July 1, 2016

False Promises of Loan Modifications in Fraudulent Foreclosure Cases

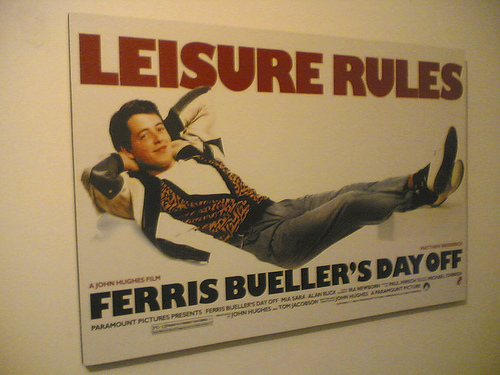

In the classic comedy, Ferris Bueller’s Day Off, Ferris’s mother meets with the assistant principal to discuss his absenteeism. She had no idea he took 9 sick days. The school official bluntly explains: “That’s probably because he wasn’t sick. He was skipping school. Wake up and smell the coffee, Mrs. Bueller. It’s a fool’s paradise. He is just leading you down the primrose path.” Mothers of truant teenage sons aren’t the only ones succumbing to the temptation of wanting to believe that everything is fine when it isn’t. Owners busy with their jobs and families would like for their home to be worry-free. Unfortunately, the Ferris Bueller’s of the world sometimes grow up to service mortgages, manage HOA’s and handle customer service for home builders. The real estate and construction industry has some predators who lead consumers on the “primrose path.” We are not talking here about mere “sales talk” and “puffery” (for example, someone merely says that they will “treat you like family”). Promissory Fraud is when someone makes promises with no intent to follow-through but with every desire for the listener to rely upon it. In the past few years, borrowers have sued mortgage servicers for false promises of loan modifications in fraudulent foreclosure cases. Loan servicers stand in the shoes of the original mortgage lender as far as the borrower is concerned. Servicers send out the loan account statements, collect the payments and make disbursements. These cases allege that the servicers used “primrose path” tactics to conduct foreclosure fraud.

Leading along the primrose path is a powerful ploy because of the psychological roller-coaster the consumer experiences. Financial struggles, default notices and foreclosure letters causes stress and troubles that impact owners’ resources, time and relationships. Promises of time extensions, foreclosure avoidance and loan modifications are spellbinding. They invite the consumer to the much-missed happy place of living their life without threat of catastrophic financial loss. If the servicer says just the right thing, the borrower will very naturally want to let down their guard and forego more arduous tasks of forging a legal and financial solution to the problems. The false sense of security is intoxicating. When the borrower later experiences foreclosure instead of the promised modification, they are left trying to pick up the pieces.

Randolph Morrison vs. Wells Fargo Bank:

Mortgage servicers often get away with this because borrowers don’t always pay close attention to what they are actually being told. When borrower listen and take notes, they protect themselves. In 2014, a federal judge in Norfolk considered a claim for fraud based on telephone misrepresentations that Wells Fargo Bank allegedly made in the foreclosure context. When Virginia Breach homeowner Veola Morrison died in 2009. Her family received a notice that the property would be foreclosed on January 19, 2011. Veola’s son Randolph offered to assume the mortgage and requested an interest rate reduction. On January 12, 2011, a Wells Fargo employee told Randolph that he was approved for a loan modification and that the January 19, 2011 foreclosure would not take place. Wells Fargo sent Randolph a letter dated January 14, 2011 offering him a special forbearance agreement, requiring him to make his first payment on February 1, 2011. A “forbearance” is when the lender agrees to hold off on foreclosure and collection activities for a period of time in anticipation that the borrower will resolve short-term cash flow difficulties. They said that the foreclosure would be suspended so long as Randolph kept to the terms of the agreement. In spite of these representations, Wells Fargo Bank’s substitute trustee conducted the foreclosure sale anyway on January 19, 2011. In his suit, Randolph alleged that he reasonably relied upon a telephone statement by Wells Fargo that the January 19, 2011 foreclosure would not occur. He relied upon the subsequent letter saying when he had to make his next monthly payment. Relying on these representations, Randolph did not take other actions to prevent foreclosure such as hiring an attorney. After he discovered what happened, Randolph sued Wells Fargo. The Court denied Wells Fargo’s initial motion to dismiss the case and allowed Randolph’s claim for promissory fraud to proceed in Court. The case settled before trial.

