February 27, 2015

Legal Thriller Published in Foreclosure Notices to Borrowers?

On December 4, 2014, I wrote a blog post about a borrower who brought a lawsuit against her lender after the Richmond law firm that conducted the foreclosure went out of business. The federal judge denied the bank’s motion to dismiss the borrower’s claims based on a faulty loan default notice. In that post, I mentioned that the involved law firm, Friedman & MacFadyen, was the target of class action litigation arising out of their debt collection and foreclosure practices. Of the several bases to the class action, the only one that will be discussed here has to do with False Representation liability under the Fair Debt Collection Practices Act. The lawsuit accused Friedman & MacFadyen of sending correspondence to borrowers containing false threats of lawsuits followed by notices with references to court actions that had not been filed. Put another way, the class action claimed that there was a legal thriller published in foreclosure notices to borrowers.

Someone with legal training knows whether a lawsuit is pending. A case cannot proceed unless the party is properly served with a copy. If one knows where to look, one can search court records to verify whether someone is party to a pending lawsuit. But the process of determining this is not common public knowledge. In its opinion, the federal court discussed the alleged practices of the law firm. F&M initially wrote to the borrowers to tell them, among other things, that their, “loan[s][had] been referred to this office for legal action based on a default under the terms of your Mortgage/Deed of Trust and Note.” Later correspondence suggested that a lawsuit was pending or about to be filed. However, the law firm never intended to file a lawsuit against these borrowers. Virginia is a non-judicial foreclosure state. Foreclosures routinely occur here as a trustee transaction and not normally in a lawsuit. Later firm correspondence instructed the borrower on how to obtain “withdrawal” or “dismissal” of the “action.” F&M would refer to these matters as the name of the bank “v.” the name of the borrower, the way lawyers style a lawsuit.

People tend to take a dispute more seriously once a case is active before the court. A legal action does not exist until a party files it in writing with the court’s clerk. Attorneys know that the threat or current existence of a lawsuit causes negative emotions on the part of the defendant, such as anger, fear, anxiety, avoidance or aggression. However, there is a difference between candidly informing an opposing party that suit will be filed if the dispute cannot be resolved and the facts alleged about Friedman & MacFadyen. The opinion discusses allegations that the law firm was in a client relationship where it would be rewarded for foreclosing quickly, and less rewarded for negotiating loan modifications. If the borrowers had known that there were no pending lawsuits, they may have handled their situations differently. In essence, the class action suit accused the foreclosure law firm of putting fictional accounts of lawsuits in foreclosure correspondence with the goal of obtaining favorable responses by borrowers in light of how the law firm was rewarded by its client.

Lawsuits have value for collecting on debts. They also cost money the parties filing them. Once the lawsuit is actually filed, the party and its attorneys have obligations to the court. A fictional lawsuit, on the other hand, does not require anything to be prepared, no court fees to be paid, scheduling conferences to attend or any other responsibilities. The plaintiffs’ suit included a Fair Debt Collection Practices Act claim for False Representation for what might be described as “shadow litigation” issues. In a January 16, 2015 blog post, I discussed the basics of FDCPA False Representation claims, where a debt collector uses a false, deceptive or misleading representation to collect consumer debt. In denying F&M’s motion to dismiss the lawsuit, the court observed that it would construe the foreclosure correspondence collectively to determine any tendency to mislead the borrowers.

If you have received any foreclosure-related correspondence that references a lawsuit that you cannot verify, contact a qualified attorney to discuss defense of your right to be communicated fairly with regarding your property rights.

case cite: Goodrow v. Friedman & MacFadyen, P.A., No. 3:11-cv-020 (E.D. Va. July 26. 2013).

photo credit: 5525 Carr Street (22) via photopin (license)(does not depict any individuals or properties involved in the discussed class action suit)

January 16, 2015

Federal Regulation of Nonjudicial Residential Foreclosure

Foreclosure of residential real estate is traditionally based on state law and agreements between the borrower and lender in the loan documents themselves. Each state has its own rules governing whether foreclosure should occur in or out of a court proceeding. In Virginia, the vast majority of foreclosures occur in bank-appointed trustee’s sales. State and federal courts review and supervise this activity through lawsuits brought by one or more of the parties, usually borrowers seeking to set aside trustee’s sales. However, they resist efforts to transform the foreclosure process into a judicial one, ruling on various motions brought early in cases.

The mortgage crisis is a national concern involving federal policies promoting home ownership. Is there a federal regulation of nonjudicial residential foreclosure? Through supervision of the mortgage giants Fannie Mae, Freddie Mac, and other administrative programs, the federal government is invested in the mortgage origination process. In some cases, a federal agency takes direct title to distressed home loans or the foreclosed real estate itself. I have written about some of those cases in the past few months. For example, Fannie Mae and Freddie Mac enjoy property recording tax exemptions. Also, in states like Nevada that allow homeowners associations to foreclose, government agencies find themselves in title litigation when properties are assigned to them pursuant to the terms of federal mortgage programs. In the event of default of a loan tied to a federal program, the government may find its interests aligned more on the creditor’s side.

Foreclosure is one of many remedies available to lenders to collect on defaulted home loan debt. For over 30 years, Congress has come to the aid of consumers in debt collection matters. In 1977, Congress enacted the Fair Debt Collections Practices Act to curb abusive practices by the debt collection industry against consumers. The FDCPA also has the effect of benefiting non-abusive debt collectors harmed by violating competitors. Since its enactment, Congress and the federal courts have clarified the FDCPA’s role in regulating debt collection law firms’ activity obtaining foreclosure sales and deficiency money judgments. Since an attorney’s sale of distressed Virginia real estate in a trustee’s auction is an activity outside of the traditional perception of debt collection, the role of the FDCPA in foreclosure practice has been relatively unclear until the past few years, when a slew of foreclosure contest lawsuits have tested the utility of the statute.

The FDCPA applies to lawyers collecting on home loan debts, not just non-attorney debt collection agencies. Federal courts in Virginia have recognized that the Act also applies when lawyer debt collectors act as trustees in residential foreclosures where the notices include a demand for payment. These consumer protection laws regulate, among other things, the communications between the debt collector and the consumer. In order to conduct a foreclosure practice, the attorney must send notices to the borrower. The FDCPA may provide independent causes of action against the attorney found to have engaged in abusive practices. FDCPA issues thus pervade residential foreclosure matters. Consumers, lenders, and their attorneys must be aware of how this Act affects a contested foreclosure matter. There are many ways the FDCPA may be violated in a foreclosure matter, including the following:

False Representations. Under ordinary circumstances, it is difficult for a party to prove that they are entitled to relief because their opponent is allegedly lying, cheating or stealing. These are weighty accusations; the standard for proof is high, and the defenses are many. In 15 U.S.C. § 1692e, the FDCPA changes the rules of the game in the consumer debt collection context. The consumer doesn’t need to prove that he was actually deceived by the misleading communication. Instead, the consumer must show that false representations in a debt collection communication materially affects a consumer’ ability to make intelligent decisions with respect to the alleged debt. The courts apply a “least sophisticated consumer” standard to alleged false representations. This tends to prevent application of 20/20 hindsight in the interpretation of correspondence. The court will consider whether the correspondence is susceptible to more than one interpretation, one of which is misleading. Between the FDCPA, the Deed of Trust and state law, the debt collection law firm and attorney foreclosure trustee have multiple compliance obligations in preparing correspondence to the borrower.

Validation Notices. The FDCPA goes beyond prohibiting false representations. In 15 U.S.C. § 1692g, Congress mandates that disclosures be put into debt collection correspondence. In nonjudicial foreclosure, notices to the borrower are an essential element of the process. The initial communication must contain several messages, including, but not limited to:

[A] statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector[.]

