October 25, 2016

Virginia Consumer Protection Claims Against Contractors

There is a lot of litigation and arbitration in the construction contracting industry. Most of these cases are disputes over whether the contractor did the work and if so, whether it has been appropriately compensated under the terms of the agreement. Some construction disputes include allegations of deceptive practices. Virginia law approaches unprofessional practices in the construction contracting industry in two ways: First, construction contractors must obtain licenses to do business here. A builder is subject to professional sanction if the Board for Contractors finds that the conduct violated regulations. There is a fund managed by the board, from which unsatisfied claims may be paid if certain criteria are met. Second, owners, general contractors, subcontractors and other parties can bring lawsuits (or where agreed, arbitration claims). Can residential owners bring Virginia consumer protection claims against contractors? Parties unfamiliar with these rules often need help navigating the legal system to protect their rights.

VCPA & License Regulation:

In the 1970’s, the General Assembly adopted the Virginia Consumer Protection Act (“VCPA”). The main purpose of the VCPA is to make it easier for consumers (including homeowners) to bring legal claims against suppliers for deceptive practices. Before the VCPA, consumers had to prove fraud. Suing for fraud is attractive because a court may award attorney’s fees or punitive damages for fraud. However, fraud carries a higher standard of proof and many defenses that the consumer must overcome. In a proper case, the VCPA allows for tripled damages and attorney’s fees. The legislature has exempted certain types of real estate related business activity from the VCPA, including regulated lenders, many landlords and licensed real estate agents. What about contractors? Are contractors subject to professional regulation and exempt from the VCPA? Last month, the Circuit Court of Loudoun County considered this question in a lawsuit arising out of a residential custom contracting dispute.

Closing the Sales Process for the Custom Residential Construction Project:

On May 20, 2015, licensed contractor Interbuild, Inc. made a written agreement with Leslie & John Sayres for the construction of a large recreational facility on their property. The Sayres agreed to pay $399.624.00 for what would include a batting cage, swimming pool, exercise area and bathroom. According to the Sayres, they relied upon certain false representations by Interbuild in their decision to move forward with the contract. They allege that Interbuild told them the following:

- Interbuild had been established since 1981.

- The project did not require a building permit.

- The contractor already priced things out with subcontractors.

- Interbuild would supervise construction full-time.

- The project would be completed in 16 weeks.

- 4000 PSI concrete would be used.

- The building would be constructed upon an agreed upon area.

On October 20, 2016, attorney Chris Hill discusses this Sayres opinion in his Construction Law Musings blog. He observes that many of the alleged misrepresentations sound like things that would be specifications or terms of the contract. Hill raises concerns expressed by Interbuild’s lawyers that the Sayres complaint attempts to transform a breach of contract case into a fraud claim. I agree that this fraud in the inducement claim will be a challenge to pursue. However, I think that some of the fraud claims described in the Sayres counterclaim sound more like promissory fraud than anything else. Under Virginia law, promissory fraud occurs when one party makes a promise to the other that they have no intention of keeping, and the listener relies upon this empty promise to their detriment. In July, I blogged about this in the foreclosure context. If a false promise remains fraud even after reduced to a contract, then the Sayres fraud in the inducement claims make more sense.

Some of these alleged misrepresentations appear potentially more serious than others. While contract management experience is important, the Sayres contracted with Interbuild for a certain result. The experience was not an end unto itself. A missing permit could become a problem if the county later decided that the construction was not code-compliant and wanted substantial, costly corrections. The subcontractor pricing could become an issue if it could be proven that Interbuild was effectively unable to complete the job from the get-go. A contractor is required to provide adequate supervision regardless of what is represented. Rarely will you see a written agreement that absolves a contractor of this. In a proper case, courts will award damages for delay. However, the Sayres would have to prove that they relied upon the agreed delivery date. I suspect that this lawsuit is not about the Sayres inconvenience of continuing to exercise in a different place. The strength of the concrete raises serious structural questions, but would require proof by expert testimony. Building the project on the spot where the customer wants is indeed a fundamental issue. However, it might be shown that the location under the contract is unfeasible due to site conditions or that the difference is only slight. In general, the damages must flow from the misrepresentations. Courts are reticent to award a windfall to purchasers if the lies are of minimal consequence.

After paying most of the purchase price but before completion, the Sayres terminated the contract. Interbuild sued for work that was allegedly performed but not paid for. The Sayres filed counterclaims for fraud in the Inducement, VCPA and breach of contract.

Fraud in the Inducement:

Interbuild sought a court ruling on whether the Sayres could move forward with their fraud in the inducement and VCPA claims. The Contractor argued that the fraud claim should be thrown out. Interbuild maintained that the fraud claim was not proper because the customer only alleges that their expectations under the contract were disappointed. In its September 8, 2016 opinion letter, the Court dispensed with this argument, distinguishing between fraud inducing formation of the contract and fraud in the performance of the contract. The court found that the counterclaim clearly alleged that the misrepresentations were made to convince the Sayres to sign the contract. Because the alleged fraud occurred before the contract came into being, the claim is not alleging disappointed contractual expectations.

When legal disputes arise, owners and contractors frequently focus their attention on things that were most recently said or done. A contractor may be unhappy about an owner’s hands-on attitude about a project. Customers may take offense at the contractor’s customer service. However, the case might be about fraud in the inducement issues that come from the sales process. In the Sayres case, the judge allowed the fraud in the inducement claim to move forward.

The VCPA:

Interbuild adopted a different approach in its attempt to get the Sayres’ VCPA claim dismissed. The contractor argued that since it is subject to regulation as a licensee of the state contracting board, it is exempt from the consumer protection statute. While the VCPA does not specifically name contractors as exempt, it does exclude “any aspect of a consumer transaction which aspect is authorized under laws or regulations of this commonwealth. Va. Code § 59.1-199. Contractors are subject to state regulation by Va. Code § 54.1-1000, et seq. In his opinion, Judge Douglas L. Fleming, Jr. followed judicial precedents distinguishing between consumer transactions that are specifically sanctioned by law vs. those that are merely regulated. The absence of a prohibition of a particular practice does not constitute authorization of that practice. Since the professional regulations do not specifically cover the particular types of business practices at issue, this statutory exemption does not protect the contractor from suit. The court found that the alleged misrepresentations are the kind of practices that are actionable under the VCPA. This is consistent with other rulings made by Virginia courts in cases between consumers and construction contractors.

The VCPA also provides that a consumer may sue a contractor for not having a license. Interbuild argued that because it had an active contracting license it was exempt from the VCPA. Since Interbuild is subject to license revocation for conduct that violates professional regulations, that should be the sole remedy under the state statutes. Judge Fleming rejected this argument, observing that the state’s licensure regulations do not, “inferentially cloak licensed contractors with VCPA immunity if they are shown to have committed deceptive practices.” In short, a professional license does not include with it a privilege to engage in fraudulent behavior.

News reports frequently raise public policy questions about professional regulation. Each year, more occupations become subject to licensure requirements. Usually this means that the leaders in that industry regulate its participants by means of a state board. Too often, self-regulating industries use these boards to protect prominent members against competition. Consumers look to the boards for relief from predatory practices, but are often frustrated by the results. Interbuild’s arguments seem to appeal to this notion that as a licensee, its customers should have to go through the board if they want a special remedy. Bear in mind that there is a public demand for housing prices to go down. Builders have a more organized lobby than consumers regarding professional regulation and limiting liability for extra damages in lawsuits. Given market demands, I wonder how close the General Assembly is to exempting contractors from the VCPA. The construction industry provides many jobs to Virginia. However, I think that the public’s interests would not be served if quality and service were sacrificed for job creation and affordability concerns. A defect-riddled house is the most unaffordable of investments to its owner and doesn’t help the “property values” of others.

