deep breaths. Stick to a diet and exercise routine. Commit to one’s own mental and physical wellness.

- Focus on solving the problem the best it can, not on destroying one’s opponent.

- Be patient. The dispute took a long time in the making and it will probably not be resolved with a single letter.

- Stay focused on the relevant issues and avoid the temptation to become distracted by peripheral matters such as some other legal dispute one’s opponent experienced in the past with somebody else.

- Understand who to turn to for help. Often the answer is a judge or arbitrator and not a regulatory official.

Succumbing to the temptation of “over-moralizing” is dangerous is because the victim becomes susceptible to further manipulation. The consumer might do or say something that might prejudice their case. They might fall victim to further fraud by accepting the assurances of their opponent and then letting down their guard and missing some sort of deadline such as filing a lawsuit or warranty claim.

I am not saying that the difference between right and wrong is unimportant. It is very important. Also, I don’t like it when people call for someone to “strip your emotion out of this.” That’s not possible. The key is to bring the right “pitch” to one’s emotional response to a situation. Not too high and not too low. If one’s voice is on pitch, then the decision-makers will be able to hear it. If the advisors and allies of one’s opponent can see that the consumer is disciplined in their approach to defending their rights and is prepared to both “show and tell” then the necessary steps have been taken to settle the dispute or achieve the best result in court or arbitration.

photo credit: Onasill ~ Bill Badzo Waterloo Ontario ~ Canada ~ Italianate Architecture via photopin (license)

July 5, 2017

To Whom Should Owners Turn with Contractor Complaints?

Property owners are frustrated when their builder fails to properly complete the agreed upon work for the purchase price. Sometimes these difficulties are relatively minor. Perhaps only a timely warranty claim letter to the builder will get the problems fixed. Not all disputes can be resolved amicably. For relatively simple matters, the owner may be able to sue pro se in small claims court. Many construction disputes require greater commitment of time, know-how and resources to resolve. When the relationship between the contractor and the owner breaks down, it may not be clear to whom should owners turn with contractor complaints. This blog post highlights various options owners may have for obtaining assistance with builder problems.

The Contracting Company’s Leadership:

Owners should first seek to amicably resolve disputes over a contractor’s performance with the company’s representatives. If the concerns can be effectively communicated and negotiated, the owner may avoid having to go to court, arbitrator or governmental agency. Sending a certified letter to the contractor may be necessary under the provisions of a statutory or contractual warranty. Check out my previous post about “Construction Defect Warranty Claims.” Communication can be a useful means of obtaining information. The owner may need to contact the leadership if their inquiries to company employees are ignored.

City or County Government Officials:

In Virginia, the city or county has the legal mandate to enforce the statewide building codes. There are offices staffed with experienced officials who conduct inspections and reviews to determine whether the project meets the building codes. The primary purpose of building code enforcement is to protect public health and safety. The code enforcement process begins long before anyone brings a complaint before the local government. Many projects, especially major renovations and new home construction require drawings to be submitted and a permit granted before work may commence. When presented with a complaint, code enforcement will look at the work on the property and consult the approved drawings and the building codes.

While compliance with the building codes is important, it is not the end of the story. If the contractor only builds to the minimum standard required to pass county inspections, the owner may be disappointed. The concept of a “dream home” includes code compliance, but goes significantly beyond that. Owners have rights not simply to a product that passes code inspection but work that conforms to the contract, warranty and drawings. There are quality control issues that aren’t addressed in most contracts, drawings or building codes. Take caution regarding contractors who talk about “dream homes” before the contract is signed and then only in terms of “code compliance” after getting several payments.

It is important for owners to understand what code enforcement is not. While the officials promote a public function, they do not exist to provide pro bono expert services. They will not provide cost estimates to finish or repair the work. Their job is not to make sure that the owners get what they bargained for in the contract with the builder. In some situations, they may enforce the building code against the owner. If the project is shut down because of code enforcement action, this may cause delays and additional expenses to the owner.

In general, the code enforcement offices do a great job within their specific legal mandate of enforcing the building codes. However, owners must understand that the county or city does not have the broad powers of a court to provide remedies and protections.

If a contractor or owner does not agree with a decision made by code enforcement, there is an appeal process available. However, appeals are rare because of the expenses and delays.

State Board of Contractors:

Contractors must be licensed to engage in the construction services they deliver. The state board performs a useful function in the contracting field. Consumers and the public have good reason to expect the government to protect their health and safety. Also, contractors often take large amounts of money from owners who then expect them to perform on the work. Some people lose motivation once they get the money in their bank account. While we don’t usually categorize contractors as “fiduciaries,” in a sense they are such. The Virginia Board of Contractors deals with the application, issuance and suspension of contractors’ licenses. They also have regulations that can be the basis of a professional disciplinary proceeding if violated. The Contractor’s Recovery Fund provides a means for financial recovery for some consumers in egregious suits where the contractor lacks resources to satisfy a judgment. In a previous post I explored the question, “Should Homeowners Bring Complaints Against Contractors Before Courts or Regulators?” As discussed there in more detail, often there isn’t much benefit to owners to go to the state board until they exhaust remedies elsewhere. However, owners and their attorneys should know what the requirements are for recovery against the state fund so that they can meet those requirements in the lawsuit. The state board will look to the records of the proceedings of the lawsuit in the city or county courts in their investigation. Also, the failure to pay a court judgment is a violation of the licensure regulations. For many aggrieved owners, petitioning the state board only makes sense towards the end of the legal process.

Law Enforcement:

In particularly egregious cases of fraud, embezzlement or other wrongful activities, the contractor may have criminal liability. In most cases, inquiring with law enforcement will not result in charges or restitution order. However, owners should not rule out going to law enforcement entirely. Some cases do rise above civil disputes.

Arbitration Services:

As the years go by, more builders put arbitration clauses in their consumer contracts. In many cases, these arbitration clauses do not help owners. Often, they tend to limit or practically eliminate the consumer’s rights to legal remedies. It can be difficult for owners to navigate the arbitration process without legal counsel because of certain delaying tactics that often occur in arbitration. I recently wrote a blog post about a New Jersey case where a consumer overcame obstructionist use of arbitration provisions. Many property owners do not focus on these provisions when they review the contract during the sales process. When a legal dispute develops, the parties should check the dispute resolution provisions of the contract to see if they mandate arbitration, waive the right to a jury trial or limit the courts where claims may be brought.