If the debtor asks for verification of the debt, the collector must cease all collections activity until the verification is made. This not only means ceasing telephone calls, letters and collections lawsuits; it also includes the nonjudicial foreclosure activity.

Since foreclosures are typically conducted by law firms that exclusively pursue debt collection activity, these provisions of the FDCPA have served as the basis for class action lawsuits. Through the FDCPA, the federal government is heavily involved in regulation of nonjudicial, residential foreclosures. Borrowers, banks and their attorneys must be cognizant of the government’s role as regulator of collection of home loans and sometimes as assignee of mortgage debt or foreclosed real estate. Ironically, consumer protection attorneys are litigating FDCPA claims in federal courts against attorneys for their debt collection work on behalf of federally subsidized mortgage giants.

Case: Townsend v. Fed. Nat’l. Mortg. Ass’n, 923 F. Supp. 2d 828 (W.D.Va. 2013).

Photo Credit: taberandrew via photopin cc (to my knowledge, this property is not the subject of the cases referenced herein or any other foreclosure or debt collection proceeding)

January 8, 2015

Attempt to Relitigate Foreclosure in Bankruptcy Sanctioned by Judge

In Virginia, borrowers have several options of where to bring a legal challenge to a foreclosure trustee’s sale. The shortest commute is usually the Virginia circuit court for the city or county where the property is located. Alternatively, the facts may allow suit to be brought in a federal district courthouses. Another common venue is federal bankruptcy court.

On June 18, 2014, I posted an article about a borrower, Rachel Ulrey, who managed to keep her foreclosed real estate because the lender, SunTrust Bank, failed to object to the plan in time. Ulrey’s case is a cautionary tale to lenders. Other cases show why borrowers cannot rely on lender inattention as a legal strategy. On November 12, 2014, U.S. Bankruptcy Judge Kevin Huennenkens issued an opinion illustrating why parties and their attorneys may not bring the same claim in bankruptcy court after they fail to achieve their desired result in a Virginia state court. The borrower and his attorney found their attempt to relitigate foreclosure in bankruptcy sanctioned by the judge.

Michael Pintz owned property in Sussex County, Virginia, in the name of Michael’s Enterprises of Virginia, Inc. In June 2008, he took out a $200,000 mortgage from Branch Banking & Trust. After he defaulted on payment, BB&T obtained a money judgment in Hanover Circuit Court. When BB&T sent Michael’s Enterprises a Notice of Foreclosure, he filed a request in Sussex Circuit Court to block the threatened sale. That court denied the motion. BB&T later purchased the property at a November 2013 Trustee’s Sale. In February 2014, Michael’s Enterprises filed for Chapter 11 reorganization in the U.S. Bankruptcy Court. The petition claimed the Sussex property as an asset of the corporation.

You may be wondering whether bankruptcy petitions can be used this way. When a court finds that someone filed something for an improper purpose, it may award litigation sanctions. State and federal courts in Virginia have similar rules prohibiting parties and their attorneys from advancing legal claims and defenses for improper purposes and not to vindicate the rights described in the court filing. Improper purposes include but are not limited to harassment, unnecessary delay or needless increase in the cost of litigation.

BB&T brought a Motion for Sanctions for Violation of Bankruptcy Rule 9011. The Bankruptcy Court initially deferred BB&T’s request for sanctions. Judge Huennenkens gave Michael’s Enterprises an opportunity to submit a proper bankruptcy reorganization plan before ruling on the sanctions request. The conditions imposed were not met. In October 2014, the bankruptcy court dismissed Michael’s Enterprises’ petition.

The court granted the lender’s renewed motion for sanctions. Judge Huennenkens observed that Michael’s Enterprises had had an opportunity in Virginia state court to litigate the same objectives sought in the bankruptcy petition. The court saw the new lawsuit as an attempt to attack the Virginia court’s decision and the nonjudicial foreclosure. The bankruptcy opinion doesn’t mention this, but if a party believes that a trial court made an erroneous decision, their recourse is to file a motion to reconsider and/or appeal it to the Supreme Court of Virginia. A bankruptcy court may be able to discharge or reorganize debts reduced to court judgments. However, they usually do not allow parties a do-over of unfavorable results of a state court case. Michael’s failure to present a proper reorganization plan in the face of a sanctions request made a poor impression. Judge Huennenkens found the case to be for an improper purpose and awarded BB&T $10,000 in sanctions against Michael’s Enterprises, Michael Pintz, individually, and his attorney. As of the date of this blog post, this result is currently on appeal before the U.S. District Court for the Eastern District of Virginia.

A common mistaken belief about litigation sanctions is that they are proper whenever a party or attorney loses in court. However, it is common for borrowers in foreclosure contest lawsuits have their cases dismissed on the merits or procedural grounds. Usually, the cases are brought as good faith attempts to obtain relief on the facts and circumstances of the foreclosure proceedings. In Michael’s Enterprises, however, the record of the state court actions together with the absence of a reorganization plan added up to an award of attorney’s fees, not only against the property owner but also its sole shareholder and the attorney. The facts of each case are different and require investigation and research before employing a legal strategy.

Case Citation: Branch Banking & Trust Co. v. Michael’s Enterprises of Virginia, Inc., et al, No. 14-30611-KRH (Bankr. E.D. Va. Nov. 12, 2014).

Photo Credit: taberandrew via photopin cc

December 4, 2014

Litigation over Property After the Foreclosure Law Firm Goes Out of Business

On January 31, 2012, F&M Services, L.C., conducted a foreclosure sale in Hampton, Virginia. F&M was the foreclosure trustee affiliate of the Richmond law firm Friedman & MacFadyen. Freedom Mortgage Corporation appointed F&M as successor trustee for the foreclosure of Hampton property owned by Ms. Gloria J. Harris. At the sale, Freedom Mortgage purchased the property. Subsequently, Freedom assigned the property to the U.S. Department of Veterans Affairs. Ms. Harris had a VA loan on the property.

In October 2012, Friedman & MacFadyen shut down their operations. That law firm was the target of class action litigation arising out of their debt collection and foreclosure practices, including “robo-signing” and violations of federal debt collection law. This law firm was the subject of an October 25, 2012 article on RichmondBizSense.com. In 2008, Diversified Lending Group, a company owned by Bruce Friedman made an undocumented $6 Million loan to his brother Mark Friedman’s law firm. In 2010, the appointed receiver for DLG entered into an agreement with the Friedman law firm for repayment of the $6 Million. A few months later, Bruce was arrested on investment scam charges. This same foreclosure operation was conducting sales and filing foreclosure accountings for many distressed properties in Virginia.

This did not stop litigation over property after the foreclosure law firm went out of business. Ms. Harris decided to bring a lawsuit in federal court to reverse F&M’s foreclosure sale. Rather than sue the law firm or the successor trustee, she decided to bring suit against the federal government and Freedom Mortgage. Ms. Harris’s suit does not focus on the debt collection rules or “robo-signing.” She alleged that a 30-day notice sent to her by LoanCare Servicing Center, Inc. failed to include information specifically required by the loan documents. For example, the amount demanded in the notice was over-stated by one-third. She also pleads that she made an October 2010 payment that was not credited in the notice amount.

Both the government and the mortgage company brought motions to dismiss the lawsuit. District Court Judge Henry Coke Morgan, Jr. denied their motions. The Court showed appreciation of the fact that the 30-day cure notice did not comply with the specific requirements of the loan documents. Of course, on an initial motion to dismiss, the court does not entertain proof of disputed facts. Later in the litigation the Court would consider the exact amount owed at the time of the notice and Ms. Harris ability to cure the payment default if she had received an accurate and compliant cure notice.