Mortgage servicers often get away with this because borrowers don’t always pay close attention to what they are actually being told. When borrower listen and take notes, they protect themselves. In 2014, a federal judge in Norfolk considered a claim for fraud based on telephone misrepresentations that Wells Fargo Bank allegedly made in the foreclosure context. When Virginia Breach homeowner Veola Morrison died in 2009. Her family received a notice that the property would be foreclosed on January 19, 2011. Veola’s son Randolph offered to assume the mortgage and requested an interest rate reduction. On January 12, 2011, a Wells Fargo employee told Randolph that he was approved for a loan modification and that the January 19, 2011 foreclosure would not take place. Wells Fargo sent Randolph a letter dated January 14, 2011 offering him a special forbearance agreement, requiring him to make his first payment on February 1, 2011. A “forbearance” is when the lender agrees to hold off on foreclosure and collection activities for a period of time in anticipation that the borrower will resolve short-term cash flow difficulties. They said that the foreclosure would be suspended so long as Randolph kept to the terms of the agreement. In spite of these representations, Wells Fargo Bank’s substitute trustee conducted the foreclosure sale anyway on January 19, 2011. In his suit, Randolph alleged that he reasonably relied upon a telephone statement by Wells Fargo that the January 19, 2011 foreclosure would not occur. He relied upon the subsequent letter saying when he had to make his next monthly payment. Relying on these representations, Randolph did not take other actions to prevent foreclosure such as hiring an attorney. After he discovered what happened, Randolph sued Wells Fargo. The Court denied Wells Fargo’s initial motion to dismiss the case and allowed Randolph’s claim for promissory fraud to proceed in Court. The case settled before trial.

Alan & Jackie Cook vs. CitiFinancial, Inc.:

Just because a false reassurance is not in writing doesn’t mean that the borrower can’t sue for fraud. Virginia Federal Judge Glen Conrad considered this question in 2014. Jackie & Alan Cook owned a property in Lovington, Virginia. In September 2011, Mr. Cook explained to his lender CitiFinancial, Inc. that he was current on his loan but struggling to make payments. The branch manager suggested that he pursue a loan modification through the Home Affordable Modification Program (“HAMP”). The manager told Mr. Cook that if he stopped paying, the lender would “have to modify the loan” and it would probably be able to cut the interest rate and principal owed. Mr. Cook became leery and asked questions. The manager reiterated that he should just stop making payments and ignore the bank’s letters until he received a notice with a date for the foreclosure sale. The customer services rep told Mr. Cook that once he got the foreclosure notice he could call the number on it and get started. Per the manager’s instructions, Mr. Cook stopped making payments and ignored the servicer’s default letters.