Judges & Juries:

Last but not least, owners can bring their complaints against builders before state or federal courts. Under our legal system, the judiciary, i.e. judges, have the legal mandate to interpret contracts and statutes and provide remedies for any breach. In Virginia, if the claim is for $5,000.00 or less it may be brought in the Small Claims Division where the parties do not ordinarily have attorneys. However, any party may bring a case out of small claims by retaining an attorney and filing for removal. Claims for money for $25,000.00 or less (not including court costs, attorney’s fees or interest) may be brought in the General District Court for the city or county where the property is located. The General District Court has the advantage that proceedings there tend to be faster and cheaper for consumers. Claims over $25,000.00 may be brought in the Circuit Court where cases may take up to a year to be resolved. Litigation in the Circuit Court tends to have lots of motions, discovery and other pretrial activities. Some of my readers say that consumers and owners should not go to litigation because it can be expensive and uncertain. In my view, there are reforms that the general assembly or the judiciary could take to reduce the laboriousness of litigation. I do not believe that creating an alternative to the court system within government agencies procedures works for owners or consumers. I explored this in a previous post on this point. That makes it too easy for special interests to gain control over the process through lobbying.

The Bank:

The bank exercises a significant amount of control over the construction process. The builder typically looks to the bank for payment. The bank will send out its own private inspectors to look at the progress on the job site and report to the loan officer whether completion of a phase of construction warrants disbursement of a draw. The purpose of the bank inspector is to protect against fraud and to confirm that the payment would be adequately secured by the bank’s lien on the property. This inspector works for the bank and does not focus on whether the owner would ultimately be happy with the work that is being done. Owners should not impede the bank inspection process and take heed if the loan officer calls to their attention that the inspector raises any questions.

Mechanic’s Lien Agent:

In Virginia and some other states, the law requires that a Mechanic’s Lien Agent be appointed at the beginning of the project. The purpose of the MLA is to accept delivery of notices by subcontractors and material suppliers that they have not been paid so that such issues can be resolved without a mechanic’s lien being filed by anyone working or supplying to the jobsite. The MLA is not there to provide a dispute resolution service regarding any threatened lien but may be a source of information for owners seeking to confirm what is happening with their contractor and its subs.

Conclusion:

To whom should owners turn with contractor complaints? That depends upon the facts of the case. One of the problems with all these separate venues, officials or information sources is that an owner might focus on one and miss a deadline to obtain the remedy they are entitled to from another. This consumer protection landscape is ripe for confusion by the people it is designed to protect. Ideally, the owner will not need to resort to any of these options and can negotiate a good deal and obtain a great result without having to bring grievances before an official, judge or arbitrator. Many owners experience this. However, owners are at a disadvantage. While they have the money that contractors want, they don’t have the technical or legal experience needed to get what they want out of the process. Contractors have experience preparing and negotiating written contracts and change orders. They know what to say to sell their services. They know the officials that work at the county inspection offices. They have their own lawyers. Consumers look to the builder for both the service itself and information about how to shop for the service. For most property owners, a custom home is the largest purchase they will ever make. Getting an attorney or other experienced person to review the contract before signing it can go a long way towards getting the bargain they seek. Owners should not rely upon their adversary to provide them with useful legal counsel. Seeking legal counsel may not require a commitment to a year of litigation. In fact, it may be the best means of avoiding that.

Photo Credit:

Shadowgate Swarovski Museum via photopin (license)

May 16, 2017

Breach of Agreement to Purchase Insurance

Many construction contracts contain provisions requiring one or more parties to purchase insurance to cover certain activities or property related to the project. These provisions put an affirmative duty on a party to go out and obtain insurance to protect themselves, the other party in the contract or for against third party claims. Given the potential for expensive property damage claims or even personal injury, it makes sense for the parties to consider insurance provisions. This can be a great way of protecting against the risks of loss and litigation. If there is damage or loss and it is covered by a policy, this “Plan B” works. But what if in the event of loss the party that agreed in the contract to purchase insurance failed to do so? Is there a “Plan C?” Can they sue for breach of agreement to purchase insurance? In Virginia, the courts often deem the party who failed to fulfill their obligations to purchase insurance responsible for the loss. This seems obvious, but in cases where the opponent also breached the contract, it may not be clear how to sort out the liabilities. Whether an owner, contractor or subcontractor is what lawyers and judges call a “constructive insurer” by failure to buy insurance turns on the specific language in the agreement.

The leading Supreme Court of Virginia case on this is the 1983 decision, Walker v. Vanderpool. Roland and Elizabeth Walker owned a home in Virginia, southwest of Richmond. In 1977, they retained Vanderpool Heating & Air Conditioning Service for purchase and installation of an oil-burning furnace for $2,305. The contract said, “All work to be completed in a workmanlike manner according to standard practices.” The terms also required the Walkers to acquire and maintain fire insurance on the house. After completion, the furnace caught fire and the house burned. The Walkers had not purchased fire insurance. The Walkers alleged that their home burned because Vanderpool negligently connected the new oil furnace to a “non-existent chimney” and then turned it on. The Walkers sued Vanderpool for $45,000.00 in damages.

Vanderpool argued that if a person enters into an agreement to obtain insurance and neglects to fulfil this obligation, that person becomes the insurer and is potentially liable as such to the other party to the contract. The Walkers responded that the insurance provisions do not properly work to protect Vanderpool from liability for their own negligence.

The Supreme Court of Virginia took a “freedom of contract” approach on this case, observing that the Walkers were free to reject the Vanderpool contract unless the insurance provision was removed or modified. The Court agreed with Vanderpool that by their failure to procure the insurance, the Walkers became self-insured on this risk, and could not come after Vanderpool.

It’s easy to see how these parties looked at the contract and saw in it what they wanted. Vanderpool liked the insurance provisions, and the Walkers liked the scope and standard of workmanship provisions. In general, courts will try to harmonize different provisions in a contract so that no sections are effectively removed or rewritten in the judge’s decision.

Owners and contractors often do not focus on the insurance provisions in a contract until after something unfortunate happens. It pays to understand any contract before signing it.

Sometimes a party who fails to purchase required insurance for a project has no means to pay on a claim. A contractor may have no assets except a few pieces of equipment. An owner may have spent all of their extra cash on the project. It is important to obtain certificates of insurance to confirm that there is coverage in place.

These insurance provisions are found in a variety of other real estate related agreements, such as lease agreements, condominium or HOA covenants or mortgage documents. Newer HOA and condominium covenants seek to shift risks off the board and onto individual owners in sections dealing with liability, indemnification and insurance. Sometimes state statutes will impose insurance requirements. For example, in the District of Columbia, the Condominium Act requires owners and the association to purchase insurance. To understand insurance obligations for an owner in a HOA or condominium, it is necessary to also check what statutes, if any may apply should a dispute arise. Owners and contractors usually need the assistance of a qualified attorney to answer questions raised by mumbo jumbo in real estate and construction documents. Individual persons can often protect themselves by purchasing insurance. Being fully insured can save property owners from potential costs, including repairs and related attorney’s fees.

Case Citation:

Walker v. Vanderpool, 225 Va. 266 (1983)

Photo Credit:

March 15, 2017

Should Homeowners Bring Complaints Against Contractors Before Courts or Regulators?