In the continuing fallout from the mortgage crisis beginning in late 2008, the federal government frequently finds itself as a party to complex foreclosure litigation. Previously, I discussed the tax advantages Fannie Mae and Freddie Mac enjoy in recording deeds in land records. In other states, such as Nevada, the federal government finds itself as a party to lien priority disputes between banks and community associations. The collapse of foreclosure operations such as Friedman & MacFadyen may prevent them from continuing their scrutinized practices. However, the homeowners, mortgage investors and even the government may find themselves in title litigation over the sale anyway.

Many lawsuits brought by borrowers after foreclosure sales never survive the initial motions filed by the defendant lenders. Although the October 17, 2014 opinion does not mention the law firm, I wonder if F&M’s role in Ms. Harris’ foreclosure afforded her case closer attention.

If you have interest in real property that has in the title report a trustee’s deed from an now out-of-business debt collection law firm, contact a qualified attorney in order to protect your rights.

Case Citation: Gloria J. Harris v. U.S. & Freedom Mortgage Corp., No. 4:14cv56 (E.D.Va. Oct. 17, 2014)(Morgan, J.)

photo credit (does not depict any properties discussed): Mike Licht, NotionsCapital.com via photopin cc

November 21, 2014

Wrongful Foreclosure Claims for Robo-Signing

Among the controversies of the mortgage foreclosure crisis is that of “Robo-Signing.” A homeowner may receive notice that the original mortgage lender assigned their rights under the loan documents to another financial institution. When a representative of a lender signs paperwork to foreclose on a property, how does the borrower (or anyone else) know whether that company has authority from the originating lender to foreclose?

Janis O’Connor owned real estate near the Appomattox-Buckingham Virginia State Forest. On March 31, 2011, Deutsche Bank foreclosed on her property for nonpayment. After the foreclosure sale, Ms. O’Connor filed suit, alleging that the foreclosure was not valid because the bank lacked the authority of a proper successor to the mortgage company that originated her loan. O’Connor filed suit on her own, without an attorney representing her.

Can a Borrower Sue for “Wrongful Foreclosure?”

Janis O’Connor sued her lender (and others) on a number of legal theories, including “Wrongful Foreclosure.” She alleges that unknown persons forged assignments of her mortgage in a fraudulent scheme to foreclose on her home. She writes that this robo-signing was exposed on the television program, “60 Minutes.” The bank brought a Motion to Dismiss. On October 6, 2014, the U.S. District Court for the Western District of Virginia found that Virginia law does not recognize a claim called “Wrongful Foreclosure.” Judge Moon observed that the borrower must be able to allege a claim for breach of loan documents, fraud, or some other recognized legal theory. Judge Moon expressed a concern that Ms. O’Connor inadequately alleged any causal relationship between the “robo-signing” and her losses.

On May 14, 2014, I posted an article to this blog about legal challenges to the validity of foreclosures on the grounds that the lender committed technical errors in navigating the loan default through the trustee’s auction. Courts are reluctant to set aside a completed foreclosure sale. The technical breaches must have a strong connection to the relief requested by the borrower.

“Show Me the Note”

The Code of Virginia addresses situations where the lender struggles to come up with documents evidencing its authority to proceed with the foreclosure. Va. Code § 55-59.1(B) requires the lender to submit to the trustee what’s called a Lost Note Affidavit. These provisions also require the lender to notify the borrower in writing that the promissory note is lost and that it will request the trustee to proceed after 14 days. The lender must include language notifying the borrower that if she believes that some other party is the true holder of the note, she must file a lawsuit asking the local circuit court to order the foreclosing bank to post bond or make some other protection against any conflicting claims. That Court would then decide whether a bond or some other security must be posted to protect the borrower. The mere absence of the original note cannot serve as a basis to reverse a foreclosure: “If the trustee proceeds to sale, the fact that the instrument is lost or cannot be produced shall not affect the authority of the trustee to sell or the validity of the sale.” Va. Code § 55-59.1(B). These provisions require borrowers to file suit before the foreclosure takes place in order to litigate over “show me the note” issues. Ms. O’Connor did not file suit until almost two years after the foreclosure sale. From the borrower’s perspective, she hasn’t been damaged until the foreclosure is complete. From the Court’s perspective, it is sometimes easier to evaluate matters prospectively than to undo the completed transaction.

Judge Moon remarks that this statute does not actually require the lender to provide the borrower with the lost note affidavit itself. The failure to provide this item cannot serve as the legal basis to reverse a bank foreclosure. Technical breaches of the notice requirements cannot, on their own, serve as a basis to invalidate a completed foreclosure sale.

Judge Moon dismissed Ms. O’Connor’s complaint, giving her leave to amend her claims for Breach of Contract and Fraud. Ms. O’Connor has filed an Amended Complaint, and the sufficiency of the amended lawsuit has not been decided by the court as of this blog post. Regardless as to how Ms. O’Connor’s case is resolved, it provides some important reminders about foreclosure contests:

- Timing of Foreclosure Contest: If a borrower wants to challenge the validity of a foreclosure, their best interests may be served in filing suit after the foreclosure notice is submitted and before the auction occurs. This does not guarantee that the “show me the note” allegation will provide a remedy for the borrower, but it does preserve the issue.

- Value of Title Insurance: Investors who desire to purchase a property in foreclosure without obtaining title insurance run the risk of being made a party to a lawsuit like Ms. O’Connor’s which may go on for months or years.

- Duties of Foreclosure Trustees: An attorney acting in the capacity as a foreclosure trustee under the loan documents may owe duties to parties other than the bank. I discuss this issue in a related May 21, 2014 blog post. However, he doesn’t have an attorney-client relationship with non-clients.

Lenders and borrowers are not the only parties that may have a property interest challenged by title problems from a past, present or future foreclosure. The purchaser in the foreclosure sale, the spouse of the borrower or purchaser, an investor in a real estate company, or a tenant may have rights at stake in foreclosure title litigation. If your property rights are threatened by such an action, contact a qualified attorney.

case citation: O’Connor v. Sand Canyon Corp., No. 6:14-CV-00024 (W.D. Va. Oct. 6, 2014)

November 4, 2014

The Future in Virginia of Foreclosure of Condominium Association Liens

Today’s blog post is the third installment in a series on the emerging trend of foreclosure of condominium association liens on private property owners. In a previous article, I discussed a new appellate court decision, Chase Plaza Condominium v. Wachovia Bank, recognizing the right of an association under the D.C. Code to sell a condo unit in foreclosure to satisfy unpaid assessments, thereby extinguishing the much larger bank mortgage. This installment examines how future, similar attempts may be viewed under the Virginia Condominium Act.

Presently, Lenders Have Priority over Association Liens in Virginia:

In 2003, the Supreme Court of Virginia heard a case involving similar facts as in the Chase Plaza case under the corresponding portion of the Virginia Condominium Act. Va. Code Sect. 55-79.84 provides that a properly recorded Condo assessment lien has priority over other encumbrances except for:

- Real Estate Tax Liens;

- Liens Recorded Before the Condominium Declaration;

- First Mortgages or First Deeds of Trusts Recorded Before the Assessment Lien.

That same code section provides for the distribution of the proceeds of the association foreclosure sale, differing materially from the aforesaid lien priorities:

- Reasonable Expenses of the Sale & Attorney’s Fees;

- Taxes;

- Lien for Unit Owner’s Assessments;

- Any Remaining Inferior Claims of Record;

- The Unit Owners Themselves.

Since the statute provides for differing priorities for liens and distribution, I’m not surprised that this issue was litigated. At the Virginia Supreme Court, Colchester Towne Condominium Council argued that these provisions permitted foreclosure of a unit for its owner’s failure to pay assessments. This Association asserted that before the bank received anything, the proceeds would first be paid for expenses, taxes or the assessments.