All the September 8, 2016 opinion decided was that Interbuild’s counterclaims may move forward in litigation. Even under the lower standards and enhanced remedies of the VCPA, claims based on deception are difficult to prove and obtain an award of damages.

When disputes arise over custom construction contract projects, the parties cannot rely upon the board of contractors or the county’s permitting office to advocate or mediate for them. When payment issues, construction defects or other disputes arise, the services of an experienced construction litigator are necessary to protect one’s best interests.

For Further Reading:

Photo Credit:

Phil’s 1stPix Too Many Tonka Toys? via photopin (license)

July 1, 2016

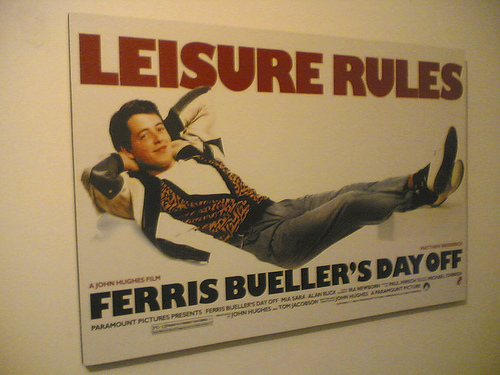

False Promises of Loan Modifications in Fraudulent Foreclosure Cases

In the classic comedy, Ferris Bueller’s Day Off, Ferris’s mother meets with the assistant principal to discuss his absenteeism. She had no idea he took 9 sick days. The school official bluntly explains: “That’s probably because he wasn’t sick. He was skipping school. Wake up and smell the coffee, Mrs. Bueller. It’s a fool’s paradise. He is just leading you down the primrose path.” Mothers of truant teenage sons aren’t the only ones succumbing to the temptation of wanting to believe that everything is fine when it isn’t. Owners busy with their jobs and families would like for their home to be worry-free. Unfortunately, the Ferris Bueller’s of the world sometimes grow up to service mortgages, manage HOA’s and handle customer service for home builders. The real estate and construction industry has some predators who lead consumers on the “primrose path.” We are not talking here about mere “sales talk” and “puffery” (for example, someone merely says that they will “treat you like family”). Promissory Fraud is when someone makes promises with no intent to follow-through but with every desire for the listener to rely upon it. In the past few years, borrowers have sued mortgage servicers for false promises of loan modifications in fraudulent foreclosure cases. Loan servicers stand in the shoes of the original mortgage lender as far as the borrower is concerned. Servicers send out the loan account statements, collect the payments and make disbursements. These cases allege that the servicers used “primrose path” tactics to conduct foreclosure fraud.

Leading along the primrose path is a powerful ploy because of the psychological roller-coaster the consumer experiences. Financial struggles, default notices and foreclosure letters causes stress and troubles that impact owners’ resources, time and relationships. Promises of time extensions, foreclosure avoidance and loan modifications are spellbinding. They invite the consumer to the much-missed happy place of living their life without threat of catastrophic financial loss. If the servicer says just the right thing, the borrower will very naturally want to let down their guard and forego more arduous tasks of forging a legal and financial solution to the problems. The false sense of security is intoxicating. When the borrower later experiences foreclosure instead of the promised modification, they are left trying to pick up the pieces.

Randolph Morrison vs. Wells Fargo Bank:

Mortgage servicers often get away with this because borrowers don’t always pay close attention to what they are actually being told. When borrower listen and take notes, they protect themselves. In 2014, a federal judge in Norfolk considered a claim for fraud based on telephone misrepresentations that Wells Fargo Bank allegedly made in the foreclosure context. When Virginia Breach homeowner Veola Morrison died in 2009. Her family received a notice that the property would be foreclosed on January 19, 2011. Veola’s son Randolph offered to assume the mortgage and requested an interest rate reduction. On January 12, 2011, a Wells Fargo employee told Randolph that he was approved for a loan modification and that the January 19, 2011 foreclosure would not take place. Wells Fargo sent Randolph a letter dated January 14, 2011 offering him a special forbearance agreement, requiring him to make his first payment on February 1, 2011. A “forbearance” is when the lender agrees to hold off on foreclosure and collection activities for a period of time in anticipation that the borrower will resolve short-term cash flow difficulties. They said that the foreclosure would be suspended so long as Randolph kept to the terms of the agreement. In spite of these representations, Wells Fargo Bank’s substitute trustee conducted the foreclosure sale anyway on January 19, 2011. In his suit, Randolph alleged that he reasonably relied upon a telephone statement by Wells Fargo that the January 19, 2011 foreclosure would not occur. He relied upon the subsequent letter saying when he had to make his next monthly payment. Relying on these representations, Randolph did not take other actions to prevent foreclosure such as hiring an attorney. After he discovered what happened, Randolph sued Wells Fargo. The Court denied Wells Fargo’s initial motion to dismiss the case and allowed Randolph’s claim for promissory fraud to proceed in Court. The case settled before trial.

Mortgage servicers often get away with this because borrowers don’t always pay close attention to what they are actually being told. When borrower listen and take notes, they protect themselves. In 2014, a federal judge in Norfolk considered a claim for fraud based on telephone misrepresentations that Wells Fargo Bank allegedly made in the foreclosure context. When Virginia Breach homeowner Veola Morrison died in 2009. Her family received a notice that the property would be foreclosed on January 19, 2011. Veola’s son Randolph offered to assume the mortgage and requested an interest rate reduction. On January 12, 2011, a Wells Fargo employee told Randolph that he was approved for a loan modification and that the January 19, 2011 foreclosure would not take place. Wells Fargo sent Randolph a letter dated January 14, 2011 offering him a special forbearance agreement, requiring him to make his first payment on February 1, 2011. A “forbearance” is when the lender agrees to hold off on foreclosure and collection activities for a period of time in anticipation that the borrower will resolve short-term cash flow difficulties. They said that the foreclosure would be suspended so long as Randolph kept to the terms of the agreement. In spite of these representations, Wells Fargo Bank’s substitute trustee conducted the foreclosure sale anyway on January 19, 2011. In his suit, Randolph alleged that he reasonably relied upon a telephone statement by Wells Fargo that the January 19, 2011 foreclosure would not occur. He relied upon the subsequent letter saying when he had to make his next monthly payment. Relying on these representations, Randolph did not take other actions to prevent foreclosure such as hiring an attorney. After he discovered what happened, Randolph sued Wells Fargo. The Court denied Wells Fargo’s initial motion to dismiss the case and allowed Randolph’s claim for promissory fraud to proceed in Court. The case settled before trial.