On June 17, 2013, Cook received a notice that on July 17, 2013, foreclosure trustee Atlantic Law Group would sell his Nelson County property in foreclosure. Remembering what CitiFinancial originally said, Cook tried to call the loan servicer 20 times, receiving no answer or he was hung up on. Finally, on July 11, 2013, Mr. Cook got ahold of CitiFinancial who told him what information they needed for a loan modification. When Mr. Cook talked to another employee of the servicer, he was told that his case would remain on “pending/hold status” for 30 days in order for him to obtain the necessary documents, and that the scheduled foreclosure would be postponed during that time. On July 17, 2013, the noticed day of foreclosure, one employee of the servicer told him on the telephone the “great news” that he was awarded a loan modification. Later that day, he talked to another employee of the servicer who told him that the foreclosure would indeed proceed as originally scheduled, because he failed to provide them with necessary documents. When Mr. Cook asked her about the 30-day hold period that he was previously given, she replied that “she had never heard of such a thing” and that there was nothing to be done to stop the foreclosure sale. Notice how the servicer used a new misrepresentation about the 30-day period to keep Mr. Cook on the “primrose path” even after he struggled to communicate with him after defaulting per their instruction. Mr. Cook rushed to an attorney’s office but by the time the trustee received the attorney’s letter the sale had already occurred. Use of the primrose path strategy is particularly damaging because the new buyer can use the foreclosure trustee’s deed to initiate eviction proceedings. Citi bought this property at the trustee’s sale and brought eviction proceedings against Mr. Cook. Cook filed suit, basing fraud claims on the servicer’s false promises. CitiFinancial initially moved for the court to dismiss the lawsuit, arguing that Cook could not have reasonably relied upon the false oral representations because the promissory note and deed of trust provided unambiguous terms for foreclosure in the event of default. Citi seemed to be saying that only things that are in writing are official in the mortgage context. Judge Glen Conrad rejected this argument because the question of whether Cook was justified to rely upon Citi’s oral statements was an evaluation of the credibility of witnesses at trial.

Jackie & Alan Cook’s case settled before trial. An agreed order reversed the foreclosure sale. While a servicer misrepresentation doesn’t have to be in writing to constitute fraud, the dispute may come down to a “he-said she-said” at trial. Few borrowers will take careful notes at the time these discussions take place. While defendants may be required to make document disclosures, homeowners can’t count on getting copies of servicer notes and internal messages during the litigation. Search warrants are not available in civil cases.

The experiences of the Morrisons and Cooks are common amongst different lenders all across the country. It’s best for homeowners struggling with their mortgages avoid the “primrose path” promises made by some servicers, foreclosure trustees and foreclosure rescue scams. If it sounds too good to be true, then it deserves thorough review and consideration. However, there are many situations where relying upon the representations of a lender or trustee is the only reasonable option. Once the foreclosure trustee’s deed is recorded, the borrower may face eviction proceedings. If a trustee or servicer breaches the mortgage documents or makes misrepresentations in conducting a foreclosure, the borrower should contact qualified legal counsel immediately.

Case Citations:

Morrison v. Wells Fargo Bank, 30 F. Supp. 3d 449 (E.D. Va. 2014)

Cook v. CitiFinancial, Inc., 2014 U.S. Dist. Lexis 67816 (W.D. Va. May 16, 2014)

Photo Credit:

June 9, 2015

Can a Buyer Sue a Sellers Real Estate Agent?

This past month, I experienced wonderful changes in my life which drew me temporarily away from my passion for blogging about property rights. On May 1st, I started my own solo law practice, Cowherd PLC. The new law firm continues my professional focus on the types of legal matters discussed in “Words of Conveyance.” On May 27th, my lovely wife and I welcomed our beautiful newborn daughter into the world. I would like to thank my friends and family for their love and support, including those who follow this blog. As a parent, I want the best home environment for my child to grow up in. As a trial attorney, I want to advocate for rights that are precious to clients.

When smart prospective buyers search the market for a home, they need to investigate the property. Typically, buyers use home inspectors to help them. Unfortunately, some defects cannot be easily discovered during the home inspection. For example, a structural defect may be concealed by drywall or other obstructions. With other houses, flooding problems may only be apparent after heavy rains.

Often, buyers will ask the seller’s agent whether there is a history of flooding or other problems. Agents know that if potential buyers learn negative information about the property they may move on to another listing. After a buyer completes a sale, the property may turn out to have defects that were concealed or contrary to representations made in the sales process. Who is legally responsible in those situations? Can a buyer sue a sellers real estate agent? Virginia courts considering this question draw varying conclusions.