Wachovia Bank argued that it had a priority over the Condominium Association for both the lien and payment. In a narrow 4-3 decision, the majority agreed with the bank. Justice Lawrence Koontz found that the General Assembly intended for the first mortgage to get paid before the association assessment liens. The Court observed that purchase money mortgages are the “primary fuel that drives the development engine in a condominium complex.” Justice Koontz remarked that a contrary result (the D.C. and Nevada cases come to mind as examples) would not adequately protect the lender’s interests.

Justice Elizabeth Lacy wrote for the three justice minority, which included now-incumbent Chief Justice Cynthia Kinser and Chief Justice-elect Donald Lemons. They favored permitting the association to conduct the foreclosure sale and give the unpaid assessments priority over the mortgage. However, they would permit the lender’s lien to survive the foreclosure process, burdening the property purchased at the auction. None of the justices on the Supreme Court at that time published an opinion that would give an Association powers like those found in the Chase Plaza case.

As of the date of this article, the conventional wisdom followed by many owners of distressed condominium properties in Virginia has a legal basis on this 4-3 decision from 11 years ago. I predict that in a matter of months or years, this same issue will resurface in the General Assembly or the Supreme Court. I don’t know to what extent the national sea change will have a ripple effect in Virginia. It is not possible to predict to what extent, if any, associations may acquire greater rights against banks and homeowners. However, local governments rely on associations to pay to maintain certain common areas and services. Cities and counties continue to seek ways to avoid budget shortfalls. New land development brings the prospect of additional tax dollars. These associations have a financial crisis of their own for the reasons I spoke of in my prior post. The financial crisis is greater today than 11 years ago, and so are the challenges to private property rights.

Where Does All This Leave Property Owners and Their Advisors?

For a homeowner, keeping one’s home and paying bills is a more immediate human concern than ending the larger rescission. What do these storm clouds mean to Virginia condominium owners? A few thoughts:

- Escrow Accounts. Courts and pundits suggest bank escrow of HOA dues may be the answer. Writer Megan McArdle points out, a “vast regulatory thicket surrounds mortgage lending.” Throwing association governance and budget issues into that thicket does not seem like an attractive option to owners, who don’t always find themselves aligned with their association’s decisions. Making banks party to disputes between Associations and owners would complicate matters further.

- Banks Shy From Financing Condos. The Wall Street Journal Reports that David Stevens, president of the Mortgage Bankers Association, expects mortgage rates to rise in Nevada. The Mortgage Bankers Association also reports that sometimes HOAs won’t accept payments from them or even tell them the amount due. I expect banks to strengthen due diligence of a condominium association’s governing documents, policies and financials before agreeing to lend on a property subject to its covenants.

- Home Buyer’s Focus on Contingency. In purchasing a condominium or another type of property in an association, a buyer has a window of time to review the association disclosures and either get out of the deal or move forward. If the banks start escrowing association fines, etc., this may become a greater focus in the home-buying process.

- Cash Only Trend Prevails in Condominium Sales. In many condominiums, unit sales are conducted in all cash. The cash only option certainly cuts out the problem of the purchase money-lender. This also cuts most owner-occupants out of the house hunt, and decreases the number of owner-occupants in the association, making the place less attractive to lenders. This does not seem to be a solution.

One option that I haven’t seem discussed elsewhere is this: What if, when unit owners default on their obligations, the property is put up for foreclosure, and the lender, association (or any other investor), could submit competing bids to a trustee? The HOA would get paid, and the lender could get the collateral property. I doubt this would work under the existing statutory framework, but perhaps it would work better than an escrow.

If you own a property that is subject to the covenants of a condominium or homeowners association, and the association has threatened to enforce its lien against your property, contact a qualified real estate attorney to protect your rights. In order to protect your rights, you may need to prepare for a sea change in the balance of powers in home ownership.

If you are considering an opportunity to purchase a property at an association assessment lien foreclosure sale, retain qualified counsel to advise you regarding related risks, and carefully consider purchase of title insurance.

Case opinions discussed: Colchester Towne Condominium Council v. Wachovia Bank, 266 Va. 46, 581 S.E.2d 201 (2003)

Photo Credit: (photo of Richmond, Va. condos, not property discussed in blog post): rvaphotodude via photopin cc

October 29, 2014

Can A Condominium Association Foreclosure Extinguish a Mortgage Lien?

On October 16, 2014, I asked in a blog post, “What Rights Do Lenders and Owners Have Against Property Association Foreclosure?” In that installment, I discussed a Nevada foreclosure case that was not between the borrower and the lender. It reflected a litigation trend between the lender, homeowners association and the federal government. Today’s article continues exploration of this legal development emerging in some states. Some courts are finding that homeowners associations have the right to foreclosure on private property for failure to pay fines, dues and special assessments. Several recent court rulings found that HOA foreclosures can extinguish the lien of the bank who financed the purchase of the property. Owners, banks and federal housing agencies find this trend an alarming sea change in the home mortgage markets.

Evaluating Competing Foreclosure Rights:

Today’s blog post focuses on where all of these legal developments put lenders when an Association attempts to enforce a lien for nonpayment of fines, assessments and dues. In a mortgage, the borrower agrees to put the property up as collateral to finance the purchase. The loan documents received at closing outline the payment obligations and the rights of foreclosure. Association obligations, on the other hand, are determined by the governing body of the Association according to the Bylaws. In many states, statutes provide for Associations to record liens in land records for unpaid assessments. Some statutes also allow Associations to conduct foreclosure sales to satisfy unpaid assessments by following certain procedures. Where state law allows, the Association’s authority to foreclose isn’t based on the owner’s agreement to make the property collateral. The statutes and recorded covenants put the buyer on notice of these Association rights.

Journalist Megan McArdle discusses on BloombergView how in about 20 states, HOAs can put homes up for auction (without the permission of the lender) and sell them to satisfy little more than outstanding dues (perhaps a four figure amount) to an investor, and the bank’s mortgage lien (six or seven figures, likely) is extinguished from the real estate. Ms. McArdle remarks that this doesn’t make a huge amount of sense, and I tend to agree with her. Some adjustment must come to the regulatory landscape in order to preserve both property rights and market liquidity.

Personal Experience with Northern Virginia Condominium Ownership:

Before I got married, I owned and lived in a condominium in Northern Virginia for over nine years. I remember hearing discussions, whether at the annual meeting or in the elevators, that some owners in the building fell on hard times and had kept on paying their taxes and mortgages but had stopped paying their condo association dues. Those distressed homeowners felt confident that while the association might consider other collection activity, it would not be able to sell their unit in foreclosure, to the prejudice of both the mortgage lender and the owner. At that time, the right to occupy the unit had a unique value to them.

This made sense to me, because the mortgage lender usually has more “skin” in the game in terms of the dollars invested. Can this strategy continue to hold up in light of new national trends in HOA foreclosure? Changes have already reached the opposite shores of the Potomac in an August 28, 2014 District of Columbia Court of Appeals decision.

Bank and Association Battle in D.C. Courts Over Priority of Liens on Condo Unit:

Two months ago, the Court of Appeals published an opinion that will likely change the lending environment for D.C. condominiums. In July 2005, Brian York financed $280,000.00 to purchase a unit in the Chase Plaza Condominium in Washington, D.C.. Unfortunately, he became unable to continue making payments on his mortgage and Association dues after the mortgage crisis began in 2008. In April 2009, the Association recorded a lien of $9,415 in land records. The Association foreclosed, selling the entire home to an investor for only $10,000.00. The Association deducted its share and then forwarded the $478.00 balance to the lender. The bank and Association found themselves in Court over whether the Association had the right to wipe off the bank’s six figure mortgage lien in the five-figure sale to the investor.

The Court of Appeals found that under the D.C. condominium association foreclosure statute, the lender gets paid from the left-over proceeds, and to the extent the lien is not fully satisfied, it no longer attaches to the real estate. (It then becomes an unsecured debt against Mr. York, who went into bankruptcy).