Alan & Jackie Cook vs. CitiFinancial, Inc.:

Just because a false reassurance is not in writing doesn’t mean that the borrower can’t sue for fraud. Virginia Federal Judge Glen Conrad considered this question in 2014. Jackie & Alan Cook owned a property in Lovington, Virginia. In September 2011, Mr. Cook explained to his lender CitiFinancial, Inc. that he was current on his loan but struggling to make payments. The branch manager suggested that he pursue a loan modification through the Home Affordable Modification Program (“HAMP”). The manager told Mr. Cook that if he stopped paying, the lender would “have to modify the loan” and it would probably be able to cut the interest rate and principal owed. Mr. Cook became leery and asked questions. The manager reiterated that he should just stop making payments and ignore the bank’s letters until he received a notice with a date for the foreclosure sale. The customer services rep told Mr. Cook that once he got the foreclosure notice he could call the number on it and get started. Per the manager’s instructions, Mr. Cook stopped making payments and ignored the servicer’s default letters.

On June 17, 2013, Cook received a notice that on July 17, 2013, foreclosure trustee Atlantic Law Group would sell his Nelson County property in foreclosure. Remembering what CitiFinancial originally said, Cook tried to call the loan servicer 20 times, receiving no answer or he was hung up on. Finally, on July 11, 2013, Mr. Cook got ahold of CitiFinancial who told him what information they needed for a loan modification. When Mr. Cook talked to another employee of the servicer, he was told that his case would remain on “pending/hold status” for 30 days in order for him to obtain the necessary documents, and that the scheduled foreclosure would be postponed during that time. On July 17, 2013, the noticed day of foreclosure, one employee of the servicer told him on the telephone the “great news” that he was awarded a loan modification. Later that day, he talked to another employee of the servicer who told him that the foreclosure would indeed proceed as originally scheduled, because he failed to provide them with necessary documents. When Mr. Cook asked her about the 30-day hold period that he was previously given, she replied that “she had never heard of such a thing” and that there was nothing to be done to stop the foreclosure sale. Notice how the servicer used a new misrepresentation about the 30-day period to keep Mr. Cook on the “primrose path” even after he struggled to communicate with him after defaulting per their instruction. Mr. Cook rushed to an attorney’s office but by the time the trustee received the attorney’s letter the sale had already occurred. Use of the primrose path strategy is particularly damaging because the new buyer can use the foreclosure trustee’s deed to initiate eviction proceedings. Citi bought this property at the trustee’s sale and brought eviction proceedings against Mr. Cook. Cook filed suit, basing fraud claims on the servicer’s false promises. CitiFinancial initially moved for the court to dismiss the lawsuit, arguing that Cook could not have reasonably relied upon the false oral representations because the promissory note and deed of trust provided unambiguous terms for foreclosure in the event of default. Citi seemed to be saying that only things that are in writing are official in the mortgage context. Judge Glen Conrad rejected this argument because the question of whether Cook was justified to rely upon Citi’s oral statements was an evaluation of the credibility of witnesses at trial.

Jackie & Alan Cook’s case settled before trial. An agreed order reversed the foreclosure sale. While a servicer misrepresentation doesn’t have to be in writing to constitute fraud, the dispute may come down to a “he-said she-said” at trial. Few borrowers will take careful notes at the time these discussions take place. While defendants may be required to make document disclosures, homeowners can’t count on getting copies of servicer notes and internal messages during the litigation. Search warrants are not available in civil cases.

The experiences of the Morrisons and Cooks are common amongst different lenders all across the country. It’s best for homeowners struggling with their mortgages avoid the “primrose path” promises made by some servicers, foreclosure trustees and foreclosure rescue scams. If it sounds too good to be true, then it deserves thorough review and consideration. However, there are many situations where relying upon the representations of a lender or trustee is the only reasonable option. Once the foreclosure trustee’s deed is recorded, the borrower may face eviction proceedings. If a trustee or servicer breaches the mortgage documents or makes misrepresentations in conducting a foreclosure, the borrower should contact qualified legal counsel immediately.

Case Citations:

Morrison v. Wells Fargo Bank, 30 F. Supp. 3d 449 (E.D. Va. 2014)

Cook v. CitiFinancial, Inc., 2014 U.S. Dist. Lexis 67816 (W.D. Va. May 16, 2014)

Photo Credit:

August 19, 2015

Donald Trump is in the Condominium Business but he does not trust Owner Associations

Donald Trump’s colorful background in the business of condominium development speaks volumes about two topics: (1) his track record as a real estate developer, and (2) the weaknesses of the community association model of real estate ownership. There are many commentators writing about the political nuances of Trump’s 2016 presidential campaign. Words of Conveyance is not a political blog. Instead, this post focuses upon a recent federal lawsuit involving the Trump Organization that illustrates a few risks in condominium ownership. Donald Trump is in the condominium business but he does not trust owner associations. As it turns out, Mr. Trump litigates in a similar way to his political campaigning.

Jacqueline Goldberg is a Certified Public Accountant who has invested over $10 million in real estate rental properties. A Trump-controlled developer made condominiums available in the Trump Tower in Chicago, Illinois. The Chicago Trump Tower’s 92 stories enclosed 486 residential units and 339 hotel condominium units. In 2006, Ms. Goldberg signed contracts to purchase two hotel condominium units as investments. Their prices were over $1.2 million and over $971,000, respectively.

The marketing materials used Mr. Trump’s personal brand to illustrate his personal involvement as an established, famous and successful developer. The Chicago Trump Tower advertised luxury amenities including a 60,000 square foot health club, concierge, laundry, garage, meeting rooms, ballrooms with 30 foot ceilings, storage areas, and an executive lounge as common areas of the condominium association. Since this was a hotel condominium, these common areas would be income generating assets and not merely perks available to owners or their tenants. The declaration is the essential document that defines these respective property rights of different owners in the association. This document defines which real estate elements are exclusively or commonly owned.

The marketing materials used Mr. Trump’s personal brand to illustrate his personal involvement as an established, famous and successful developer. The Chicago Trump Tower advertised luxury amenities including a 60,000 square foot health club, concierge, laundry, garage, meeting rooms, ballrooms with 30 foot ceilings, storage areas, and an executive lounge as common areas of the condominium association. Since this was a hotel condominium, these common areas would be income generating assets and not merely perks available to owners or their tenants. The declaration is the essential document that defines these respective property rights of different owners in the association. This document defines which real estate elements are exclusively or commonly owned.

While the hotel condominium units in the Trump Tower were more expensive than most detached single family dwellings, Ms. Goldberg’s purchase contracts had some language that would make many real estate people nauseous. The agreements provided that the, “[s]eller reserves the right, its sole and absolute discretion, to modify the Condominium Documents.” The Condominium Documents include the declaration, bylaws and floor plans. The purchase contract only required Ms. Goldberg’s approval to change the Condominium Documents when specifically required by law. Her risk was that the contract language gave Trump the unilateral authority to change the material terms of the deal.

After signing the purchase agreements, Ms. Goldberg learned that the Trump Organization made subsequent changes to the Declaration, removing the health club, concierge, laundry, meeting rooms, ballrooms, storage areas and executive lounge from the association’s common areas. Perceiving a “bait- and-switch,” Ms. Goldberg refused to go to closing on the sale of the two units.

When the Trump Organization refused to return her $516,000 earnest money deposits, Ms. Goldberg filed a lawsuit. The principal theory of her case was that the developer defrauded her by including the later-removed elements in the original package while never intending to keep them as common elements of the hotel condominium association. In his defense, Mr. Trump insisted that the association could not be trusted with management of these elements of a mixed-use development:

Mr. Trump, a self-described “expert” on condominium developments, testified that based on his experience, he went into the Trump Tower project aware that “it can be very difficult” for a condominium board to manage function rooms, ballrooms, and food/beverage operations. Mr. Trump explained that, as a general matter, condominium associations “can change their mind,” “fire managers,” “do lots of different things to create tremendous turmoil,” and “really ruin the operation very easily.” He further explained that if a condominium association fired a manager, “[i]t could become a disaster.” This “has happened before, many times, where condo boards are involved and they can’t make a decision, they can’t hire a manager, and the whole thing goes to hell.” This may affect not only the stability and profitability of the building, but also the Trump Organization.