Property owners frequently have complaints about construction contractors. Some of these complaints involve thousands of dollars in damage or serious infringement upon the use or value of property. These property owners (and their attorneys) want to know who to turn to. Should homeowners bring complaints against contractors before courts or regulators? This question raises issues about how the government ought to enforce its laws and resolve disputes. There is a perspective that regulatory boards ought to be a welcome forum for owners threatened or damaged by alleged contractor misconduct. In this blog post I will explain why I believe that, for all its imperfections, the judicial system is the best venue for vindication of legal rights in consumer disputes.

In 2015, the Court of Appeals of Virginia decided an illustrative case arising out of a complaint of a home purchaser about the seller’s contractor. Around 2002, Mark Holmes purchased an Alexandria, Virginia home, including an addition constructed by Culver Design Build, Inc. Mr. Holmes was unhappy about defective construction of the addition. He went to the city government, whom the General Assembly tasked with enforcing the building code in his locality. The City Code Administration found extensive water damage caused by construction defects and issued a Notice of Violation to Culver. Holmes was not satisfied with Culver regarding corrective work, so he filed a complaint with the Virginia State Board of Contractors. Holmes asked the Board to suspend Culver’s license until it corrected the violation. Culver Design Build, Inc. argued that Holmes did not have legal standing to seek judicial review of the Board’s ruling because this was a license disciplinary proceeding. The Holmes case also includes issues about how deferential the courts should be to a licensing agency’s administrative rulings. This case is unusual in that Mark Holmes represented himself in his appeal to the Court of Appeals of Virginia. Mr. Holmes acknowledged that unlike the seller, he lacked the privity of contract with the contractor which potentially could be used to go to court in breach of contract. The Court of Appeals agreed with Culver and the Board for Contractors.

When homeowners conclude that a state-licensed contractor or tradesperson committed a wrongful act depriving them of their home or damaging its value, it is easy to see why the aggrieved party would want a governmental agency to help them. Most people deal with governmental agencies much more than courthouses or law offices. Lawsuits require significant commitments to pursue or defend. Public resources go to supporting various agencies that have apparent subject-matter authority. This may appear to be a taxpayer-financed legal authority to go after the professional. However, this strategy often does little more than aggravate the licensed professional, the agency officials and the consumer. The Holmes v. Culver case illustrates one key weakness with homeowners pursuing consumer complaints through the professional licensure and disciplinary board process.

When consumers are harmed by unprofessional conduct, usually what they want is to have the defect corrected, an award of money or the transaction voided. These kinds of remedies are conventionally handled in the court system. The professional regulatory boards focus on licensure. They consider whether a business is properly licensed, should the license be suspended or revoked, should fines be assessed, and so on. Prominent members of the industry typically dominate these boards. For example, licensed contractors sit on the Board for Contractors. Initiating a professional licensure proceeding is a clumsy means of advancing the specific interests of the consumer having a transactional relationship with the business. It is the judiciary that can grant money damages or other remedies arising out of the formation and any breach of the contract. Regulators focus on whether disciplinary action is warranted regarding the registration or licensure of the business. In the Culver Design Build, Inc. case, the Board for Contractors and the Court of Appeals for Virginia agreed that Mark Holmes did not have standing to contest a regulatory decision in favor of the contractor. The board had authority to punish Culver for failing to abate a regulatory violation. However, the board had no authority to order the contractor to take any specific action at the job site. The board did not deny Homes any right or impose upon him any duty in its decision, because its authority revolves around Culver’s licensure. It is the State Building Code Technical Review Board that has the authority to review appeals of local building code enforcement decisions, not the Board of Contractors. One of the appeals judges suggested that if Holmes’ contentions were taken to a logical conclusion, the new buyer of the house could have greater leverage over a contractor than the previous owner, whose remedies may be limited by the contract. In his oral argument, Mark Holmes admitted that trying to resolve his complaints through the Board of Contractors complaint process was, “cumbersome and very long lasting.”

Even if the consumer unhappy with an adverse decision made by a regulatory agency in response to a complaint has standing, her appeal to the courts may encounter other obstacles. The licensure dispute is unlikely to starts afresh on appeal. The courts tend to be receptive to the agency’s interpretation of the legislature’s statutes. In Virginia, courts accord deference to an agency’s reasonable interpretation of its own regulations (as adopted by the board pursuant to the statutes). A consumer’s ability to raise new factual issues may be strictly limited in her attempts to get the courts to overturn the board’s decision. Judicial deference to agency rulemaking is not without controversy. Judge Neil Gorsuch, whom President Trump nominated for the U.S. Supreme Court is a high-profile critic of judicial deference to agencies. In his August 23, 2016 concurrence to a federal appeals decision Gutierrez-Brizuela v. Lynch, Judge Gorsuch explained that concentration of both legislative and judicial power in regulatory agencies creates constitutional problems. The constitution protects the public from authoritarianism by separating the government by the type of power, not the subject-matter. Under the constitution, the legislature prescribes new laws of general applicability. Taken to its logical conclusion, doctrine that courts should defer to agencies’ quasi-judicial determinations of what the statutes mean unconstitutionally undercuts the independence of the judiciary. The constitutional problems identified by Judge Gorsuch are illustrated in the arena of housing industry occupational regulation.

Where does this leave an owner when property rights are infringed by regulated professionals? Should everyone should go back to renting? Certainly not! This is what the independent judiciary is there for. Usually owners have privity of contract with the contractor and do not need to go to an agency. They can sue for remedies for breach of contract or deceptive practices. Consumer advocates with an interest in legislation should focus on increasing access to the court system and not promoting an administrative process that may not be a good fit for the homeowner. If you find yourself needing to bring or defend a construction claim, contact my office or a qualified attorney in your jurisdiction.

Case Citations:

Homes v. Culver Design Build, Inc., No. 2091-13-4 (Va. Ct. App. Jan. 27, 2015) (Alston, J.)

HOMES V. CULVER DESIGN BUILD, INC. APPELLATE ORAL ARGUMENT

Gutierrez-Brizuela v. Lynch, No. 14-9585 (U.S. Ct. App. 10th Cir. Aug. 23, 2016) (Gorsuch, J.)

Photo Credit:

ehpien Old Town Alexandria via photopin (license)

October 25, 2016

Virginia Consumer Protection Claims Against Contractors

There is a lot of litigation and arbitration in the construction contracting industry. Most of these cases are disputes over whether the contractor did the work and if so, whether it has been appropriately compensated under the terms of the agreement. Some construction disputes include allegations of deceptive practices. Virginia law approaches unprofessional practices in the construction contracting industry in two ways: First, construction contractors must obtain licenses to do business here. A builder is subject to professional sanction if the Board for Contractors finds that the conduct violated regulations. There is a fund managed by the board, from which unsatisfied claims may be paid if certain criteria are met. Second, owners, general contractors, subcontractors and other parties can bring lawsuits (or where agreed, arbitration claims). Can residential owners bring Virginia consumer protection claims against contractors? Parties unfamiliar with these rules often need help navigating the legal system to protect their rights.