J.P. Morgan, the successor in interest to the original lender, pointed out that such a conclusion, “will leave mortgage lenders unable to protect their interests, which in turn will cripple mortgage lending in the District of Columbia.” The Association and investor responded that the alternative leaves HOAs often unable to enforce their liens or find buyers in foreclosure sales. The Court suggested that lenders can protect their own liens by escrowing the HOA dues, like property taxes.

The decisions of Nevada, the District of Columbia and other jurisdictions do not control the Supreme Court of Virginia or the General Assembly. However, the same economic and human forces exert pressure on lending and home ownership in Virginia as they do in the District of Columbia. What is the current law in Virginia? How are owners and lenders to react to these changes here? The answer will come in the next installment in this series on Community Association Foreclosure.

If you are the beneficiary or servicer of a loan on distressed real estate subject to a lien of a community association, contact qualified legal counsel to protect your interest in the collateral.

Case opinion discussed: Chase Plaza Condominium Ass’n, Inc., et al. v. J.P. Morgan Chase Bank, 98 A.3d 166 (2014).

Photo credit: To my knowledge, the featured photo does not depict any of the property specifically discussed in this blog post. The credit is here: c.schuyler@verizon.net via photopin cc

October 16, 2014

What Rights Do Lenders and Owners Have Against Property Association Foreclosure?

How are Virginia homeowners to evaluate competing threats from their mortgage bank and property association foreclosure? For many years, owners unable to pay their bills associated with their homes have focused on the threat of foreclosure from their mortgage lender.

Homeowners’ Varying Obligations to Lenders and Property Associations:

The conventional wisdom, in Virginia at least, is that homeowners should focus on keeping bills paid in the following priority: (1) local property taxes (have priority as liens, and are non-dischargable in bankruptcy), (2) mortgage lenders (monthly payments largest) (3) the monthly dues and special assessments of the homeowners association or condominium unit owners association. These notions are reinforced by mortgage lenders who escrow property taxes but not association assessments. Should owners continue to follow this in making decisions in the face of risk of payment default? Tax liens will certainly continue to enjoy a super-priority. However, a unit owner’s rights and responsibilities to their community association are of a different nature than bank mortgages. The rights of Associations to fix dues, special assessments and fines change. The General Assembly can amend the statutes. Courts make new legal interpretations. The owners can vote to change the Association Bylaws. Although the Association has significant influence over a unit owner’s rights, its lien is often overlooked to the detriment of many owners. What foreclosure, rights, if any, may an Association use to enforce its assessments? Florida and Nevada tend to be bellwethers of national trends in property associations because of their extraordinary number of condominiums and other associations. One recent case illustrates the chaos that may arise from these competing claims.

Las Vegas Foreclosure Contest Between HOA, Bank and U.S. Government:

On September 25, 2014, Judge Gloria Navarro of the U.S. District Court for Nevada issued an opinion providing clues to how Virginia homeowners may one day find themselves caught up in legal crossfires between banks and HOA’s. Emiliano & Martha Renteria owned a single-family home in Las Vegas that was a part of the Washington & Sandhill Homeowners Association (“HOA”). This is not a condominium but the issues are analogous. In September 2009, they defaulted on their Bank of America mortgage. Like Virginia, Nevada allows non-judicial foreclosure proceedings wherein title is transferred transactionally. The Court becomes involved if there is a dispute. In July 2012, the Bank-appointed Trustee foreclosed on the property. Five months later they rescinded that foreclosure. In May 2013, the Bank completed a foreclosure (in a do-over), claiming title to the property. On May 17, 2013 the Bank conveyed the home to the U.S. Department of Housing & Urban Development in a claim under the Single Family Mortgage Insurance Program.

To make matters more confusing, the HOA pursued its own foreclosure proceedings on the property at the same time to enforce its lien for the Renteria’s failure to pay their assessments. Most of the procedural aspects of Nevada condominium foreclosures are substantially different from Virginia. The HOA purchased the Renteria property at its own foreclosure sale in May 23, 2012, before the Bank’s first foreclosure sale. In July 2012, the HOA filed a release of its lien. A couple of months later, the HOA resumed its foreclosure, asserting an unpaid assessment lien of $4,983.00, this time against the Bank as owner. In October 2012, the HOA reacted to the Bank’s conveyance of the property to HUD, asserting a lien of $1,250.00 against the government. Note that this association foreclosed on a single-family home in an urban area to satisfy only $1,000-$5,000. When those demands went unpaid, the HOA abandoned this position. On October 9, 2013, the Association filed a federal lawsuit claiming ownership pursuant to the May 23, 2012 sale. In the lawsuit, the HOA disputed the Bank and HUD’s claims of title.

On September 18, 2014, the Supreme Court of Nevada ruled in a similar case that a HOA foreclosure extinguishes a mortgage lien such as that held by the Bank. Local readers may be interested that on August 28, 2014, the D.C. Court of Appeals reached a similar decision. In Nevada, Judge Navarro discussed how it is illogical for the HOA to simultaneously claim to be the rightful owner of a property and also assert an assessment claim against another party as owner. She found that under Nevada law, the Association was not permitted to waive its right to extinguish the Bank’s prior lien through foreclosure. The Court decided that the HOA’s subsequent release of the lien against the Renterias and new liens against the Bank and HUD were not valid because it had no right to change course. Had an individual investor purchased the property from the Bank’s foreclosure following the HOA’s release, he would have found himself caught up in this mess. The Court did not discuss whether these latter actions also created unwaivable rights. Judge Navarro ultimately decided that the HOA claim of title violated the U.S. Constitution. She dismissed of the Association’s lawsuit on the grounds that the HUD enjoyed an interest in the property under the Single Family Mortgage Insurance Program that could only be released under federal law. The Property Clause of the Constitution states that, only “Congress has the Power to dispose of and make all needful Rules and Regulations respecting the Territory or other Property belonging to the United States.” Since the Bank’s mortgage was HUD-insured, a HOA cannot violate the government’s rights as insurer. This case is currently on appeal.

All of this caught my attention because it illustrates how HOA’s and Banks may use nonjudicial foreclosure procedures to duel over residual rights in distressed real estate. This case illustrates, if nothing else, why title examination and insurance are valuable investments to individual investors who may find themselves caught up in such a case. Well-advised home buyers must study the association bylaws and other disclosures carefully before waiving the contingency. If legal developments like this continue, associations will likely require a substantial legal reform. Otherwise, property values, especially condominiums will be in jeopardy, banks may restrict financing in fear of HOA lien priority, and investors may lose interest.

Will a Reordering of Rights of Banks and HOA’s Come to Virginia?

The competing rights of HOA’s and Banks is a critical aspect of the foreclosure crisis. On October 2, 2014, Nevada real estate attorney Bob Massi was interviewed on cable news about trends in HOA foreclosures. He predicted that lenders will start requiring borrowers to make their HOA payments into a bank escrow so that the lender’s foreclosure rights are not prejudiced by unpaid assessments.If this becomes a reality, mortgage servicers will become collection agents for associations. What remedies will owners have with respect to the escrow if they have disputes with the association over a fine? Will lenders change their underwriting guidelines to make loans more difficult for property subject to association covenants?

I expect that the issue of HOA lien priority will soon return to the Virginia Supreme Court and General Assembly. What responses to these trends can homeowners expect in Virginia? In a later installation in this new blog series about Association Foreclosure, I will discuss how a 2003 Supreme Court of Virginia decision presently limits a Condominium Association’s remedies for unpaid assessments. This Virginia opinion limits the rights of Virginia’s community association to disturb a lender’s rights under a purchase money mortgage. Given these new developments in Nevada and D.C., this 11-year-old opinion is important to every owner, association and lender with an interest in Virginia condominiums.