“Great Party Room:”

The Circuit Court of the City of Norfolk recently considered whether a buyer can sue a sellers real estate agent under the Virginia Real Estate Broker’s Act. Megan Winesett is an active duty servicemember who bought her first home in 2010. The property listing described the basement as a “great party room.” During the walk-through, Ms. Winesett asked her own agent about basement flooding. The buyer’s agent told her that the seller’s agent explained that flooding was not a problem. A few years later, Winesett renovated the property and discovered rotting and termite damage in vertical support beams in the basement under her kitchen. She also found cracks in her foundation.

Buyer’s Relationship with the Seller’s Agent:

Winesett sued the seller, seller’s agent, her own agent and the real estate brokerages for $75,000 for repairs plus $350,000 in punitive damages. She sued the seller for fraud and the realtors for violation of the Real Estate Broker’s Act (“REBA”). The seller’s agents sought to dismiss the lawsuit on the grounds that the statute does not create a private cause of action against the agents. They argued that the REBA only allows for professional discipline by the Real Estate Board and not lawsuits by individuals. In a 1989 decision, Allen v. Lindstrom, the Supreme Court of Virginia observed that:

The [seller’s agents]’ primary and paramount duty, as broker and broker’s agent, was to the sellers, with whom they had an exclusive contract. While there may be some type of general duty to the public owed by every realtor, it is not the type of duty that converts into a liability against a seller’s agent for improper conduct to one in the adversary position of prospective purchaser, where there is no foreseeable reliance by the prospect on the agent’s actions.

In that case, the Court rejected the buyer’s attempt to sue the listing agent for violation of a duty arising out real estate agent regulations.

Ms. Winesett brought her case against the agents on the Virginia Real Estate Broker’s Act, which also governs the practices of real estate agents. That statute creates duties for agents (licensees) to their own clients and also the opposite parties in the transaction:

Licensees shall treat all prospective buyers honestly and shall not knowingly give them false information. A licensee engaged by a seller shall disclose to prospective buyers all material adverse facts pertaining to the physical condition of the property which are actually known by the licensee. Va. Code Sect. 54.1-2131(B).

The Act requires such disclosures to be in writing. The realtor doesn’t need to be an expert in every issue. An agent is entitled to pass on information provided by the seller, the government, or a licensed professional. However, the agent may not rely upon information provided by others if he has actual knowledge of falsity or act in reckless disregard for the truth. Va. Code Sect. 54.1-2142.1.

On May 21, 2015, Judge Mary Jane Hall denied the seller’s agent’s motion, finding that the REBA does create a private cause of action for buyers against seller’s agents for violations. Judge Hall focused her analysis on language in the statute providing that, “This includes any regulatory action brought under this chapter and any civil action filed.” This case is currently set for trial in August. While the Court allowed this claim to move forward, Ms. Winesett bears the burden of proving it at trial.

Judge Hall’s legal conclusion is not consistently reached by all courts in Virginia. Unlike other consumer protection statutes, the REBA does not contain specific provisions about how a civil action may be brought and what remedies are allowed.

In 2004, the Circuit Court of Loudoun County entertained the same issue and concluded that a buyer is not entitled to a private cause of action against a seller’s agent for violation of the REBA. In Monica v. Hottel, Judge Thomas Horne decided instead that a buyer may allege a negligence per se claim against the seller’s agent for violation of the duty of ordinary care set forth in REBA.

I have a few observations about what these recent decisions mean to current and prospective real estate owners in Virginia:

- Discipline vs. Liability: In these cases, the sellers argued that the General Assembly contemplated that the statute would only be enforced by professional discipline, not private lawsuits. To a professional, the prospect of having one’s license suspended or revoked is a different type of threat than a jury award of a large money judgment. To the buyer saddled with a house requiring more repairs than they can afford, money is much more of a consolation than the knowledge that an agent is no longer selling real estate.