VCPA & License Regulation:

In the 1970’s, the General Assembly adopted the Virginia Consumer Protection Act (“VCPA”). The main purpose of the VCPA is to make it easier for consumers (including homeowners) to bring legal claims against suppliers for deceptive practices. Before the VCPA, consumers had to prove fraud. Suing for fraud is attractive because a court may award attorney’s fees or punitive damages for fraud. However, fraud carries a higher standard of proof and many defenses that the consumer must overcome. In a proper case, the VCPA allows for tripled damages and attorney’s fees. The legislature has exempted certain types of real estate related business activity from the VCPA, including regulated lenders, many landlords and licensed real estate agents. What about contractors? Are contractors subject to professional regulation and exempt from the VCPA? Last month, the Circuit Court of Loudoun County considered this question in a lawsuit arising out of a residential custom contracting dispute.

Closing the Sales Process for the Custom Residential Construction Project:

On May 20, 2015, licensed contractor Interbuild, Inc. made a written agreement with Leslie & John Sayres for the construction of a large recreational facility on their property. The Sayres agreed to pay $399.624.00 for what would include a batting cage, swimming pool, exercise area and bathroom. According to the Sayres, they relied upon certain false representations by Interbuild in their decision to move forward with the contract. They allege that Interbuild told them the following:

- Interbuild had been established since 1981.

- The project did not require a building permit.

- The contractor already priced things out with subcontractors.

- Interbuild would supervise construction full-time.

- The project would be completed in 16 weeks.

- 4000 PSI concrete would be used.

- The building would be constructed upon an agreed upon area.

On October 20, 2016, attorney Chris Hill discusses this Sayres opinion in his Construction Law Musings blog. He observes that many of the alleged misrepresentations sound like things that would be specifications or terms of the contract. Hill raises concerns expressed by Interbuild’s lawyers that the Sayres complaint attempts to transform a breach of contract case into a fraud claim. I agree that this fraud in the inducement claim will be a challenge to pursue. However, I think that some of the fraud claims described in the Sayres counterclaim sound more like promissory fraud than anything else. Under Virginia law, promissory fraud occurs when one party makes a promise to the other that they have no intention of keeping, and the listener relies upon this empty promise to their detriment. In July, I blogged about this in the foreclosure context. If a false promise remains fraud even after reduced to a contract, then the Sayres fraud in the inducement claims make more sense.

Some of these alleged misrepresentations appear potentially more serious than others. While contract management experience is important, the Sayres contracted with Interbuild for a certain result. The experience was not an end unto itself. A missing permit could become a problem if the county later decided that the construction was not code-compliant and wanted substantial, costly corrections. The subcontractor pricing could become an issue if it could be proven that Interbuild was effectively unable to complete the job from the get-go. A contractor is required to provide adequate supervision regardless of what is represented. Rarely will you see a written agreement that absolves a contractor of this. In a proper case, courts will award damages for delay. However, the Sayres would have to prove that they relied upon the agreed delivery date. I suspect that this lawsuit is not about the Sayres inconvenience of continuing to exercise in a different place. The strength of the concrete raises serious structural questions, but would require proof by expert testimony. Building the project on the spot where the customer wants is indeed a fundamental issue. However, it might be shown that the location under the contract is unfeasible due to site conditions or that the difference is only slight. In general, the damages must flow from the misrepresentations. Courts are reticent to award a windfall to purchasers if the lies are of minimal consequence.

After paying most of the purchase price but before completion, the Sayres terminated the contract. Interbuild sued for work that was allegedly performed but not paid for. The Sayres filed counterclaims for fraud in the Inducement, VCPA and breach of contract.

Fraud in the Inducement:

Interbuild sought a court ruling on whether the Sayres could move forward with their fraud in the inducement and VCPA claims. The Contractor argued that the fraud claim should be thrown out. Interbuild maintained that the fraud claim was not proper because the customer only alleges that their expectations under the contract were disappointed. In its September 8, 2016 opinion letter, the Court dispensed with this argument, distinguishing between fraud inducing formation of the contract and fraud in the performance of the contract. The court found that the counterclaim clearly alleged that the misrepresentations were made to convince the Sayres to sign the contract. Because the alleged fraud occurred before the contract came into being, the claim is not alleging disappointed contractual expectations.

When legal disputes arise, owners and contractors frequently focus their attention on things that were most recently said or done. A contractor may be unhappy about an owner’s hands-on attitude about a project. Customers may take offense at the contractor’s customer service. However, the case might be about fraud in the inducement issues that come from the sales process. In the Sayres case, the judge allowed the fraud in the inducement claim to move forward.

The VCPA:

Interbuild adopted a different approach in its attempt to get the Sayres’ VCPA claim dismissed. The contractor argued that since it is subject to regulation as a licensee of the state contracting board, it is exempt from the consumer protection statute. While the VCPA does not specifically name contractors as exempt, it does exclude “any aspect of a consumer transaction which aspect is authorized under laws or regulations of this commonwealth. Va. Code § 59.1-199. Contractors are subject to state regulation by Va. Code § 54.1-1000, et seq. In his opinion, Judge Douglas L. Fleming, Jr. followed judicial precedents distinguishing between consumer transactions that are specifically sanctioned by law vs. those that are merely regulated. The absence of a prohibition of a particular practice does not constitute authorization of that practice. Since the professional regulations do not specifically cover the particular types of business practices at issue, this statutory exemption does not protect the contractor from suit. The court found that the alleged misrepresentations are the kind of practices that are actionable under the VCPA. This is consistent with other rulings made by Virginia courts in cases between consumers and construction contractors.

The VCPA also provides that a consumer may sue a contractor for not having a license. Interbuild argued that because it had an active contracting license it was exempt from the VCPA. Since Interbuild is subject to license revocation for conduct that violates professional regulations, that should be the sole remedy under the state statutes. Judge Fleming rejected this argument, observing that the state’s licensure regulations do not, “inferentially cloak licensed contractors with VCPA immunity if they are shown to have committed deceptive practices.” In short, a professional license does not include with it a privilege to engage in fraudulent behavior.

News reports frequently raise public policy questions about professional regulation. Each year, more occupations become subject to licensure requirements. Usually this means that the leaders in that industry regulate its participants by means of a state board. Too often, self-regulating industries use these boards to protect prominent members against competition. Consumers look to the boards for relief from predatory practices, but are often frustrated by the results. Interbuild’s arguments seem to appeal to this notion that as a licensee, its customers should have to go through the board if they want a special remedy. Bear in mind that there is a public demand for housing prices to go down. Builders have a more organized lobby than consumers regarding professional regulation and limiting liability for extra damages in lawsuits. Given market demands, I wonder how close the General Assembly is to exempting contractors from the VCPA. The construction industry provides many jobs to Virginia. However, I think that the public’s interests would not be served if quality and service were sacrificed for job creation and affordability concerns. A defect-riddled house is the most unaffordable of investments to its owner and doesn’t help the “property values” of others.