Mr. Trump argued that these elements were originally included as common elements only as an oversight. When he later figured this out, he transferred them over to one of his companies in order to prevent some association board of directors from ruining the Trump Tower for everyone. To anyone unfamiliar with Mr. Trump’s personal bravado, these comments would sound outrageous. How can a developer strong-arm luxury, income generating amenities away from a group of unit owners in the name of “protecting property values” against the incompetence of their neighbors? Yet, in Goldberg’s case, this argument worked. Trump won the 2013 jury trial in the U.S. District Court for the Northern District of Illinois. Goldberg then appealed to the Seventh Circuit Court of Appeals. Judge Richard Posner, a well-known federal appeals court judge, wrote a June 10, 2014 opinion affirming the trial court decision. He had some interesting observations about this case:

- “She signed with her eyes open.” Goldberg was an experienced real estate investor who should have understood the risks of signing the contracts with the “change clause.” The Court declined to paternalistically rewrite these contracts or condominium instruments made between these sophisticated investors. We know from the first Republican 2016 presidential debate that Mr. Trump’s businesses declared bankruptcy four times in order to discharge real estate loans. Given Mr. Trump’s business practices and what was spelled out in the contracts, the Trump Tower units were speculative investments.

- “He is not infallible.” What is to be made of Mr. Trump’s decision to change the condominium instruments after Ms. Goldberg signed the agreements? Judge Posner observed that, “Donald Trump is of course a highly experienced real estate developer, but he is not infallible – he has had many successes in the real estate business but also failures.” Given Judge Posner’s reputation for use of a wry sense of humor in carefully written judicial opinions, one cannot help but believe that the Court had Mr. Trump’s bombastic style in mind here. Trump’s current presidential ambitions enhance the irony.

- No Real Expectation of Profit. For Ms. Goldberg’s securities laws claims to prevail, there must have been an expectation of profits from the disputed common elements. Judge Posner observed that Ms. Goldberg’s share of the projected profits would have been so small that her share of the annual maintenance fees would have been adjusted by at most 3%. He was not persuaded that the amounts in controversy were more than speculation.

For most people, opportunities to invest in condominium units do not involve the complex issues found in a Trump Tower. However, even commonplace initial purchases of units from a residential condominium developer involve substantial risks. One cannot conduct home inspections for properties that have not yet been built. The developer (or some other investor) may enjoy an oppressive supermajority vote in the governance of the owners’ association. There may be ambiguity in the Condominium Documents. Since seasoned investors like Jackie Goldberg experienced heartburn, there’s all the more reason for others to have advisors help them navigate such an investment. In a post-trial interview with the Chicago Tribune, Goldberg said she felt good about “exposing” Trump and offered this advice for anyone going into business with him: “Read the contract.”

As a presidential candidate, Mr. Trump lacks political electoral experience. However, the Goldberg case shows that Mr. Trump does have a governance background within his real estate dominion. Industry people espouse that community associations are “mini-governments” that alleviate the burdens on cities and counties while permitting neighborhoods to enjoy autonomy on how things are run on democratic principles. If condominium associations are indeed analogous to political democracy, what does Ms. Goldberg’s case say about how a Trump White House would treat other organs of government?

Case Citations:

Goldberg v. 401 North Wabash Venture LLC, 755 F.3d 456 (7th Cir. 2014)

Goldberg v. 401 North Wabash Venture LLC, 904 F. Supp. 2d 820 (N.D. Ill. 2012)

Photo Credits:

June 9, 2015

Can a Buyer Sue a Sellers Real Estate Agent?

This past month, I experienced wonderful changes in my life which drew me temporarily away from my passion for blogging about property rights. On May 1st, I started my own solo law practice, Cowherd PLC. The new law firm continues my professional focus on the types of legal matters discussed in “Words of Conveyance.” On May 27th, my lovely wife and I welcomed our beautiful newborn daughter into the world. I would like to thank my friends and family for their love and support, including those who follow this blog. As a parent, I want the best home environment for my child to grow up in. As a trial attorney, I want to advocate for rights that are precious to clients.

When smart prospective buyers search the market for a home, they need to investigate the property. Typically, buyers use home inspectors to help them. Unfortunately, some defects cannot be easily discovered during the home inspection. For example, a structural defect may be concealed by drywall or other obstructions. With other houses, flooding problems may only be apparent after heavy rains.

Often, buyers will ask the seller’s agent whether there is a history of flooding or other problems. Agents know that if potential buyers learn negative information about the property they may move on to another listing. After a buyer completes a sale, the property may turn out to have defects that were concealed or contrary to representations made in the sales process. Who is legally responsible in those situations? Can a buyer sue a sellers real estate agent? Virginia courts considering this question draw varying conclusions.

“Great Party Room:”

The Circuit Court of the City of Norfolk recently considered whether a buyer can sue a sellers real estate agent under the Virginia Real Estate Broker’s Act. Megan Winesett is an active duty servicemember who bought her first home in 2010. The property listing described the basement as a “great party room.” During the walk-through, Ms. Winesett asked her own agent about basement flooding. The buyer’s agent told her that the seller’s agent explained that flooding was not a problem. A few years later, Winesett renovated the property and discovered rotting and termite damage in vertical support beams in the basement under her kitchen. She also found cracks in her foundation.

Buyer’s Relationship with the Seller’s Agent:

Winesett sued the seller, seller’s agent, her own agent and the real estate brokerages for $75,000 for repairs plus $350,000 in punitive damages. She sued the seller for fraud and the realtors for violation of the Real Estate Broker’s Act (“REBA”). The seller’s agents sought to dismiss the lawsuit on the grounds that the statute does not create a private cause of action against the agents. They argued that the REBA only allows for professional discipline by the Real Estate Board and not lawsuits by individuals. In a 1989 decision, Allen v. Lindstrom, the Supreme Court of Virginia observed that:

The [seller’s agents]’ primary and paramount duty, as broker and broker’s agent, was to the sellers, with whom they had an exclusive contract. While there may be some type of general duty to the public owed by every realtor, it is not the type of duty that converts into a liability against a seller’s agent for improper conduct to one in the adversary position of prospective purchaser, where there is no foreseeable reliance by the prospect on the agent’s actions.

In that case, the Court rejected the buyer’s attempt to sue the listing agent for violation of a duty arising out real estate agent regulations.

Ms. Winesett brought her case against the agents on the Virginia Real Estate Broker’s Act, which also governs the practices of real estate agents. That statute creates duties for agents (licensees) to their own clients and also the opposite parties in the transaction:

Licensees shall treat all prospective buyers honestly and shall not knowingly give them false information. A licensee engaged by a seller shall disclose to prospective buyers all material adverse facts pertaining to the physical condition of the property which are actually known by the licensee. Va. Code Sect. 54.1-2131(B).

The Act requires such disclosures to be in writing. The realtor doesn’t need to be an expert in every issue. An agent is entitled to pass on information provided by the seller, the government, or a licensed professional. However, the agent may not rely upon information provided by others if he has actual knowledge of falsity or act in reckless disregard for the truth. Va. Code Sect. 54.1-2142.1.