If you are a lender and have questions whether an association’s lien has priority over your own mortgage, contact qualified legal counsel. If you are an owner and have questions whether an attempt by your association to enforce a lien on your property runs afoul of the law or your condominium instruments, contact a real estate attorney to protect your rights.

Case citation: Washington & Sandhill Homeowners Association v. Bank of America, et al., No. 2:13-cv-01845-GMN-GWF (D.Nev. Sept. 25, 2014)(Navarro, J.).

Thanks to Shu Bartholomew, host of the weekly property rights radio show “On the Commons,” for letting me know about the Bob Massi interview.

Photo credit (photo does not depict the property discussed in this post): JoeInSouthernCA via photopin cc

June 18, 2014

Contesting Foreclosure In Bankruptcy Court

Can a homeowner block a foreclosure by filing for bankruptcy protection immediately after the bank-appointed trustee auctions the property? On June 2, 2014, a bankruptcy court judge ruled that Rachel Ulrey’s Roanoke property was not excluded from the bankruptcy estate because the foreclosure trustee completed the memorandum of sale prior to the court filing. The court opinion is of interest to homeowners facing foreclosure, mortgage investor or buyers at foreclosure sales. The case illustrates what can happen when a borrower is contesting foreclosure in bankruptcy court.

Rachel Sue Ulrey lives in Roanoke, Virginia. She fell behind on her payments to Suntrust Mortgage. Suntrust instituted foreclosure. Timothy Spaulding, the foreclosure trustee, conducted the sale on the steps of Roanoke Circuit Courthouse at 9:45 A.M on April 18, 2013. Suntrust submitted the only bid of $98,275.52. To memorialize the sale to Suntrust, Spaulding inscribed the details on the bidding instructions form.

About 45 minutes later, Ms. Ulrey filed for protection from creditors pursuant to Chapter 13 of the Bankruptcy Code. Unlike a Chapter 7 where the debtor’s estate is liquidated and the unsatisfied debts are discharged, in Chapter 13 the debtor has the opportunity to present a plan to reorganize and pay off existing debts according to a plan approved by the bankruptcy judge. This presents an opportunity to keep significant assets such as cars and homes.

Ulrey put Suntrust on notice of the bankruptcy case and presented a plan which the Court confirmed by an order entered July 12, 2013. Ulrey wanted to work out her arrearage with Suntrust and keep her home. Ulrey even made electronic mortgage payments in May – July 2013 to Suntrust. The bank returned these payments into Ulrey’s checking account.

Suntrust and Ulrey litigated in Bankruptcy Court over the validity of the foreclosure sale and whether the homeowner could make keeping the home part of her Chapter 13 Plan. The Court decided that because Suntrust never contested Ulrey’s bankruptcy plan, the bank is bound by that order. However, there is a catch – Ulrey must make sufficient payment to the bank to bring her plan current within 30 days. Otherwise, the Bank can proceed against the Ulrey house. Ulrey is both protected and bound by her reorganization plan. How can the Court find the foreclosure sale to be valid and then go on to enforce the bankruptcy plan treating the property as part of Ulrey’s estate? Doesn’t it have to validate one and void the other? The answer provides an expansive vision of bankruptcy jurisdiction:

Formality Requirement for a Written Memorandum of Foreclosure Sale: The Memorandum of Sale in foreclosure is comparable to a Regional Sales Contract in an ordinary deal. They both give the buyer a contractual right to later exchange the purchase price for a title deed. However, most Memoranda of Sale do not contain detailed contractual provisions. The one in Ulrey was a one page form containing the basic identifying facts of the sale and the bank’s bidding instructions. Ulrey challenged the validity of this document on the grounds that it did not contain enough terms. The sufficiency of the memorandum is legally significant. Contracts for sale of real property generally must be in writing to be enforceable. The Court suggests that Spaulding actually included more information in the Memorandum than was necessary to make it enforceable. The terms of the Memorandum of Sale are the business of the trustee and the buyer in foreclosure because they set a framework for going to closing. Whether the memorandum contains particular warranties or descriptions is not the prior owner’s issue.

Legal Rights of Homeowner Post-Foreclosure: If the foreclosure sale produced an enforceable contract between the trustee and the buyer, how does Ulrey have standing to put the property into her Chapter 13 Plan? The Court observed that post-foreclosure there were litigatible issues over the validity of the sale and Ulrey’s continued occupation of the premises. Without filing for bankruptcy, Ulrey could have tried to sue Suntrust challenging the foreclosure or opposing the eviction proceeding. These “residual” legal rights brought the dispute over the property into the jurisdiction of the bankruptcy court. The Court does not discuss whether Ulrey could have properly set forth a nonfrivolous claim contesting the foreclosure proceeding. It is one thing to have a lawsuit that could be filed and it is another to have one that could go to trial and possibly win. The Court implies that Suntrust waived that issue.

Power of Bankruptcy Court Orders Confirming Chapter 13 Plans: Although the memorandum of sale was valid, Ulrey succeeded in putting the ball back in Suntrust’s side of the court by filing a bankruptcy plan that included keeping the home. Ulrey got another opportunity to keep the home, because Suntrust failed to object to the bankruptcy plan. Ulrey succeeded not because she discovered a legal trick to successfully block a foreclosure. Rather, she got another bite at the apple because Suntrust failed to pay attention to her bankruptcy case. Ulrey’s case stands as a warning to mortgage investors to not ignore the owner’s post-sale bankruptcy filing, even when the foreclosure is conducted properly.

Hopefully for Ulrey she can come current on her bankruptcy plan and continue to make her mortgage payments. However, the Court states that Ulrey suffered a job loss and drained her bank accounts to pay living expenses. Her case illustrates the fleeting nature of successful foreclosure contests.

If Ulrey doesn’t come current, does Suntrust proceed with eviction or does the bank have to conduct a foreclosure sale again beforehand? Since the Court found the sale to be valid, perhaps re-auctioning the property would be unnecessary.

Case Citation: In Re Ulrey, 511 B.R. 401 (Bankr. W.D. Va. 2014).

Photo Credit: milknosugar via photopin cc

May 21, 2014

Dealing With Trust Issues: Fiduciary Duties of Foreclosure Trustees

In Virginia, unlike some other states, a foreclosure is a transaction and not necessarily a court proceeding. A trustee appointed by the lender auctions the property. The proceeds of the sale must be applied to reduce the outstanding loan amount and transaction costs. A Trustee has special duties to the parties as their “fiduciary.” What are the fiduciary duties of foreclosure trustees?

At real estate closings, settlement attorneys present borrowers with a document entitled “Deed of Trust.” In this document, the borrower pledges the purchased property as collateral. The Deed of Trust provides the legal framework for the lender to pursue foreclosure in a default. It also procedurally protects the borrower’s property rights. When the lender records the Deed of Trust in the land records, a lien encumbers the property until the debt is released. The Deed of Trusts names one or more persons as Trustees for the property. It describes the borrower as the creator of the trust and the bank as the beneficiary. If the borrowers avoid falling into persistent default of their loan obligations, this trust language is largely irrelevant.

If the borrower experiences economic hardship and falls behind on their payments, however, they will begin to receive notices referencing the Deed of Trust. The bank may appoint a Substitute Trustee to handle the foreclosure. The culmination of the foreclosure process is the Foreclosure Trustee’s public auction of the property to satisfy the distressed loan. What does the foreclosure process have to do with trusts and trustees? Generally, under Virginia law, a breach of a trustee’s duties gives rise to a Breach of Fiduciary Duty legal claim. Lawyers like to pursue these claims because they may impose duties and remedies not articulated in the contract. Does this trust relationship give the homeowner greater or fewer protections against breaches by the bank’s agents during the process?