All the September 8, 2016 opinion decided was that Interbuild’s counterclaims may move forward in litigation. Even under the lower standards and enhanced remedies of the VCPA, claims based on deception are difficult to prove and obtain an award of damages.

When disputes arise over custom construction contract projects, the parties cannot rely upon the board of contractors or the county’s permitting office to advocate or mediate for them. When payment issues, construction defects or other disputes arise, the services of an experienced construction litigator are necessary to protect one’s best interests.

For Further Reading:

Photo Credit:

Phil’s 1stPix Too Many Tonka Toys? via photopin (license)

July 15, 2016

Dealing with Memorandum for Mechanics Lien

A disgruntled contractor or supplier may attempt to collect a payment from owners by filing a Memorandum for Mechanics Lien against the real estate. Under Virginia law, claimants (contractors or material suppliers) can interfere with owners’ ability to sell or refinance property by filing a lien in land records without first filing a lawsuit and obtaining a judgment.

A March 2016 opinion by federal Judge Leonie Brinkema shows why purchasers at Virginia foreclosure sales must give care to mechanics liens. In April 2013 and October 2015 Jan-Michael Weinberg filed a Memorandum of Mechanics Lien against a Fairfax County property, then owned by Ann & James High. J.P. Morgan Chase Bank later foreclosed on the High property. In early 2016, Mr. Weinberg brought a lawsuit to enforce the mechanics lien against J.P. Morgan Chase and the property.

If a claimant pursues a Memorandum for Mechanics Lien correctly, the property may be sold to satisfy the secured debt. A Memorandum for Mechanics Lien is a two-page form that anyone can download online for general contractors or subcontractors. The filing fee is a few dollars. By contrast, removal of the lien may require significant time and attention by the owner. Overall, it is best for owners to work with their advisory team to avoid having contractors file mechanics liens in the first place. Sometimes, disputes cannot be easily avoided and owners must deal with recorded liens. A Memorandum for Mechanics Lien differs from a mortgage or a money judgment. Fortunately for the owner, Virginia courts apply strict requirements on contractors pursuing mechanic’s liens. Just because a contractor fills out all the blanks in the form that doesn’t meant it necessarily is valid. This blog post is a brief overview of key owner considerations. The Weinberg case provides a good example because the court found so many problems with that lien.

- Who? The land records system in Virginia index by party names. For this reason, the claimant must correctly list its own name and the name of the true owner of record. The owner’s team will need a title report and the construction contract. Whether the claimant is a general contractor, subcontractor or supplier will determine which form must be used. Mr. Weinberg’s Memorandum for Mechanics Lien claimed a lien of $195,000. Virginia law requires a contractor to have a “Class A” license for projects of $120,000 or more. Judge Brinkema found this Memorandum defective because Weinberg’s claim was not supported by a reference to a Class A license number. In some residential construction jobs, the Virginia Code requires appointment of a “Mechanic’s Lien Agent” to receive certain advance notices of performance of work from claimants that might later become the object of a mechanics lien. This creates an additional hurdle for the contractor, suppliers and subcontractors. In many construction projects, the builder works with the owner’s bank to obtain draws on construction loans. If mechanics lien disputes arise, owners can work with the bank to obtain documents.

- What? The Memorandum for Mechanics Lien must describe the dollar amount claimed and the type of materials or services furnished. The written agreement determines the scope of work, payment obligations and other terms. Generally speaking, only construction, removal, repair or improvement of a permanent structure will support a mechanics lien. Mr. Weinberg claimed that he conducted “grass, shrub, flower care,” “week killer,” “tree removal/cutting,” general property cleanup,” “infrastructure work,” “planting grass,” “site work,” “general household work” and “handy man jobs.” The Court found that this description of work was invalid. The work described was either landscaping or too vaguely connected to actual structures. Where the agreement was for work that could actually be the basis of a mechanics lien, the owner should consider how much of the work the contractor actually performed? Is the work free of defects? Does the Memorandum state the date the claim is due or the date from which interest is claimed?

- When? The contractor or supplier must meet strict timing deadlines for the mechanics lien. Generally speaking, the Memorandum for Mechanics Lien must be filed within 90 days from the last day of the month in which the claimant performed work. Judge Brinkema observed that Mr. Weinberg failed to indicate on the Memoranda the dates he allegedly performed the work. Also, no Memorandum may include sums for labor or materials furnished more than 150 days prior to the last day of work or delivery. Furthermore, the claimant must bring suit to enforce the lien no more than 6 months after recording the Memorandum or 60 days after the project was completed or otherwise terminated. Weinberg’s 2013 Memorandum was untimely because he did not sue to enforce it until 2016. Because Weinberg’s 2015 Memorandum was the same as the 2013 version, they both probably describe the same work on the property.

- Where? The Memorandum for Mechanics Lien must correctly describe the location of the real estate that it seeks to encumber. If it lists the wrong property, the lien may be invalid. Property description problems frequently arise in condominium construction cases because the same builder is doing work in the same building for multiple housing units. The Memorandum must be filed in the land records for the circuit court for the city or county in Virginia where the property is located.

- Why? There is usually a reason why a contractor decides to file a Memorandum for Mechanics Lien instead of pursuing some other means of payment collection. The Highs allegedly didn’t pay Weinberg for his landscaping and handyman services. The Highs’ weren’t able to pay their mortgage either. Weinberg filed for bankruptcy. In order to resolve a mechanics lien dispute with a contractor, an owner should consider how the dispute arose in the first place. Is someone acting out of desperation, confusion, or is the lien a predatory tactic? Could investigation need some other explanation?

- How? The owner must understand how the mechanics lien dispute with the contractor relates to the overall plan for the property. Mr. Weinberg tried to use mechanics liens to collect on debts. At the same time, he went through bankruptcy and the property went through foreclosure. Context cannot be ignored. Few owners can afford to remain completely passive in the face of a dispute with a contractor. The owner may have a construction loan or other debt financing to consider. An unfinished project is difficult to sell at a favorable price. Potential tenants won’t lease unfinished property.

On March 15, 2016, Judge Brinkema denied Mr. Weinberg’s motion to amend his lawsuit and dismissed the case. When a contractor or supplier files a Memorandum of Mechanics Lien against property, the owner must carefully consider whether to pay the contractor directly, deposit a bond into the court in order to release the lien and resolve the dispute with the contractor later, bring suit to invalidate the lien on legal grounds or simply wait 6 months to see if any suit is brought in a timely fashion to enforce the lien. Fortunately for owners, there are strict requirements on contractors for them to take advantage of mechanics lien procedures. A Virginia property owner should consult with qualified legal counsel immediately upon receipt of a Memorandum of Mechanics Lien to protect her legal rights.

