January 29, 2015

New Book Review: The Articulate Witness

One of the duties of a litigator is to prepare the client to testify at a deposition, mediation, hearing or trial. Clear, credible and cogent testimony puts the party in the best position to prevail. While judges, arbitrators and juries want to see the contracts and key documents, they also want to hear directly from the parties whose dispute is before the court.

Experienced trial attorneys know what to expect of themselves and their witnesses from the facts of the case. When it comes to public speaking, witness preparation typically includes discussion of the disputed facts and legal arguments in the case. While an attorney may not tell the client or witness what to say, he may ask practice examination questions. Witnesses quickly learn that courtroom or deposition testimony differs from ordinary conversation or interviews. A witness may have little or no public speaking training or experience. There may not be time for a witness to gain valuable experience in Toastmasters International or other activities to practice speaking skills. So how can a witness prepare herself to give effective testimony in her own case?

This month, Brian K. Johnson and Marsha Hunter published a new book, “The Articulate Witness: An Illustrated Guide to Testifying Confidently Under Oath.” This edition is available in print or e-book format. Johnson & Hunter are consultants who train attorneys for a variety of public speaking settings. I have read one of their other books and attended one of their seminars. “The Articulate Witness” is useful to parties and witnesses seeking an overview of the legal testimonial process. It is a valuable resource for attorneys and law students seeking insights in how to better prepare their clients to testify. Professional experts evaluating their own habits and skills would benefit as well. The book is a breezy 50 pages with copious illustrations. I finished it riding on the D.C. Metro between the Judiciary Square & West Falls Church stations. The book focuses on the mechanics of speaking confidently in litigation situations, including cross-examination. The book would be useful to a witness when they first know that a deposition, hearing, trial, etc. will occur. It is not a good book to read the evening before the big day. The reader may desire to practice some of the exercises or discuss them with the attorney beforehand. The book is not a proper substitute for trial preparation with one’s attorney.

A common mistaken belief is that public speaking involves only expressing one’s thoughts using one’s voice. Johnson & Hunter do a great job of showing how it is also a “physical” activity, involving posture, gestures, handling exhibit documents, facial expression and eye contact.

“The Articulate Witness” is an excellent reference for witnesses,attorneys, experts or any other person whose profession or circumstances require him to speak in a legal proceeding. Mastery of the facts and laws is not sufficient. One must be prepared to cogently communicate one’s position to others.

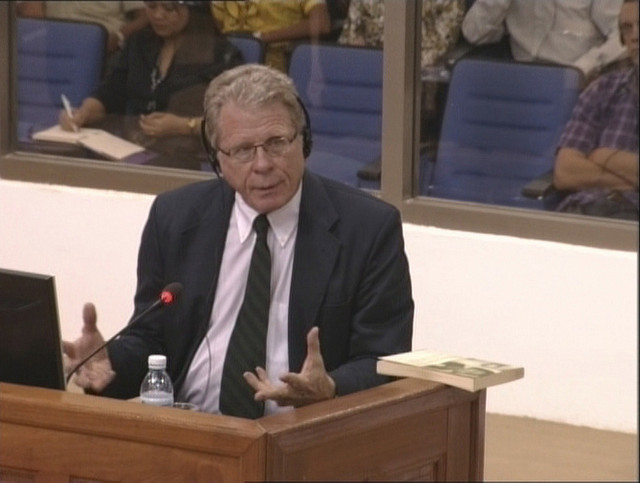

photo credit: Extraordinary Chambers in the Courts of Cambodia via photopin cc

August 20, 2014

Crying Sham: Challenges to Character at Trial

On Aug. 12, 2014, I blogged about a judicial admission issue in the trial of Minter vs. Prosperity Mortgage, et al. Today’s post is Part Two in a series on this case. The following focuses on challenges to character at trial.

The integrity of the parties lies near the heart of every trial. The classic test of credibility occurs on cross-examination by the opposing lawyer. Prepared trial lawyers show up with cross-examination questions thoroughly exploring the relevant issues.

Challenges to the character of a party or witness can be a delicate matter. Trial lawyers, including those defending a case, are sometimes accused of “blame the victim” strategies. How does one distinguish between zealous, competent advocacy and unprofessional, undisciplined aggression? In his blog post, “Take Care with Character Attacks,” Jury consultant Ken Broda-Bahm, Ph.D., discusses the Police Department’s release of surveillance footage showing 18-year old Michael Brown robbing a store in Ferguson, MO. They disclosed this video after the police shooting of the unarmed Brown in a later incident. Broda-Bahm used this Ferguson story to discuss how perceived relevance of a character attack may determine whether it is interpreted as (1) a red-herring or (2), information useful to understand disputed events. Audiences largely reject recognized ad hominem fallacies. Broda-Bram observes, “The question of whether a character attack is relevant or irrelevant is often ambiguous – and this is nowhere more true than in law where fact finders are asked to evaluate the credibility of parties and witnesses.”