On May 16, 2014, I posted an article about the materiality of technical errors committed by the mortgage investors in the foreclosure process. That post focused on two new April 2014 court opinions providing some guidance on what remedies borrowers may have for those errors. Those new court opinions also provide fresh guidance about fiduciary duties of foreclosure trustees. Today’s blog post is about dealing with trust issues in foreclosure.

Bonnie Mayo v. Wells Fargo Bank & Samuel I. White, PC:

The Deed of Trust on Bonnie Mayo’s Williamsburg home listed Wells Fargo Bank as the “beneficiary” and the foreclosure law firm Samuel I. White, PC, as the Trustee. Mayo’s post-foreclosure sale lawsuit alleged that the White Firm breached its fiduciary duties to the borrower. For example, Mayo’s Deed of Trust required the lender to state in written default notices that she may sue to assert her defenses to foreclosure. The lender’s notices did not advise her of this, and she did not sue until after the foreclosure occurred. The Federal Judge considering her claims noted that there is conflicting legal authority on the extent to which a foreclosure Trustee can be sued for Breach of Fiduciary Duty. In his April 11, 2014 opinion, Judge Jackson observed that under Virginia law, a Foreclosure Trustee is a fiduciary for both the borrowing homeowner and the mortgage investor. While courts impose those duties on Foreclosure Trustees set forth in the Deed of Trust, they are reluctant to impose all general trust law principles.

Judge Jackson concluded that in addition to those duties set forth or incorporated into the Deed of Trust, the only other imposed on Trustees is the duty of impartiality. For example a foreclosure sale must be set aside where a trustee failed to refrain from placing himself in a position where his personal interests conflicted with the interests of the borrower and the lender. For example, the Trustee may not purchase the auctioned property himself or assist the bank in setting its bid. The Federal Judge dismissed Ms. Mayo’s Breach of Fiduciary Duty claims against the White Law firm, since impartiality was not adequately pled in the lawsuit.

Squire v. Virginia Housing & Development Authority:

In an April 17, 2014 opinion, the Supreme Court of Virginia focused on the limited nature of a Foreclosure Trustee’s powers. In this case, the Deed of Trust required the lender to try to conduct a face-to-face meeting with the borrower between the default and the foreclosure. The lender’s Trustee foreclosed, even though the lender did not make such an effort. The Court observed that the trustee’s authority to foreclose is set forth in the Deed of Trust. The Trustee’s power to conduct the sale does not accrue until the specified conditions are met. The borrowers’ failure to make monthly payments does not constitute a waiver of their right to expect the lender’s appointee to follow the rules. The fact that the borrower is in default does not authorize the mortgage investor and the trustee to disregard the Borrower’s protections set forth in the Deed of Trust and any incorporated regulations.

This holding is consistent with Virginia’s practice of conducting foreclosures out of court. The procedures set forth in the deed of trust provide the lender with a means of selling the property without the time & expense of a judicial sale. If the procedural nature of those rights is not preserved, then foreclosure disputes will go to court more often, depriving the lenders of the convenience of non-judicial foreclosure.

Ms. King alleged that the Foreclosure Trustee breached its fiduciary duty by conducting the sale prior to a required face-to-face meeting with the borrower. The Supreme Court of Virginia found that the Breach of Fiduciary duty claim was improperly dismissed by the Norfolk judge. The Court sent the case back down for consideration of damages.

These two new court opinions show how breach of fiduciary duty claims against foreclosure trustees require legal interpretation of the deed of trust. If the lender and trustee digress from its procedures, impartiality may be easier to prove.

Discussed Case Opinions:

Mayo v. Wells Fargo Bank, No. 4:13-CV-163 (E.D.Va. Apr. 11, 2014)(Jackson, J.)

Squire v. Virginia Housing Development Authority, 287 Va. 507 (2014)(Powell, J.)

Credits: Trust Arch photo credit: Lars Plougmann via photopin cc Williamsburg photo credit: Corvair Owner via photopin cc (for illustrative/informational purposes only. Depicts colonial Williamsburg, not Ms. Mayo’s home)

May 16, 2014

What Difference Does It Make? Technical Breaches By Banks in Foreclosure

If a bank makes a technical error in the foreclosure process, what difference does it make? This blog post explores new legal developments regarding the materiality of breaches of mortgage documents. Residential foreclosure is a dramatic remedy. A lender extended a large sum of credit. Borrowers stretch themselves to make a down payment, monthly payments, repairs, association dues, taxes, etc. If financial hardships present obstacles to borrowers making payments, usually they will do what they can to keep their home.

In order to foreclose, lenders must navigate a complex web of provisions in the loan documents and relevant law. Note holders frequently commit errors in processing a payment default through a foreclosure sale. Sometimes these breaches are flagrant, such as foreclosing on a property to which that lender does not hold a lien. Usually they are less significant in the prejudice to the borrower’s rights. For example, written notices may not follow contract provisions or regulations verbatim, or a notice went out a day late or by regular mail instead of certified mail. Regardless of their significance, these rules were either willingly adopted by the parties or represent public policies reduced to law.

When homeowners challenge foreclosures in Court, lenders frequently argue in defense that the errors committed by the bank in the foreclosure process are not material. One could express this argument in another way by quoting the title lyric to British band The Smiths’ 1984 song, “What difference does it make?” The lenders typically highlight that the borrowers fell behind on their payments, did not come current, and do not have a present ability to come current on their loans. Borrowers face an uphill battle convincing judges to set aside or block foreclosure trustee sales or award money damages for non-material breaches. However, last month, two new court opinions illustrate a trend towards allowing remedies to homeowners for technical breaches. A relatively small award of money damages may not give homeowners their house back, but it may provide some consolation to the borrower and provide an incentive to mortgage investors, servicers and foreclosure trustees to strengthen their compliance programs.

When homeowners challenge foreclosures in Court, lenders frequently argue in defense that the errors committed by the bank in the foreclosure process are not material. One could express this argument in another way by quoting the title lyric to British band The Smiths’ 1984 song, “What difference does it make?” The lenders typically highlight that the borrowers fell behind on their payments, did not come current, and do not have a present ability to come current on their loans. Borrowers face an uphill battle convincing judges to set aside or block foreclosure trustee sales or award money damages for non-material breaches. However, last month, two new court opinions illustrate a trend towards allowing remedies to homeowners for technical breaches. A relatively small award of money damages may not give homeowners their house back, but it may provide some consolation to the borrower and provide an incentive to mortgage investors, servicers and foreclosure trustees to strengthen their compliance programs.

Content of Written Notices Required by Mortgage Documents:

On June 13, 2010, Wells Fargo Bank sent Bonnie Mayo a letter telling her he was in default on her mortgage on her Williamsburg residence. The letter indicated that if she failed to cure within 30 days, Wells Fargo would proceed with foreclosure. The letter informed her that, “[i]f foreclosure is initiated, you have the right to argue that you did keep your promises and agreements under the Mortgage Note and Mortgage, and to present any other defenses you may have.” However, the Mortgage required the lender to state in the written notice the borrower’s “right to reinstate after acceleration and right to bring a court action to assert the non-existence of a default or any other defense of Borrower to acceleration and sale.” Ms. Mayo’s notice did not include this language. She did not bring a lawsuit until after the date of the foreclosure sale.

In her post-foreclosure lawsuit, Mayo alleged (among other claims) that this breach entitled her to rescind the foreclosure and receive money damages. Wells Fargo moved to dismiss this claim on the grounds that the difference between the contractually required language and the actual letter was immaterial. In an April 11, 2014 opinion, Judge Raymond Jackson observed that just because a breach is non-material does not mean it is not a breach at all. He reached a conclusion contrary to a relatively recent opinion of another judge in the U.S. District Court for the Eastern District of Virginia.