- Virginia Consumer Protection Act: Unlike auto dealers, construction contractors and many other types of businesses, licensed real estate agents are excepted from liability under the Consumer Protection Act. To the extent seller’s agents have responsibilities to buyers, liability would have to arise out of some other legal theory, such as the REBA, negligence or fraud.

- Challenges and Advantages of Suing for Fraud: Trial attorneys know that it is much easier to prove negligence or breach of contract than claims based on misrepresentation. In fraud, the standard tends to be higher and there are many recognized defenses. For example, expressions of opinion may not normally serve as the basis for a fraud suit. It is unclear what the standard of proof is for a civil action under the REBA and whether the usual defenses permitted in fraud cases apply. Buyers aren’t normally privy to the private conversations of the seller and his agent. Proof of “actual knowledge” may be hard to come by in many cases. However, there are advantages for suing for fraud. The plaintiff may be entitled to attorney’s fees and punitive damages. Fraud is a flexible legal theory which may provide a remedy in situations that statutes don’t cover.

- REBA Standard for Agents: Normally, a buyer must follow the traditional principle of Caveat Emptor (“Buyer Beware”). The REBA imposes a higher standard of professionalism on seller’s agents by requiring them to affirmatively disclose material adverse facts under many situations. Broad legal enforcement of REBA may change the way that real estate is sold in Virginia.

Although they construe the REBA in different ways, these recent court decisions demonstrate a trend towards greater consumer protection against predatory conduct in the real estate industry. In my experience litigating cases under common law fraud, consumer protection statutes, breach of contract and warranty law, I have learned that there is usually a legal theory that provides a consumer with a remedy. However, claims have a defined time period in which they may be brought. If you fell victim to dishonest conduct in your real estate purchase, discovered that a defect was concealed during your property inspection or your requests for relief under a warranty are being stonewalled, contact a qualified real estate litigation attorney before the passage of time may prejudice your rights. As an owner, you make a tremendous commitment and personal sacrifice to acquire and keep real estate. You are entitled to the legal protections owed by others.

Authorities:

Virginia Real Estate Broker’s Act, Va. Code Sect. 54.1-2100, et seq.

P. Fletcher, “Homeowner Can Sue Agents Under Brokers’ Act,” Va. Lawyers Weekly, (Jun. 5, 2015)

Winesett v. Edwards-Soblotne, No. CL14-6964 (Norfolk Cir. Ct. May 21, 2015)(Hall, J.)

Monica v. Hottel, 64 Va. Cir. 439 (Loudoun Co. May 24, 2004)(Horne, J.)

Allen v. Lindstrom, 237 Va. 489 (Va. 1989)

Photo Credit: Fixer upper via photopin (license)(Used to illustrate themes of post. Does not depict any properties described herein. To my knowledge, this property does not suffer any defects)

February 27, 2015

Legal Thriller Published in Foreclosure Notices to Borrowers?

On December 4, 2014, I wrote a blog post about a borrower who brought a lawsuit against her lender after the Richmond law firm that conducted the foreclosure went out of business. The federal judge denied the bank’s motion to dismiss the borrower’s claims based on a faulty loan default notice. In that post, I mentioned that the involved law firm, Friedman & MacFadyen, was the target of class action litigation arising out of their debt collection and foreclosure practices. Of the several bases to the class action, the only one that will be discussed here has to do with False Representation liability under the Fair Debt Collection Practices Act. The lawsuit accused Friedman & MacFadyen of sending correspondence to borrowers containing false threats of lawsuits followed by notices with references to court actions that had not been filed. Put another way, the class action claimed that there was a legal thriller published in foreclosure notices to borrowers.