Case Citation: Weinberg v. JP Morgan Chase & Co. (E.D. Va. Mar. 15, 2015)

Photo Credit: Views from a parking garage via photopin (license)

March 21, 2016

Finding Traction in Construction Defect Claims against Contractors

New owners frequently struggle to timely resolve construction defect disputes with builders. For example, owners in Palm Beach Gardens, Florida have home workmanship complaints. Their HOA sued Kolter Homes, LLC for defects including lighting problems, window gaps, sloping balconies and water intrusion. On March 15, 2016, the Daily Business Review reported that Kolter began a new, larger development nearby before resolving their defects. Furious, the owners took to the streets to protest in front of the new project. Owners have rights to effective repairs under warranties arising out of the contract or law. When owners make warranty claims and builders send repair crews in response, these disputes are rarely resolved satisfactorily. The owner’s life is disrupted by living with the undesirable reality of the defects, communicating with the builder, and making arrangements for repairs that may not even be effective. For many owners the “playing field” seems unbalanced because the builder wrote the contract terms, knows the construction business, and has their money. How can owners break out of this cycle of frustrating customer service and get the house they initially bargained for? With smartphone cameras, it is easy for a buyer to record visible defects and the date they took the photographs. When calling and emailing isn’t enough, owners need more effective strategies for finding traction in construction defect claims against contractors.

Understanding Contractual & Warranty Rights. The sales process gives the buyer an understanding of what they will get for their money. New construction is an expensive consumer purchase. Builders know what consumers are looking to hear. Buyers usually make substantial financial sacrifices and commitments to purchase a property that they hope will fit their lifestyle and be a solid investment. Once they make the down payment, sign the contract and go to closing, the buyer’s bargaining position shifts. What builder promises, assurances and expectations can be legally enforced after they have been paid? Deceptive practices may lead to a consumer protection, fraud or even criminal prosecutorial action. However, for most owners the remedy for unfulfilled expectations lies in the contract and warranty commitments made by the builder. The owners can confirm what they bargained for by collecting and understanding the contract and warranty documents provided by the builder. This helps the owner to sort out sales talk from contract rights. Many of the documents may be organized into a packet provided when the parties went under contract or at closing. Other documents may be found elsewhere. For example, warranties, manuals, arbitration rules and other documents may be on file with the builder or available on its website. The contract may reference drawings that are on file with the city or county’s permitting office. If the documents are unclear on a particular point the owners or their attorney may have to consult building codes to understand their rights.

Mark Warranty Deadlines on the Calendar. The written warranties, contracts and state law will impose strict time limits on defect claims. Usually the builder is entitled to a written notice of a defect claim. For many warranties this must be done within a year. The owner usually has a subsequent deadline for submitting the claim to the court or arbitration. It is not really in the builder’s financial interest for the owner to focus on these deadlines. Just because the builder has actual knowledge of a defect does not preserve the claim absent legal notice requirements.

Obtain Reports for Defects & Estimates for Repairs. Once an owner knows the builder’s legal obligations, the next issue is diagnosing the defects and determining the cost to make it conform to the warranty. Owners making defect complaints to the builder have a strong sense of what is wrong from their day-to-day experience of living or working in the property. However, the defects may not be limited to what is immediately experienced by the senses. There may be latent defects that will require expensive repairs in a few years. Owners owe it to themselves to fully understand what is wrong and how much it would cost them to fix by a third party. After six to ten months of frustrating negotiations and ineffectual repairs, the owner may have lost confidence in the builder’s willingness or practical ability to make the repairs. The owner cannot effectively negotiate with the builder for a cash settlement without written assessments by experts that are independent from the builder. The needs of each case are different, and might require engineers, home inspectors, contractors or other qualified experts. At a minimum, the owner usually needs an experienced, licensed contractor. Strong communication skills are needed to handle cross-examination by builder’s counsel before a judge, jury or arbitrator. The written estimate must be for repair of the defects covered by the warranty and not simply projects that the estimator wants to sell and the owner wants to receive. A written estimate can confirm for the owner whether they have a $10,000.00 or $100,000.00 claim. It is in the owner’s best interests to find out the cost before any decisions must be made in light of warranty deadlines.

In construction disputes, the builder has some advantages. They prepared the contract and warranty documents with their lawyers before presenting them to the owners. The builder passed the contracting license exam and knows the building code requirements to get an occupancy permit. The builder negotiated defect complaints with customers before. But it is the owner who must live with or pay to repair construction defects that aren’t acceptably resolved in the warranty claim process. However, owners can level the playing field and obtain good results by determining the gaps between what was contracted for and the structure’s actual condition. A written estimate for defects covered by an unexpired warranty provides owners with what they need to obtain satisfactory results in litigation, arbitration or settlement negotiations. The builder has their own qualified legal and technical advisors working for them to deal with consumer complaints. Owners can level the playing field, gain traction in negotiations and make financial decisions with greater peace of mind by retaining their own counsel as soon as defect disputes arise, and before they become seemingly intractable.

Photo Credit: Pacific Northwest Architecture via photopin (license)

October 14, 2015

Common Misconceptions about Home Builder Warranties

Home buyers want assurances that someone will correct defects in construction to make it conform to what they bargained for. In the sale of new homes, these assurances usually come in the form of the builder’s warranties. Homeowners must make serious decisions about whether to go under contract, go through with closing and allow a year or so to go by without making a warranty claim. The purpose of this blog post is to identify some of the top misconceptions buyers have about home builder warranties that interfere with good decision-making.

- “My Warranty Coverage is Only Shown in the Packet of Contract Documents.” In fact, warranties can also arise out of legislation or court decision precedents. Warranty law is a solution to the problem that a buyer can inspect something, pay for it and later discover that the construction was materially defective. In Virginia, the courts traditionally ruled that in every contract with a builder there is an implied warranty of good workmanship unless the terms of the contract provided specific disclaimers or modifications. This rule helped consumers by requiring that the contractor would have to stand behind their work unless there was some fine print otherwise. Builders responded by having their attorneys write-up those warranty documents that can range from a paragraph to over 50 pages. The Virginia General Assembly observed that contractors were finding ways to get buyers through real estate closings on properties that did not conform to contracts in spite of the efforts of local building code enforcement officials and the buyer’s inspections. They passed legislation that creates implied warranties of quality workmanship that arise in the sale of each new home construction. Unfortunately, both contractors and homeowners are often unaware of these statutory warranties and their relationship with the written contract documents including the written limited warranties. Homeowners find it much easier to negotiate with their builder if they know the full extent of their warranty rights from review of the agreements and statutes.