On May 21, 2015, Judge Mary Jane Hall denied the seller’s agent’s motion, finding that the REBA does create a private cause of action for buyers against seller’s agents for violations. Judge Hall focused her analysis on language in the statute providing that, “This includes any regulatory action brought under this chapter and any civil action filed.” This case is currently set for trial in August. While the Court allowed this claim to move forward, Ms. Winesett bears the burden of proving it at trial.

Judge Hall’s legal conclusion is not consistently reached by all courts in Virginia. Unlike other consumer protection statutes, the REBA does not contain specific provisions about how a civil action may be brought and what remedies are allowed.

In 2004, the Circuit Court of Loudoun County entertained the same issue and concluded that a buyer is not entitled to a private cause of action against a seller’s agent for violation of the REBA. In Monica v. Hottel, Judge Thomas Horne decided instead that a buyer may allege a negligence per se claim against the seller’s agent for violation of the duty of ordinary care set forth in REBA.

I have a few observations about what these recent decisions mean to current and prospective real estate owners in Virginia:

- Discipline vs. Liability: In these cases, the sellers argued that the General Assembly contemplated that the statute would only be enforced by professional discipline, not private lawsuits. To a professional, the prospect of having one’s license suspended or revoked is a different type of threat than a jury award of a large money judgment. To the buyer saddled with a house requiring more repairs than they can afford, money is much more of a consolation than the knowledge that an agent is no longer selling real estate.

- Virginia Consumer Protection Act: Unlike auto dealers, construction contractors and many other types of businesses, licensed real estate agents are excepted from liability under the Consumer Protection Act. To the extent seller’s agents have responsibilities to buyers, liability would have to arise out of some other legal theory, such as the REBA, negligence or fraud.

- Challenges and Advantages of Suing for Fraud: Trial attorneys know that it is much easier to prove negligence or breach of contract than claims based on misrepresentation. In fraud, the standard tends to be higher and there are many recognized defenses. For example, expressions of opinion may not normally serve as the basis for a fraud suit. It is unclear what the standard of proof is for a civil action under the REBA and whether the usual defenses permitted in fraud cases apply. Buyers aren’t normally privy to the private conversations of the seller and his agent. Proof of “actual knowledge” may be hard to come by in many cases. However, there are advantages for suing for fraud. The plaintiff may be entitled to attorney’s fees and punitive damages. Fraud is a flexible legal theory which may provide a remedy in situations that statutes don’t cover.

- REBA Standard for Agents: Normally, a buyer must follow the traditional principle of Caveat Emptor (“Buyer Beware”). The REBA imposes a higher standard of professionalism on seller’s agents by requiring them to affirmatively disclose material adverse facts under many situations. Broad legal enforcement of REBA may change the way that real estate is sold in Virginia.

Although they construe the REBA in different ways, these recent court decisions demonstrate a trend towards greater consumer protection against predatory conduct in the real estate industry. In my experience litigating cases under common law fraud, consumer protection statutes, breach of contract and warranty law, I have learned that there is usually a legal theory that provides a consumer with a remedy. However, claims have a defined time period in which they may be brought. If you fell victim to dishonest conduct in your real estate purchase, discovered that a defect was concealed during your property inspection or your requests for relief under a warranty are being stonewalled, contact a qualified real estate litigation attorney before the passage of time may prejudice your rights. As an owner, you make a tremendous commitment and personal sacrifice to acquire and keep real estate. You are entitled to the legal protections owed by others.

Authorities:

Virginia Real Estate Broker’s Act, Va. Code Sect. 54.1-2100, et seq.

P. Fletcher, “Homeowner Can Sue Agents Under Brokers’ Act,” Va. Lawyers Weekly, (Jun. 5, 2015)

Winesett v. Edwards-Soblotne, No. CL14-6964 (Norfolk Cir. Ct. May 21, 2015)(Hall, J.)

Monica v. Hottel, 64 Va. Cir. 439 (Loudoun Co. May 24, 2004)(Horne, J.)

Allen v. Lindstrom, 237 Va. 489 (Va. 1989)

Photo Credit: Fixer upper via photopin (license)(Used to illustrate themes of post. Does not depict any properties described herein. To my knowledge, this property does not suffer any defects)

January 16, 2015

Federal Regulation of Nonjudicial Residential Foreclosure

Foreclosure of residential real estate is traditionally based on state law and agreements between the borrower and lender in the loan documents themselves. Each state has its own rules governing whether foreclosure should occur in or out of a court proceeding. In Virginia, the vast majority of foreclosures occur in bank-appointed trustee’s sales. State and federal courts review and supervise this activity through lawsuits brought by one or more of the parties, usually borrowers seeking to set aside trustee’s sales. However, they resist efforts to transform the foreclosure process into a judicial one, ruling on various motions brought early in cases.

The mortgage crisis is a national concern involving federal policies promoting home ownership. Is there a federal regulation of nonjudicial residential foreclosure? Through supervision of the mortgage giants Fannie Mae, Freddie Mac, and other administrative programs, the federal government is invested in the mortgage origination process. In some cases, a federal agency takes direct title to distressed home loans or the foreclosed real estate itself. I have written about some of those cases in the past few months. For example, Fannie Mae and Freddie Mac enjoy property recording tax exemptions. Also, in states like Nevada that allow homeowners associations to foreclose, government agencies find themselves in title litigation when properties are assigned to them pursuant to the terms of federal mortgage programs. In the event of default of a loan tied to a federal program, the government may find its interests aligned more on the creditor’s side.

Foreclosure is one of many remedies available to lenders to collect on defaulted home loan debt. For over 30 years, Congress has come to the aid of consumers in debt collection matters. In 1977, Congress enacted the Fair Debt Collections Practices Act to curb abusive practices by the debt collection industry against consumers. The FDCPA also has the effect of benefiting non-abusive debt collectors harmed by violating competitors. Since its enactment, Congress and the federal courts have clarified the FDCPA’s role in regulating debt collection law firms’ activity obtaining foreclosure sales and deficiency money judgments. Since an attorney’s sale of distressed Virginia real estate in a trustee’s auction is an activity outside of the traditional perception of debt collection, the role of the FDCPA in foreclosure practice has been relatively unclear until the past few years, when a slew of foreclosure contest lawsuits have tested the utility of the statute.

The FDCPA applies to lawyers collecting on home loan debts, not just non-attorney debt collection agencies. Federal courts in Virginia have recognized that the Act also applies when lawyer debt collectors act as trustees in residential foreclosures where the notices include a demand for payment. These consumer protection laws regulate, among other things, the communications between the debt collector and the consumer. In order to conduct a foreclosure practice, the attorney must send notices to the borrower. The FDCPA may provide independent causes of action against the attorney found to have engaged in abusive practices. FDCPA issues thus pervade residential foreclosure matters. Consumers, lenders, and their attorneys must be aware of how this Act affects a contested foreclosure matter. There are many ways the FDCPA may be violated in a foreclosure matter, including the following:

False Representations. Under ordinary circumstances, it is difficult for a party to prove that they are entitled to relief because their opponent is allegedly lying, cheating or stealing. These are weighty accusations; the standard for proof is high, and the defenses are many. In 15 U.S.C. § 1692e, the FDCPA changes the rules of the game in the consumer debt collection context. The consumer doesn’t need to prove that he was actually deceived by the misleading communication. Instead, the consumer must show that false representations in a debt collection communication materially affects a consumer’ ability to make intelligent decisions with respect to the alleged debt. The courts apply a “least sophisticated consumer” standard to alleged false representations. This tends to prevent application of 20/20 hindsight in the interpretation of correspondence. The court will consider whether the correspondence is susceptible to more than one interpretation, one of which is misleading. Between the FDCPA, the Deed of Trust and state law, the debt collection law firm and attorney foreclosure trustee have multiple compliance obligations in preparing correspondence to the borrower.