Virginia courts recognize claims to set aside foreclosure sales for “weighty” reasons but not “mere technical” grounds. Judge Jackson suggested that the bar may be higher for a homeowner to set aside a foreclosure sale after it occurs than to block it from happening in the first place. The Court declined to dismiss this claim on the sufficiency of the notices. Judge Jackson found that the materiality of this breach was a factual dispute requiring additional facts and argument to resolve.

A foreclosure is less susceptible to legally challenge after a subsequent purchaser goes to closing. Thus, the bank’s omission of language informing the borrower of her right to sue prior to the foreclosure carried a heightened potential for prejudice. Whether Ms. Mayo had a likelihood of prevailing in an earlier-filed lawsuit is a different story.

Failure to Conduct a Face-to-Face Meeting Prior to Foreclosure:

In 2002, Kim Squire King financed the purchase of a home in Norfolk, Virginia, with a Virginia Housing Development Authority mortgage. Her loan documents incorporated U.S. Department of Housing & Urban Development regulations requiring a lender to make reasonable efforts to arrange a face-to-face interview with the borrower between default and foreclosure. Loss of employment caused King to go into default on her VHDA loan in March 2010. VHDA never offered King a face-to-face meeting. VHDA instituted foreclosure wherein the trustee sold King’s property to a third-party.

King filed a lawsuit seeking money damages and an order rescinding the foreclosure sale. The judge in Norfolk agreed with defense arguments that the error was not grounds to set aside the completed foreclosure or award compensatory damages. The court dismissed the lawsuit. Squire appealed to the Supreme Court of Virginia. The Justices upheld the dismissal of her request to set aside the completed foreclosure sale. The lawsuit failed to allege facts sufficient to show that the sale was fraudulent or grossly inadequate.The Supreme Court distinguished King’s situation from legal precedents where the borrower filed suit prior to the foreclosure. Surprisingly, the Court found that the trial judge erred in dismissing King’s claim for money damages arising out of the failure to arrange the face to face meeting. The Justices remanded the case to proceed on the damages issue.

When mortgage servicers and foreclosure trustees commit technical errors, what difference does it make? These new legal decisions show increasingly nuanced analysis of these particular issues. The materiality of the lender’s breach depends on a number of factors, including:

- The borrower’s apparent ability to reinstate the loan. If it is unlikely that the homeowner will get back on track, denying the bank foreclosure makes less sense.

- Did the borrower file suit before or after the foreclosure sale? A lawsuit can delay a foreclosure until the borrowers enforce their rights under the loan documents and incorporated regulations. However, unless the borrowers have a strategy to work-out the distressed loan or otherwise favorably dispose of the property, a pre-foreclosure lawsuit may only delay.

- The relationship between the technical error and the relief requested by the borrower. For example, if the loan documents require a notice to go out by certified mail and it only goes out by first class mail, but the borrower received it anyway, then there isn’t any prejudice.

- Money damages suffered by the borrower that arose out of the technical breach. Borrowers seek to keep their homes and to pay according to their abilities. The U.S. District Court for the Eastern District of Virginia and the Supreme Court of Virginia show an increasing willingness to hold lenders monetarily responsible for prejudicial lender breaches in the foreclosure process. A legal claim that partially offsets the lender’s judgment for the balance of the loan post-foreclosure may provide some consolation but may not avoid bankruptcy.

Discussed Case Opinions:

Mayo v. Wells Fargo Bank, No. 4:13-CV-163 (E.D.Va. Apr. 11, 2014)(Jackson, J.)

Squire v. Virginia Housing Development Authority, 287 Va. 507 (2014)(Powell, J.)

photo credit: Fabio Bruna via photopin cc

May 6, 2014

Mortgage Fraud Shifts Risk of Decrease in Value of Collateral in Sentencing

On March 5, 2014, I blogged about the oral argument before the U.S. Supreme Court in U.S. v. Benjamin Robers, a criminal mortgage fraud sentencing appeal. At stake was how Courts should credit the sale of distressed property in calculating restitution awards. The U.S. Court of Appeals for the Seventh Circuit interpreted the Mandatory Victims Restitution Act to apply the sales price obtained by the bank selling the property post foreclosure as a partial “return” of the defrauded loan proceeds. Robers appealed, arguing that he was entitled to the Fair Market Value of the property at the time of the foreclosure auction. According to Robers, the mortgage investors should bear the risk of market fluctuations post-foreclosure because they control the disposition of the collateral. See Mar. 5, 2014, How Should Courts Determine Mortgage Fraud Restitution?

Yesterday, the Supreme Court affirmed the re-sale price approach in a unanimous decision. The Court observed that the perpetrators defrauded the victim banks out of the purchase money, not the real estate. The foreclosure process did not restore the “property” to the mortgage investors until liquidation at re-sale.

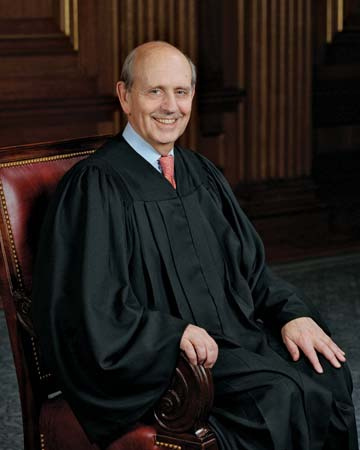

The Court focused on defense arguments that the real estate market, not Robers, caused the decrease in value of collateral between the time of the foreclosures and the subsequent bank sales. Justice Stephen Breyer wrote that:

Fluctuations in property values are common. Their existence (through not direction or amount) are foreseeable. And losses in part incurred through a decline in the value of collateral sold are directly related to an offender’s having obtained collateralized property through fraud.

Breyer distinguished “market fluctuations” from actions that could break the causal chain, such as a natural disaster or decision by the victim to gift the property or sell it to an affiliate for a nominal sum. See Lance Rogers, May 6, 2014, BNA U.S. Law Week, “Justices Clarify that Restitution ‘Offset’ is Gauged at Time Lender Sells Collateral.”

Falsified mortgage applications cause a lender to make a loan that it would not otherwise extend. A restitution award mirroring what the lender would receive in a civil deficiency judgment is inadequate. The defendant’s conduct opened the door for the Court to shift the risk of post-foreclosure market fluctuation from the bank to the borrower. Robers did not single-handedly render the local real estate market illiquid. However, as Justice Sonia Sotomayor mentions in her concurrence, real estate takes time to liquidate. These banks did not unreasonably delay the liquidation process. The Court opinion did not mention the prominent role of origination fraud in the subprime mortgage crisis. The Supreme Court’s unanimous decision strongly rejected defense arguments that downward “market fluctuations” severed the causal connection between the origination fraud and the depressed sales prices obtained by the lenders.

The Court did not discuss the original purchase prices for Robers’ two homes. In many mortgage fraud schemes, loan officers find “straw purchasers” such as Mr. Robers for sellers who agree to provide kickbacks on the inflated sales prices. See Mar. 15, 2009, Milwaukee Journal-Sentinel, “Amid Subprime Rush, Swindlers Snatched $4 Million.” The perpetrators do not disclose these kickbacks to the lenders. The mortgage originators also receive origination fees from the lenders on the fraudulent closings. Under this arrangement, the purchase price will naturally reflect the highest sales price the bank’s appraiser will support. The bank is defrauded both by the fictitious qualifications of the borrower and the exaggerated sales prices.

U.S. v. Robers may result in stricter, more consistent restitution awards in mortgage fraud cases. I wonder how it will be applied in cases where the defendant presents stronger evidence that the victims acted unreasonably in liquidating the property. The opinion seems to leave discretion to District Courts to determine whether a bank’s conduct or omissions breaks the connection between the mortgage fraud and the sales price.