- “My Neighbor Couldn’t Make Use out of Her Warranty, So I’m Also Out of Luck.” Tragically, many homeowners allow their warranty rights to expire without preserving their right to exercise them. Builders, neighbors, building code officials and inspectors can give useless or misleading legal advice. Because the contract documents vary builder-to-builder and the implied warranty laws vary by state, it is impossible to give a general summary that can be applied in every case. Understanding warranty coverage requires compiling the contract and warranty paperwork and state statutes. Usually, the basic warranty lasts for only one year.

- “My Builder is the Best Person to Ask about what they are Required to Fix.” Builders know that the courts will not expect them to continue making warranty repairs to one house for as long as they continue to be in business. To the extent a builder is still working on a house they have already sold, they aren’t making any new money. Contractors sometimes use written warranty paperwork to confuse or limit the buyer’s warranty rights at the time of sale. The builder’s warranty too often is used as a sales tactic to assuage nervous buyers concerned about construction defects. If the homeowner complains to the builder about construction defects after move-in, some contractors try to keep them occupied with inspections and ineffectual repairs. If the builder’s employees are frequently at the house, the owner probably won’t invite independent inspectors, experts or other contractors who might diagnose serious warranty claims and help the owner protect their rights. Once the owner starts to lose confidence in the builder or the warranty period is approaching, the owner needs the help of independent experts.

- “The Only Construction Defects Worth Focusing on are the Ones I Look at Everyday.” Homeowners frequently focus on the types of construction defects that they notice everyday. Defects in drywall, painting, grout, trim and other finish work can add up to thousands of dollars in repair costs, but they may not be the most substantial defects made by the builder. Water may be leaking into the house. Major systems such as roofing, plumbing, electrical, HVAC, etc. may require extensive repairs or replacement if not properly addressed during a warranty period. In order to properly diagnose these problems, the owner must coordinate investigation with inspectors, experts or other contractors who are independent from their builder. Every homeowner owes it to themselves to know the truth about the condition of their house.

- My Realtor, Mortgage Broker, Settlement Agent or Builder Recommended This Home Inspector, so they must be fine.” In hiring a third party inspector to help with a home purchase, the independence of the home inspector is just as important as their competence. Most professionals in a real estate transaction are only paid when the deal goes to closing. If a home inspector or other participant does find a defect that would cause a deal to not go through or be substantially delayed, the other professionals won’t want them to be involved in the next sale. Most home inspectors know enough about houses to provide a report that is a great help to the buyer. What’s important to the buyer is having an inspector who isn’t allied with the people being paid out of settlement. That way, the buyer knows he is working for her.

A homeowner should not rely solely on the contractor to clarify what their warranty rights are. It’s better to find out from qualified inspectors, engineers or other contractors what, if anything is wrong with your house. A qualified attorney can help determine whether those defects are legally covered before time runs out. If the closing on the new home was less than 12 months ago, there is a strong chance the owner may be entitled to repairs or financial compensation from the builder for failure to make the house conform to the warranty.

Legal Authority:

Va. Code § 55-70.1. Implied Warranties on New Homes.

Mann v. Clowser, 190 Va. 887, 59 S.E.2d 78 (1950)

Photo Credit:

Northwest Modernism via photopin (license)(provided to illustrate home construction – not known whether depicted property has any construction defects)

December 9, 2014

Resolutions for Homeowners Dealing with Construction Defects

A good home provides a safe, comfortable and enjoyable place to live. When a contractor makes mistakes in construction, renovation or repair, the owner or tenant has to live with those defects every day until the problem is resolved. The coming New Year is a good time for homeowners to prioritize addressing contractor defects. In 2015, devise a strategy for relief from construction defects and feel love for your home again.

The key to efficiently realizing a goal is outlining the steps needed to realize it. This gives the owner a “to-do” list that can be tackled step-by-step over time. This may include a warranty claim against the contractor. Many contractors stand by their work and will honor well-founded warranty claims. It’s difficult to build a business from a base of disgruntled former customers. With some contractors, legal assistance may be necessary to obtain relief under a warranty. No two construction defect cases are the same. In each case, the contracts, warranties, physical conditions and defects are different. However, there are strategies that can make the process easier for the homeowner. The following are 7 New Year’s resolutions for homeowners dealing with construction defects:

- Investigate Defects Fully: Examine and photograph the physical appearance of the defects. Obtain copies of the manufacturer’s installation instructions. Research online reviews or other information about the materials used. Wise homeowners focus first on any safety or health concerns. In some cases, taking temporary action to limit future damage may be necessary. Discovering the truth about the defect is a solid foundation for dealing with it.

- Organize Warranty Information. The contractor likely provided contracts, correspondence, warranties and invoices. Usually installers do not warranty the materials used. The warranties for materials may have been provided in the packaging or available from the manufacturer. These items must be reviewed together and can become easily misplaced if not organized.

- Consult Regarding Implied Warranties. Many homeowners are not aware that a written set of terms is not the only way that products and installation may be covered by a warranty. In Virginia, there are certain contractor warranties that arise under operation of law. Consult with a qualified attorney about how coverage may arise under implied or written warranties. Unfortunately, warranties are easily waived if claims are not timely pursued.

- Consult Regarding Obtaining Expert Reports About Defects. In order to fix the defect, ultimately a qualified person will need to do further work on the house. To prove a warranty claim in court, the owner may need an expert witness to testify regarding the breach of duties or the proper figure of damages. Depending on the needs of the case, that expert may be a home inspector, licensed contractor, engineer, tradesperson or professional estimator. Hiring an expert to provide assistance in a lawsuit, reports or court testimony is not like hiring a professional to work on the house. If an expert is being engaged to provide legal support or trial testimony, the owner’s lawyer is the proper representative to work directly with the expert. One of the most important characteristics in retaining an expert in these types of cases is independence. A homeowner is not well served by an inspector or other contractor who will not be able to testify against the interests of the contractor who committed the defects. It’s best to go completely outside of the referral network of the builder.

- Consider Goals for the Property. When a dispute with a contractor erupts, sometimes even smart homeowners may struggle to maintain focus on how the project fits in to their goals for maintaining and developing the property. The homeowner may need to adjust their goals to fit new circumstances.

- Preserve Copies of Contractor’s Representations: If the contractor used intentional concealment, fraud or misrepresentation in the course of selling his services, the owner may have a claim for enhanced damages. Fraud cases are very difficult to prove, and the facts of most cases don’t support them. However, sometimes misrepresentations can be found in e-mail, text message or social media communications. Savvy owners take care to preserve any electronic communications with the contractor’s representatives.

- Consult with Counsel About Pursuing Claims. Once the case has been properly investigated with the assistance of legal counsel, the homeowner is in the best position to go back to the contractor about the warranty claim and, if necessary, pursue a legal remedy.