Validation Notices. The FDCPA goes beyond prohibiting false representations. In 15 U.S.C. § 1692g, Congress mandates that disclosures be put into debt collection correspondence. In nonjudicial foreclosure, notices to the borrower are an essential element of the process. The initial communication must contain several messages, including, but not limited to:

[A] statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector[.]

If the debtor asks for verification of the debt, the collector must cease all collections activity until the verification is made. This not only means ceasing telephone calls, letters and collections lawsuits; it also includes the nonjudicial foreclosure activity.

Since foreclosures are typically conducted by law firms that exclusively pursue debt collection activity, these provisions of the FDCPA have served as the basis for class action lawsuits. Through the FDCPA, the federal government is heavily involved in regulation of nonjudicial, residential foreclosures. Borrowers, banks and their attorneys must be cognizant of the government’s role as regulator of collection of home loans and sometimes as assignee of mortgage debt or foreclosed real estate. Ironically, consumer protection attorneys are litigating FDCPA claims in federal courts against attorneys for their debt collection work on behalf of federally subsidized mortgage giants.

Case: Townsend v. Fed. Nat’l. Mortg. Ass’n, 923 F. Supp. 2d 828 (W.D.Va. 2013).

Photo Credit: taberandrew via photopin cc (to my knowledge, this property is not the subject of the cases referenced herein or any other foreclosure or debt collection proceeding)

December 9, 2014

Resolutions for Homeowners Dealing with Construction Defects

A good home provides a safe, comfortable and enjoyable place to live. When a contractor makes mistakes in construction, renovation or repair, the owner or tenant has to live with those defects every day until the problem is resolved. The coming New Year is a good time for homeowners to prioritize addressing contractor defects. In 2015, devise a strategy for relief from construction defects and feel love for your home again.

The key to efficiently realizing a goal is outlining the steps needed to realize it. This gives the owner a “to-do” list that can be tackled step-by-step over time. This may include a warranty claim against the contractor. Many contractors stand by their work and will honor well-founded warranty claims. It’s difficult to build a business from a base of disgruntled former customers. With some contractors, legal assistance may be necessary to obtain relief under a warranty. No two construction defect cases are the same. In each case, the contracts, warranties, physical conditions and defects are different. However, there are strategies that can make the process easier for the homeowner. The following are 7 New Year’s resolutions for homeowners dealing with construction defects:

- Investigate Defects Fully: Examine and photograph the physical appearance of the defects. Obtain copies of the manufacturer’s installation instructions. Research online reviews or other information about the materials used. Wise homeowners focus first on any safety or health concerns. In some cases, taking temporary action to limit future damage may be necessary. Discovering the truth about the defect is a solid foundation for dealing with it.

- Organize Warranty Information. The contractor likely provided contracts, correspondence, warranties and invoices. Usually installers do not warranty the materials used. The warranties for materials may have been provided in the packaging or available from the manufacturer. These items must be reviewed together and can become easily misplaced if not organized.

- Consult Regarding Implied Warranties. Many homeowners are not aware that a written set of terms is not the only way that products and installation may be covered by a warranty. In Virginia, there are certain contractor warranties that arise under operation of law. Consult with a qualified attorney about how coverage may arise under implied or written warranties. Unfortunately, warranties are easily waived if claims are not timely pursued.

- Consult Regarding Obtaining Expert Reports About Defects. In order to fix the defect, ultimately a qualified person will need to do further work on the house. To prove a warranty claim in court, the owner may need an expert witness to testify regarding the breach of duties or the proper figure of damages. Depending on the needs of the case, that expert may be a home inspector, licensed contractor, engineer, tradesperson or professional estimator. Hiring an expert to provide assistance in a lawsuit, reports or court testimony is not like hiring a professional to work on the house. If an expert is being engaged to provide legal support or trial testimony, the owner’s lawyer is the proper representative to work directly with the expert. One of the most important characteristics in retaining an expert in these types of cases is independence. A homeowner is not well served by an inspector or other contractor who will not be able to testify against the interests of the contractor who committed the defects. It’s best to go completely outside of the referral network of the builder.

- Consider Goals for the Property. When a dispute with a contractor erupts, sometimes even smart homeowners may struggle to maintain focus on how the project fits in to their goals for maintaining and developing the property. The homeowner may need to adjust their goals to fit new circumstances.

- Preserve Copies of Contractor’s Representations: If the contractor used intentional concealment, fraud or misrepresentation in the course of selling his services, the owner may have a claim for enhanced damages. Fraud cases are very difficult to prove, and the facts of most cases don’t support them. However, sometimes misrepresentations can be found in e-mail, text message or social media communications. Savvy owners take care to preserve any electronic communications with the contractor’s representatives.

- Consult with Counsel About Pursuing Claims. Once the case has been properly investigated with the assistance of legal counsel, the homeowner is in the best position to go back to the contractor about the warranty claim and, if necessary, pursue a legal remedy.

Whether a homeowner’s best interests lie in simply fixing the problem on their own or pursuing a legal claim against the contractor depends upon the unique circumstances of the case. Homeowners have the benefit of control over the property where key evidence may be preserved. The New Year is a good time for families to take necessary action to protect their physical, financial and legal aspects of home ownership.

photo credit: ungard via photopin cc (I am not aware of any defects with the house depicted in this photo, which was chosen for its seasonal characteristics)

November 21, 2014

Wrongful Foreclosure Claims for Robo-Signing

Among the controversies of the mortgage foreclosure crisis is that of “Robo-Signing.” A homeowner may receive notice that the original mortgage lender assigned their rights under the loan documents to another financial institution. When a representative of a lender signs paperwork to foreclose on a property, how does the borrower (or anyone else) know whether that company has authority from the originating lender to foreclose?

Janis O’Connor owned real estate near the Appomattox-Buckingham Virginia State Forest. On March 31, 2011, Deutsche Bank foreclosed on her property for nonpayment. After the foreclosure sale, Ms. O’Connor filed suit, alleging that the foreclosure was not valid because the bank lacked the authority of a proper successor to the mortgage company that originated her loan. O’Connor filed suit on her own, without an attorney representing her.

Can a Borrower Sue for “Wrongful Foreclosure?”

Janis O’Connor sued her lender (and others) on a number of legal theories, including “Wrongful Foreclosure.” She alleges that unknown persons forged assignments of her mortgage in a fraudulent scheme to foreclose on her home. She writes that this robo-signing was exposed on the television program, “60 Minutes.” The bank brought a Motion to Dismiss. On October 6, 2014, the U.S. District Court for the Western District of Virginia found that Virginia law does not recognize a claim called “Wrongful Foreclosure.” Judge Moon observed that the borrower must be able to allege a claim for breach of loan documents, fraud, or some other recognized legal theory. Judge Moon expressed a concern that Ms. O’Connor inadequately alleged any causal relationship between the “robo-signing” and her losses.