Someone with legal training knows whether a lawsuit is pending. A case cannot proceed unless the party is properly served with a copy. If one knows where to look, one can search court records to verify whether someone is party to a pending lawsuit. But the process of determining this is not common public knowledge. In its opinion, the federal court discussed the alleged practices of the law firm. F&M initially wrote to the borrowers to tell them, among other things, that their, “loan[s][had] been referred to this office for legal action based on a default under the terms of your Mortgage/Deed of Trust and Note.” Later correspondence suggested that a lawsuit was pending or about to be filed. However, the law firm never intended to file a lawsuit against these borrowers. Virginia is a non-judicial foreclosure state. Foreclosures routinely occur here as a trustee transaction and not normally in a lawsuit. Later firm correspondence instructed the borrower on how to obtain “withdrawal” or “dismissal” of the “action.” F&M would refer to these matters as the name of the bank “v.” the name of the borrower, the way lawyers style a lawsuit.

People tend to take a dispute more seriously once a case is active before the court. A legal action does not exist until a party files it in writing with the court’s clerk. Attorneys know that the threat or current existence of a lawsuit causes negative emotions on the part of the defendant, such as anger, fear, anxiety, avoidance or aggression. However, there is a difference between candidly informing an opposing party that suit will be filed if the dispute cannot be resolved and the facts alleged about Friedman & MacFadyen. The opinion discusses allegations that the law firm was in a client relationship where it would be rewarded for foreclosing quickly, and less rewarded for negotiating loan modifications. If the borrowers had known that there were no pending lawsuits, they may have handled their situations differently. In essence, the class action suit accused the foreclosure law firm of putting fictional accounts of lawsuits in foreclosure correspondence with the goal of obtaining favorable responses by borrowers in light of how the law firm was rewarded by its client.

Lawsuits have value for collecting on debts. They also cost money the parties filing them. Once the lawsuit is actually filed, the party and its attorneys have obligations to the court. A fictional lawsuit, on the other hand, does not require anything to be prepared, no court fees to be paid, scheduling conferences to attend or any other responsibilities. The plaintiffs’ suit included a Fair Debt Collection Practices Act claim for False Representation for what might be described as “shadow litigation” issues. In a January 16, 2015 blog post, I discussed the basics of FDCPA False Representation claims, where a debt collector uses a false, deceptive or misleading representation to collect consumer debt. In denying F&M’s motion to dismiss the lawsuit, the court observed that it would construe the foreclosure correspondence collectively to determine any tendency to mislead the borrowers.

If you have received any foreclosure-related correspondence that references a lawsuit that you cannot verify, contact a qualified attorney to discuss defense of your right to be communicated fairly with regarding your property rights.

case cite: Goodrow v. Friedman & MacFadyen, P.A., No. 3:11-cv-020 (E.D. Va. July 26. 2013).

photo credit: 5525 Carr Street (22) via photopin (license)(does not depict any individuals or properties involved in the discussed class action suit)

January 16, 2015

Federal Regulation of Nonjudicial Residential Foreclosure

Foreclosure of residential real estate is traditionally based on state law and agreements between the borrower and lender in the loan documents themselves. Each state has its own rules governing whether foreclosure should occur in or out of a court proceeding. In Virginia, the vast majority of foreclosures occur in bank-appointed trustee’s sales. State and federal courts review and supervise this activity through lawsuits brought by one or more of the parties, usually borrowers seeking to set aside trustee’s sales. However, they resist efforts to transform the foreclosure process into a judicial one, ruling on various motions brought early in cases.

The mortgage crisis is a national concern involving federal policies promoting home ownership. Is there a federal regulation of nonjudicial residential foreclosure? Through supervision of the mortgage giants Fannie Mae, Freddie Mac, and other administrative programs, the federal government is invested in the mortgage origination process. In some cases, a federal agency takes direct title to distressed home loans or the foreclosed real estate itself. I have written about some of those cases in the past few months. For example, Fannie Mae and Freddie Mac enjoy property recording tax exemptions. Also, in states like Nevada that allow homeowners associations to foreclose, government agencies find themselves in title litigation when properties are assigned to them pursuant to the terms of federal mortgage programs. In the event of default of a loan tied to a federal program, the government may find its interests aligned more on the creditor’s side.