In the 17-day Minter v. Prosperity Mortgage trial, the parties challenged each other’s credibility. The consumers accused Long & Foster and Wells Fargo Bank of creating Prosperity Mortgage as a “sham” “affiliated business arrangement” to exchange “kickbacks” or commissions violating the Real Estate Settlement Practices Act. Of course, business associations don’t have “character” in the sense that individual persons do. However, the integrity of the defendants’ business practices were on trial in the class action suit. One representative plaintiff alleged paying $945 in settlement charges to Prosperity. The two other representative plaintiffs paid $777.03 in settlement charges to Prosperity.

What is a “sham”? According to the common dictionary meaning, it is “a thing that is not what it is purported to be.” In R.E.S.P.A. compliance matters, “sham” is used as a shorthand for “affiliated business arrangements” that fail to comply with the complex legal requirements.

On appeal, the consumers identified two specific character attacks made by their opponents. When the defense attorney made his closing argument, he accused the plaintiffs’ lawyers of putting on a “sham lawsuit” and having “an interest in the outcome of this case.” The “sham lawsuit” accusation appears to be tit-for-tat for the “sham brokerage” accusation. Everyone is calling everyone else a “sham.”

The second accusation is more interesting – every lawyer has at least one “interest” in the outcome of his case. Lawyers don’t try cases without an attorney-client relationship. The interest might be a financial one, such as a percentage contingency fee or unpaid invoices on hourly work. It might be reputational. It might be relational to a client. It might be malpractice related, or even a personal motive. The apparent inference here is that the plaintiff lawyers had a financial interest in the outcome of the case. Defense counsel suggested that the jurors could punish the plaintiffs’ lawyers financially in their verdict.

While the Federal Appeals Court found these comments inappropriate and improper, they remarked that they only came at the end and did not permeate the whole trial. The Court found them irrelevant. However, their prejudicial effect was mitigated by their isolated context and the jury instructions, where the judge told them that lawyer arguments are not evidence. The Court of Appeals upheld the trial judge’s decision with respect to these comments, letting the defense verdict stand.

It is difficult to say whether the defense verdict was influenced by the improper statements. The jurors disregarded other closing arguments made by the defense. They may have ignored these as well. Juries know that lawyers work for fees.

While the lawyers defending this case succeeded in making improper statements, I think it would be a mistake to interpret this court opinion as an invitation for more character attacks in closing arguments. Challenges to personal or corporate integrity must be carefully considered, evaluated in light of the other evidence, rigorously prepared and reevaluated at all stages of the case.

case citation: Minter v. Wells Fargo Bank, 762 F.3d 339 (4th Cir. 2014).

photo credit: Kartik Ramanathan via photopin cc

August 12, 2014

Admit One: Attorney Wins By Failing to Effectively Communicate to Jury

A complex case goes to trial. The parties, witnesses, jurors and lawyers endure weeks of frantic preparation, arguments and witness testimony. Near the end, the defense lawyer faces the jury to deliver his closing argument. He does not want to let his client down by failing to effectively communicate. However, while articulating his client’s position, he admits a key fact.

A complex case goes to trial. The parties, witnesses, jurors and lawyers endure weeks of frantic preparation, arguments and witness testimony. Near the end, the defense lawyer faces the jury to deliver his closing argument. He does not want to let his client down by failing to effectively communicate. However, while articulating his client’s position, he admits a key fact.

Perhaps his opponent writes this judicial admission down on a legal pad, shifts back in his chair, smiles modestly and relaxes muscles that have been tense for weeks. Defense counsel concludes his argument. The Judge reads instructions to the jurors. After deliberation, the jury returns with a verdict completely in favor of the defendants, contrary to the admission! Surely relief from the verdict is available, at least on the point of the judicial admission? What amount of jury supervision can attorneys and their clients expect from a trial judge in similar situations?

In June 2013, William Nickerson, a Senior Federal Judge in Maryland, faced a similar situation. He ruled that the plaintiff’s lawyer’s failure to move to revise the jury instructions after the closing arguments rendered the defense lawyer’s admission not binding. On August 5, 2014, Federal Court of Appeals upheld this decision. (This appeals court has authority to also hear appeals from federal trial courts in Virginia) This case illustrates how attention to detail and quick decision-making in jury trials challenges even seasoned litigators. An attorney and client should not bring a lawsuit unless they are willing to prepare to take the case to trial. They must also have sufficient risk tolerance to permit the result to be determined by disinterested judges and jurors.

Class Action Against Long & Foster, Wells Fargo Bank & Prosperity Mortgage:

In the facts of Judge Nickerson’s case, Denise Minter and others used Long & Foster to help them purchase homes. Long & Foster has a joint venture with Wells Fargo Bank called Prosperity Mortgage. Prosperity lends home loans on a wholesale line of credit provided by Wells Fargo. Some of Prosperity’s offices are next door to Long & Foster’s. Ms. Minter used Prosperity to obtain a home loan.