On May 14, 2014, I posted an article to this blog about legal challenges to the validity of foreclosures on the grounds that the lender committed technical errors in navigating the loan default through the trustee’s auction. Courts are reluctant to set aside a completed foreclosure sale. The technical breaches must have a strong connection to the relief requested by the borrower.

“Show Me the Note”

The Code of Virginia addresses situations where the lender struggles to come up with documents evidencing its authority to proceed with the foreclosure. Va. Code § 55-59.1(B) requires the lender to submit to the trustee what’s called a Lost Note Affidavit. These provisions also require the lender to notify the borrower in writing that the promissory note is lost and that it will request the trustee to proceed after 14 days. The lender must include language notifying the borrower that if she believes that some other party is the true holder of the note, she must file a lawsuit asking the local circuit court to order the foreclosing bank to post bond or make some other protection against any conflicting claims. That Court would then decide whether a bond or some other security must be posted to protect the borrower. The mere absence of the original note cannot serve as a basis to reverse a foreclosure: “If the trustee proceeds to sale, the fact that the instrument is lost or cannot be produced shall not affect the authority of the trustee to sell or the validity of the sale.” Va. Code § 55-59.1(B). These provisions require borrowers to file suit before the foreclosure takes place in order to litigate over “show me the note” issues. Ms. O’Connor did not file suit until almost two years after the foreclosure sale. From the borrower’s perspective, she hasn’t been damaged until the foreclosure is complete. From the Court’s perspective, it is sometimes easier to evaluate matters prospectively than to undo the completed transaction.

Judge Moon remarks that this statute does not actually require the lender to provide the borrower with the lost note affidavit itself. The failure to provide this item cannot serve as the legal basis to reverse a bank foreclosure. Technical breaches of the notice requirements cannot, on their own, serve as a basis to invalidate a completed foreclosure sale.

Judge Moon dismissed Ms. O’Connor’s complaint, giving her leave to amend her claims for Breach of Contract and Fraud. Ms. O’Connor has filed an Amended Complaint, and the sufficiency of the amended lawsuit has not been decided by the court as of this blog post. Regardless as to how Ms. O’Connor’s case is resolved, it provides some important reminders about foreclosure contests:

- Timing of Foreclosure Contest: If a borrower wants to challenge the validity of a foreclosure, their best interests may be served in filing suit after the foreclosure notice is submitted and before the auction occurs. This does not guarantee that the “show me the note” allegation will provide a remedy for the borrower, but it does preserve the issue.

- Value of Title Insurance: Investors who desire to purchase a property in foreclosure without obtaining title insurance run the risk of being made a party to a lawsuit like Ms. O’Connor’s which may go on for months or years.

- Duties of Foreclosure Trustees: An attorney acting in the capacity as a foreclosure trustee under the loan documents may owe duties to parties other than the bank. I discuss this issue in a related May 21, 2014 blog post. However, he doesn’t have an attorney-client relationship with non-clients.

Lenders and borrowers are not the only parties that may have a property interest challenged by title problems from a past, present or future foreclosure. The purchaser in the foreclosure sale, the spouse of the borrower or purchaser, an investor in a real estate company, or a tenant may have rights at stake in foreclosure title litigation. If your property rights are threatened by such an action, contact a qualified attorney.

case citation: O’Connor v. Sand Canyon Corp., No. 6:14-CV-00024 (W.D. Va. Oct. 6, 2014)

July 24, 2014

Tenancy by the Entirety and Creditor Recourse to Marital Real Estate

Last week I focused on first-time home buyers and new opportunities for state tax-exempt estate planning. This week’s post continues on the theme of family. Spouses who own Virginia property together may enjoy special protections against the claims of their individual creditors. This special form of ownership is called “Tenancy by the Entirety.” For this to arise, the husband and wife must own in unity of (a) time, (b) title, (c) interest and (d) possession. These requirements may be inferred if the deed specifically conveys to the husband and wife by tenancy by the entirety or with an intent to create a right of survivorship.

As far as creditors are concerned, the couple jointly owns an undivided 100% interest. This ancient doctrine continues to be applied by Virginia courts in contemporary real estate controversies. This post focuses on ways creditors may succeed in spite of this manner of holding title:

- Joint Consent. Neither spouse may sever the tenancy by his sole act. Likewise, one spouse cannot convey the property unilaterally. This becomes significant if one spouse attempts to mortgage the property without the consent of the other. However, the spouses may cause the termination of the tenancy by the entirety ownership or jointly liability for a lien or judgment. For example, when the owners take out a mortgage, if properly perfected, that lien will persevere against acts of divorce and/or bankruptcy unless exceptions apply. Also, if only one spouse files for bankruptcy, the tenancy by the entirety property remains outside of the Bankruptcy Estate.

- Divorce. Completion of a divorce transforms a tenancy by the entirety into a tenancy in common, the ordinary form of co-ownership. In equitable distribution, a Judge has considerable latitude in dividing up marital property.

- Death. Because of the right of survivorship, no transfer of title occurs to the survivor upon the death of a spouse. Upon death, the interest of the surviving spouse converts from a tenancy by the entirety to a sole ownership interest. At that time, the property then becomes subject to creditor claims.

- Fraud. If the husband and wife attempt to work a fraud on a creditor by improper use of a tenancy by the entirety conveyance, it is unlikely that the court would permit the fraud. However, if the couple sells real estate held in a tenancy by the entirety, the proceeds of that sale automatically also enjoy the same status as the real estate, unless there is an agreement to the contrary. A transfer from the husband and wife holding in tenancy by the entirety to the sole name of one of the spouses does not subject those funds to the claims of the other spouse’s creditors.

The gist of tenancy by the entirety flows intuitively from the legal understanding of marriage. It possesses a seemingly “magical” quality when it comes to protecting against many individual creditor claims. However, it can be difficult applying the doctrine to a family’s individual circumstances. If you have questions about Tenancy by the Entirety, whether as a spouse or a creditor, contact a qualified attorney.

Court Opinions:

In Re Eidson, 481 B.R. 380 (Bankr. E.D. Va. 2012) (interpreting Va. law).

Alvarez v. HSBC Bank USA, 733 F.3d 136 (4th Cir. 2013) (interpreting Md. law).

U.S. v. Parr, File No. 3:10-cv-061 (W.D. Va. Oct. 6, 2011) (Moon, J.) (interpreting Va. law).

In Re Bradby, 455 B.R. 476 (Bankr. E.D. Va. 2011) (interpreting Va. law).

In Re Nagel, 298 B.R. 582 (Bankr. E.D. Va. 2003).

July 2, 2014

Attorneys Fees for Rescission of Contracts Obtained by Fraud

In lawsuits over real estate, attorney’s fees awards are a frequent topic of conversation. In Virginia, unless there is a statute or contract to the contrary, a court may not award attorney’s fees to the prevailing party. This general rule provides an incentive to the public to make reasonable efforts to conduct their own affairs to avoid unnecessary legal disputes. An exception to the general rule provides a judge with the discretion to award attorney’s fees in favor of a victim of fraud who prevails in court. Effective July 1, 2014, a new act of the General Assembly allows courts greater discretion to award attorneys fees for rescission of contracts obtained by fraud and undue influence. The text reads as follows:

This new statute narrowly applies to fraud in the inducement and undue influence claims requesting as a remedy rescission of a written instrument. I expect this new attorney’s fees statute to become a powerful tool in litigation over many real estate matters.