Whether a homeowner’s best interests lie in simply fixing the problem on their own or pursuing a legal claim against the contractor depends upon the unique circumstances of the case. Homeowners have the benefit of control over the property where key evidence may be preserved. The New Year is a good time for families to take necessary action to protect their physical, financial and legal aspects of home ownership.

photo credit: ungard via photopin cc (I am not aware of any defects with the house depicted in this photo, which was chosen for its seasonal characteristics)

June 3, 2014

Engineer Personal Liability: Signed, Sealed & Delivered?

An engineer must obtain and maintain a Professional Engineer’s license from the APELSCIDLA Board to practice in the Commonwealth of Virginia. Pursuant to professional regulations, when an engineer, or other design professional, completes a set of drawings, he affixes his professional seal with the date and signature. His seal displays his professional license number. This finishing touch assures the reader, especially the owner and the builder, that the plans are ready to go.

If the project built according to the stamped plans fail, one would expect a claim against the engineering firm. With smaller design firms, the customer may only interact with one representative who handles everything. In such a case, what about engineer personal liability? On May 20, 2014, a federal judge in southwest Virginia issued an opinion in a case where the owner of a collapsing feed barn filed suit against an engineer after a barn he designed fell apart. The opinion shows the tension between the interests of freedom of contract and consumer protection in professional malpractice cases.

Ken McConnell hired Servinsky Engineering, PLLC to design a foundation for a barn on his farm. Mark Servinsky, a Virginia Professional Engineer, was its principal. The foundation constructed according to Servinsky’s plans failed, damaging the structure and tearing the fabric roof. The barn cannot be used safely. McConnell sued both the Servinsky firm and Mr. Servinsky personally. The engineering firm filed for bankruptcy protection. Mr. Servinsky filed a motion to have the personal claims against him dismissed.

McConnell alleged that Mr. Servinsky was personally liable for negligently performing the engineering work that resulted in an unusable barn. McConnell argued for liability on the grounds that Virginia law requires an engineer to affix his professional seal, signature and date to his drawings. Judge James Jones ruled that only the firm, and not the personal defendant, could be liable under the contract with McConnell. Here are a few takeaways in this judicial opinion:

- Privity of Contract: This is a legal principle whereby (except in limited situations) only the parties to a contract may sue other parties to the contract. Whether contractual privity is required in malpractice cases varies by profession and jurisdiction. If the customer sues for an engineer’s failure to meet the expectations set by the contract, then only the parties to the contract may be sued. Judge Jones does not address any arguments that McConnell’s contract was with anyone other than the engineering firm.

- Professional Regulations: Unless they specifically provide for personal liability, laws governing design professionals create duties surrounding licensure, not liability to consumers. The state board decides who can or cannot have a license.

- Professional Standards: If personal liability is difficult to prove and bankruptcy is available, what assurances does working with a professional provide to consumers? Judge Jones observed that in malpractice cases, the professional standards are implicit terms to any contract for services with a professional engineer. The professional standards fill in gaps as to the duty of care in performance of the contract. That is why negligence is discussed in these types of cases. The professional services firm cannot hide behind the absence of a specific term in the contract when there is a professional standard that articulates that duty.

Judge Jones dismissed McConnell’s claims against Mr. Servinsky personally, finding that the professional seal did not create professional duties to the customer above & beyond the professional services contract.

The Bankruptcy Court allowed McConnell’s suit against the engineering firm to proceed, since it was covered by insurance. That case is set to go to trial later this year. Servinsky’s engineer license provided McConnell with a potential remedy, but not by personal liability. The license was the prerequisite by which Servinsky to obtain a professional liability policy that may cover McConnell’s claim.

Case Citation: McConnell v. Servinsky Engineering, PLLC, 22 F.Supp.3d 610 (W.D. Va. 2014)

Photo Credit: Silver Smith, 2009″ Si1very via photopin cc (I could not find a fabric barn roof photo – this is actually of the Dallas Cowboys practice facility, not the facts of case discussed)

February 20, 2014

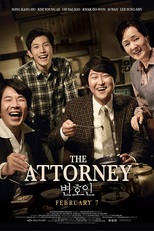

Reel Property: “The Attorney” (Korean, 2013)

Before Roh Moo-hyun became a human rights advocate and President of South Korea, he was a lawyer in private practice. Director Yang Woo-seok loosely based the 2013 Korean movie The Attorney (Byeon-ho-in) on Mr. Roh’s early career. After a blockbuster run in S. Korea, “The Attorney” now appears in American theaters. On Presidents Day, my wife and I watched this film, coincidentally featuring a foreign president. “The Attorney” has his weaknesses, but captures what it means to be an advisor, entrepreneur and advocate.

Song Kang-ho plays lawyer Song Woo-seok, a fictionalized, young Roh. Mark Jenkins observes that “The Attorney” begins as a comedy about a pioneer in land registration practice in Busan, Korea. Like a lawyer changing focus mid-trial, director Yang shifts gears in the middle of the film. Song accepts the defense of a young waiter who, after brutal torture, “confessed” to fomenting overthrow of the government. See Mark Jenkins, Feb. 6. 2014, Wash. Post, “‘The Attorney’ Movie Review: An Earnest and Instructive South Korean Box-Office Hit.”

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

Part One of this blog series focuses on Song’s success building a residential settlements practice. Part Two will focus on his trial preparation and advocacy for victims of human rights abuse.

1. Don’t Give Up – Re-calibrate and Move On:

Song pulls himself by his boot straps by maintaining a positive outlook. Before Song conducted legal settlements of homes, he literally built them. When I watched this film, I personally identified with the title character. After a day on the job, Song washes the construction site grime off his hands and starts to study. Your humble blogger worked as a laborer for a construction company during his college years. Song studied law in the evenings in neighborhood restaurants and unfinished buildings. I attended law school in an evening program while working a normal day job. A few years ago, I discovered culinary gems in Northern Virginia’s Korean restaurants. The restaurant scenes in the movie made me feel hungry!

After dinner at a restaurant managed by Choi Soon-ae, Song skips out on the bill. The dinner money goes to buy back his pawned law books. Song motivates himself by writing “Never Give Up” on the textblock of his books and into concrete facades at work sites. Song has little education or money to support his family or pay his debts. He uses “Never Give Up” to reinforce a positive outlook in the face of adversity. Writing or sharing a constructive affirmation can overcome self-doubt or the negativity of others.

2. Fearless Niching & Frequent Networking:

After passing the bar, Song receives a judgeship. Struggling to support his family, he resigns to found a real estate registration practice. This practice is similar to that performed by title companies and settlement agents in the U.S. Song capitalizes on a rule change authorizing attorneys to do work previously restricted to notaries public. Initially, his bar association colleagues scorn him for doing work they consider beneath them. At a bar meeting, he overhears them gossiping as they sit down to eat at his table. They complain that he is out meeting people and handing out business cards. Unperturbed, Song introduces himself and hands out his cards.