Foreclosure is one of many remedies available to lenders to collect on defaulted home loan debt. For over 30 years, Congress has come to the aid of consumers in debt collection matters. In 1977, Congress enacted the Fair Debt Collections Practices Act to curb abusive practices by the debt collection industry against consumers. The FDCPA also has the effect of benefiting non-abusive debt collectors harmed by violating competitors. Since its enactment, Congress and the federal courts have clarified the FDCPA’s role in regulating debt collection law firms’ activity obtaining foreclosure sales and deficiency money judgments. Since an attorney’s sale of distressed Virginia real estate in a trustee’s auction is an activity outside of the traditional perception of debt collection, the role of the FDCPA in foreclosure practice has been relatively unclear until the past few years, when a slew of foreclosure contest lawsuits have tested the utility of the statute.

The FDCPA applies to lawyers collecting on home loan debts, not just non-attorney debt collection agencies. Federal courts in Virginia have recognized that the Act also applies when lawyer debt collectors act as trustees in residential foreclosures where the notices include a demand for payment. These consumer protection laws regulate, among other things, the communications between the debt collector and the consumer. In order to conduct a foreclosure practice, the attorney must send notices to the borrower. The FDCPA may provide independent causes of action against the attorney found to have engaged in abusive practices. FDCPA issues thus pervade residential foreclosure matters. Consumers, lenders, and their attorneys must be aware of how this Act affects a contested foreclosure matter. There are many ways the FDCPA may be violated in a foreclosure matter, including the following:

False Representations. Under ordinary circumstances, it is difficult for a party to prove that they are entitled to relief because their opponent is allegedly lying, cheating or stealing. These are weighty accusations; the standard for proof is high, and the defenses are many. In 15 U.S.C. § 1692e, the FDCPA changes the rules of the game in the consumer debt collection context. The consumer doesn’t need to prove that he was actually deceived by the misleading communication. Instead, the consumer must show that false representations in a debt collection communication materially affects a consumer’ ability to make intelligent decisions with respect to the alleged debt. The courts apply a “least sophisticated consumer” standard to alleged false representations. This tends to prevent application of 20/20 hindsight in the interpretation of correspondence. The court will consider whether the correspondence is susceptible to more than one interpretation, one of which is misleading. Between the FDCPA, the Deed of Trust and state law, the debt collection law firm and attorney foreclosure trustee have multiple compliance obligations in preparing correspondence to the borrower.

Validation Notices. The FDCPA goes beyond prohibiting false representations. In 15 U.S.C. § 1692g, Congress mandates that disclosures be put into debt collection correspondence. In nonjudicial foreclosure, notices to the borrower are an essential element of the process. The initial communication must contain several messages, including, but not limited to:

[A] statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector[.]

If the debtor asks for verification of the debt, the collector must cease all collections activity until the verification is made. This not only means ceasing telephone calls, letters and collections lawsuits; it also includes the nonjudicial foreclosure activity.

Since foreclosures are typically conducted by law firms that exclusively pursue debt collection activity, these provisions of the FDCPA have served as the basis for class action lawsuits. Through the FDCPA, the federal government is heavily involved in regulation of nonjudicial, residential foreclosures. Borrowers, banks and their attorneys must be cognizant of the government’s role as regulator of collection of home loans and sometimes as assignee of mortgage debt or foreclosed real estate. Ironically, consumer protection attorneys are litigating FDCPA claims in federal courts against attorneys for their debt collection work on behalf of federally subsidized mortgage giants.

Case: Townsend v. Fed. Nat’l. Mortg. Ass’n, 923 F. Supp. 2d 828 (W.D.Va. 2013).