- Obtaining Approval of Written Instruments by Misconduct. This new statute does not focus on the manner or sufficiency of how obligations under a contract or deed are performed. Instead, it concerns remedies where one party obtains the other’s consent on a written instrument by material, knowing misrepresentations made to induce the party to sign (fraud) or abusive behavior serving to overpower the will of a mentally impaired person (undue influence). Fraud and undue influence are usually hard to prove. There are strong presumptions that individuals are (a) in possession of their faculties, (b) are reasonably circumspect about the deals and transfers they make and (c) read documents before signing them. This new statute does not allow for fees absent clear & convincing proof of the underlying wrong. Tough row to hoe.

- Undoing Deals Predicated on Fraud or Undue Influence: This new statute doesn’t help plaintiffs who only want damages or some other relief. The lawsuit must be to rescind the deed or contract that was procured by the fraud or undue influence. Rescission is a traditional remedy for fraud and undue influence, and it seeks to “undo the deal” and put the parties back in the positions they were in prior to the consummation of the transaction. This statute should give defendants added incentive to settle disputes by rescission where a fraud in the inducement or undue influence case is likely to prevail.

- Reasonableness of the Attorney’s Fees Award: When these circumstances are met, the Court has discretion to award reasonable attorney’s fees. Note that the statute does not require that fees be awarded in every rescission case. Under these provisions, on appeal the judge’s attorney’s fees award or lack thereof will be reviewed according to the Virginia legal standard for reasonableness of attorney’s fees.

Prior to enactment of Va Code Sect. 8.01-221.2, defrauded parties had to meet a heightened standard in order to get attorney’s fees. In 1999, the Supreme Court of Virginia held in the Bershader case that even if there is no statute or contract provision, a judge may award attorney’s fees to the victim of fraud. However, in Bershader the Court found that the defendants engaged in “callous, deliberate, deceitful acts . . . described as a pattern of misconduct. . .” The Court also found that the award was justified because otherwise the victims’ victory would have been “hollow” because of the great expense of taking the case through trial. The circumstances cited by the Court in justifying the attorney’s fees award in Bershader show that the remedy was closer to a form of litigation sanction than a mere award of fees. Bershader addressed an extraordinary set of circumstances. Trial courts have been reluctant to award attorney’s fees under Berschader because it did not define a clear standard.

The new statutory enactment removes the added burden to the plaintiff of showing extraordinary contentiousness and callousness or other circumstances appropriate on a litigation sanctions motion. It is hard enough to prove fraud or undue influence by clear and convincing evidence, and then show reasonableness of attorney’s fees. Why should the plaintiff be forced to prove callousness and a threat of a “hollow victory” if fraud has already been proven and the court is bound by a reasonableness standard in awarding fees? The old rule placed a standard for awarding attorney’s fees in fraud cases to a heightened standard comparable to the one available for imposition of litigation sanctions. Va. Code 8.01-221.2 permits attorney’s fees in a rescission case without transforming every dispute in which deception is alleged into a sanctions case.

case citation: Prospect Development Co. v. Bershader, 258 Va. 75, 515 S.E.2d 291 (1999).

photo credit: taberandrew via photopin cc (photo is a city block in Richmond, Virginia and does not illustrate any of the facts or circumstances described in this blog post)

May 6, 2014

Mortgage Fraud Shifts Risk of Decrease in Value of Collateral in Sentencing

On March 5, 2014, I blogged about the oral argument before the U.S. Supreme Court in U.S. v. Benjamin Robers, a criminal mortgage fraud sentencing appeal. At stake was how Courts should credit the sale of distressed property in calculating restitution awards. The U.S. Court of Appeals for the Seventh Circuit interpreted the Mandatory Victims Restitution Act to apply the sales price obtained by the bank selling the property post foreclosure as a partial “return” of the defrauded loan proceeds. Robers appealed, arguing that he was entitled to the Fair Market Value of the property at the time of the foreclosure auction. According to Robers, the mortgage investors should bear the risk of market fluctuations post-foreclosure because they control the disposition of the collateral. See Mar. 5, 2014, How Should Courts Determine Mortgage Fraud Restitution?

Yesterday, the Supreme Court affirmed the re-sale price approach in a unanimous decision. The Court observed that the perpetrators defrauded the victim banks out of the purchase money, not the real estate. The foreclosure process did not restore the “property” to the mortgage investors until liquidation at re-sale.

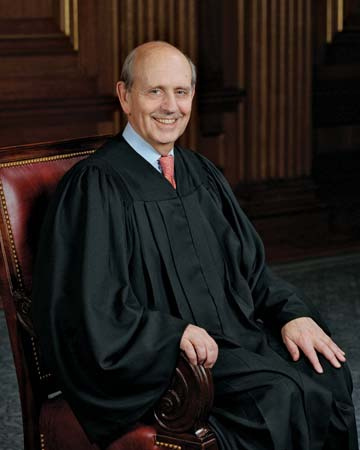

The Court focused on defense arguments that the real estate market, not Robers, caused the decrease in value of collateral between the time of the foreclosures and the subsequent bank sales. Justice Stephen Breyer wrote that:

Fluctuations in property values are common. Their existence (through not direction or amount) are foreseeable. And losses in part incurred through a decline in the value of collateral sold are directly related to an offender’s having obtained collateralized property through fraud.

Breyer distinguished “market fluctuations” from actions that could break the causal chain, such as a natural disaster or decision by the victim to gift the property or sell it to an affiliate for a nominal sum. See Lance Rogers, May 6, 2014, BNA U.S. Law Week, “Justices Clarify that Restitution ‘Offset’ is Gauged at Time Lender Sells Collateral.”

Falsified mortgage applications cause a lender to make a loan that it would not otherwise extend. A restitution award mirroring what the lender would receive in a civil deficiency judgment is inadequate. The defendant’s conduct opened the door for the Court to shift the risk of post-foreclosure market fluctuation from the bank to the borrower. Robers did not single-handedly render the local real estate market illiquid. However, as Justice Sonia Sotomayor mentions in her concurrence, real estate takes time to liquidate. These banks did not unreasonably delay the liquidation process. The Court opinion did not mention the prominent role of origination fraud in the subprime mortgage crisis. The Supreme Court’s unanimous decision strongly rejected defense arguments that downward “market fluctuations” severed the causal connection between the origination fraud and the depressed sales prices obtained by the lenders.

The Court did not discuss the original purchase prices for Robers’ two homes. In many mortgage fraud schemes, loan officers find “straw purchasers” such as Mr. Robers for sellers who agree to provide kickbacks on the inflated sales prices. See Mar. 15, 2009, Milwaukee Journal-Sentinel, “Amid Subprime Rush, Swindlers Snatched $4 Million.” The perpetrators do not disclose these kickbacks to the lenders. The mortgage originators also receive origination fees from the lenders on the fraudulent closings. Under this arrangement, the purchase price will naturally reflect the highest sales price the bank’s appraiser will support. The bank is defrauded both by the fictitious qualifications of the borrower and the exaggerated sales prices.

U.S. v. Robers may result in stricter, more consistent restitution awards in mortgage fraud cases. I wonder how it will be applied in cases where the defendant presents stronger evidence that the victims acted unreasonably in liquidating the property. The opinion seems to leave discretion to District Courts to determine whether a bank’s conduct or omissions breaks the connection between the mortgage fraud and the sales price.