Photo Credit: taberandrew via photopin cc (to my knowledge, this property is not the subject of the cases referenced herein or any other foreclosure or debt collection proceeding)

December 9, 2014

Resolutions for Homeowners Dealing with Construction Defects

A good home provides a safe, comfortable and enjoyable place to live. When a contractor makes mistakes in construction, renovation or repair, the owner or tenant has to live with those defects every day until the problem is resolved. The coming New Year is a good time for homeowners to prioritize addressing contractor defects. In 2015, devise a strategy for relief from construction defects and feel love for your home again.

The key to efficiently realizing a goal is outlining the steps needed to realize it. This gives the owner a “to-do” list that can be tackled step-by-step over time. This may include a warranty claim against the contractor. Many contractors stand by their work and will honor well-founded warranty claims. It’s difficult to build a business from a base of disgruntled former customers. With some contractors, legal assistance may be necessary to obtain relief under a warranty. No two construction defect cases are the same. In each case, the contracts, warranties, physical conditions and defects are different. However, there are strategies that can make the process easier for the homeowner. The following are 7 New Year’s resolutions for homeowners dealing with construction defects:

- Investigate Defects Fully: Examine and photograph the physical appearance of the defects. Obtain copies of the manufacturer’s installation instructions. Research online reviews or other information about the materials used. Wise homeowners focus first on any safety or health concerns. In some cases, taking temporary action to limit future damage may be necessary. Discovering the truth about the defect is a solid foundation for dealing with it.

- Organize Warranty Information. The contractor likely provided contracts, correspondence, warranties and invoices. Usually installers do not warranty the materials used. The warranties for materials may have been provided in the packaging or available from the manufacturer. These items must be reviewed together and can become easily misplaced if not organized.

- Consult Regarding Implied Warranties. Many homeowners are not aware that a written set of terms is not the only way that products and installation may be covered by a warranty. In Virginia, there are certain contractor warranties that arise under operation of law. Consult with a qualified attorney about how coverage may arise under implied or written warranties. Unfortunately, warranties are easily waived if claims are not timely pursued.

- Consult Regarding Obtaining Expert Reports About Defects. In order to fix the defect, ultimately a qualified person will need to do further work on the house. To prove a warranty claim in court, the owner may need an expert witness to testify regarding the breach of duties or the proper figure of damages. Depending on the needs of the case, that expert may be a home inspector, licensed contractor, engineer, tradesperson or professional estimator. Hiring an expert to provide assistance in a lawsuit, reports or court testimony is not like hiring a professional to work on the house. If an expert is being engaged to provide legal support or trial testimony, the owner’s lawyer is the proper representative to work directly with the expert. One of the most important characteristics in retaining an expert in these types of cases is independence. A homeowner is not well served by an inspector or other contractor who will not be able to testify against the interests of the contractor who committed the defects. It’s best to go completely outside of the referral network of the builder.

- Consider Goals for the Property. When a dispute with a contractor erupts, sometimes even smart homeowners may struggle to maintain focus on how the project fits in to their goals for maintaining and developing the property. The homeowner may need to adjust their goals to fit new circumstances.

- Preserve Copies of Contractor’s Representations: If the contractor used intentional concealment, fraud or misrepresentation in the course of selling his services, the owner may have a claim for enhanced damages. Fraud cases are very difficult to prove, and the facts of most cases don’t support them. However, sometimes misrepresentations can be found in e-mail, text message or social media communications. Savvy owners take care to preserve any electronic communications with the contractor’s representatives.

- Consult with Counsel About Pursuing Claims. Once the case has been properly investigated with the assistance of legal counsel, the homeowner is in the best position to go back to the contractor about the warranty claim and, if necessary, pursue a legal remedy.

Whether a homeowner’s best interests lie in simply fixing the problem on their own or pursuing a legal claim against the contractor depends upon the unique circumstances of the case. Homeowners have the benefit of control over the property where key evidence may be preserved. The New Year is a good time for families to take necessary action to protect their physical, financial and legal aspects of home ownership.

photo credit: ungard via photopin cc (I am not aware of any defects with the house depicted in this photo, which was chosen for its seasonal characteristics)