This case caught my attention because Long & Foster has a large market share in residential real estate in Northern Virginia. This case held many business relationships in the balance. On a personal note, Long & Foster has been the listing or buyers agent for every real estate transaction I have been personally involved in. Long & Foster has some agents that I would use again (or refer to others) and some that I would not. I’ve never used Prosperity Mortgage.

Ms. Minter and other common customers (but not me) became dissatisfied with the services of Long & Foster and Prosperity and filed a class action lawsuit. They alleged that Wells Fargo and Long & Foster created Prosperity as a “sham” in order to skirt legal prohibitions on “kickbacks” obtained in settlements that were inadequately disclosed to the consumers. They brought their class action under the Federal Real Estate Settlement Procedures Act.

The trial court certified the plaintiffs class action except for certain claims that could only be brought if Prosperity customers were actually referred by Long & Foster. Those potential claims were set aside for a future, separate trial. In order to get a trial on those other claims, the court required a factual finding at the first trial that Long & Foster referred the plaintiffs to Prosperity.

The jury received extensive evidence in the 17 day trial. Near the end, Long & Foster lawyer Jay Veron presented a closing argument, including, “I think the only thing I agree way (sic) for sure is that Long & Foster did refer the named plaintiffs to Prosperity. There’s no dispute about that.” The jury received predetermined instructions from the Judge. These included Verdict Question No. 3:

Have Plaintiffs proved, by a preponderance of the evidence, that Long & Foster Real Estate Inc., referred or affirmatively influenced the Plaintiffs to use Prosperity Mortgage Company for the provision of settlement services.

This question was almost identical to one proposed by the Plaintiffs’ lawyers. After deliberation, the jury answered “No” to Question No. 3.

The consumers’ attorneys moved the court to set aside the jury’s verdict and order a new trial. Counsel argued that Long & Foster’s factual concession during the closing arguments constituted a “judicial admission” that bound Long & Foster in the case.

Judicial Admissions:

What is a Judicial Admission? The Circuit Court opinion explains that under federal evidence law, they are a representations by a party or their agent that are conclusive in the court case unless the judge allows them to be withdrawn. They can occur in pleadings, discovery or at trial. The are not limited to written communications. Judicial Admissions include intentional and unambiguous waivers that release the opposing party from its burden to prove the facts necessary to establish the waived conclusion of law.

For these reasons, lawyers routinely counsel clients with strategies designed to avoid making undesired admissions regarding issues in controversy. Even if an admission does not achieve binding effect, it remains fertile ground for cross-examination and falls outside the protection of a hearsay objection.

Mr. Veron’s decision to tell the jury that there was no dispute whether Long & Foster referred the plaintiffs to Prosperity was significant. Perhaps he thought that the jury would think this anyway and that he needed to concede this in order to maintain credibility. The jury either wasn’t listening, didn’t understand or believe him. In many trials, the jurors’ least favorite parts are when lawyers are talking. Veron achieved a complete victory by failing to effectively communicate what he was trying to say to the jury. In the words of the prison warden in the 1967 film, Cool Hand Luke, “What we got here is a failure to communicate.” In a 17 day trial, there is bound to be some mis-communication.

Post-Trial Motions:

The plaintiffs’ attorney needed the Court to accept Mr. Veron’s admission for the consumers to get another trial on separate, related claims predicated on that admitted fact. Plaintiff’s counsel moved to have the jury verdict set aside as contrary to the admission and the evidence. The Judge Nickerson rejected the motion for a new trial, explaining that:

Trial advocacy involves knowing when to interject with objections and motions and when to allow the case to simply flow on. In this 17 day trial, undoubtedly there were many objections and motions made by both sides calculated to steer the outcome. However, a trial attorney cannot object or make a motion whenever his opponent tries to accomplish anything. Judges and juries become weary of frequent interruptions of the flow of testimony. When Long & Foster’s attorney made this admission to the jury, the consumers’ lawyer may have thought: “Finally, something unobjectionable and consistent with what I have been saying for the past 17 days.” Unfortunately, by not moving to have the jury instructions and verdict forms changed to reflect this stipulated fact, the jury was permitted to decide it. The jury probably was not aware that there was a whole separate trial that could be precluded based on that factual finding. In the end, the joint venture known as Prosperity Mortgage survived this class action assault.

This Minter trial has several takeaways:

- Just because the parties agree doesn’t mean the jury will.

- Juries have been known to ignore things lawyers say.

- Never give up! Always listen for things that require immediate action to avoid waiver. (This does not mean object to each and every thing.)

- Going to trial, especially with a jury, requires risk tolerance.

- When a problem that requires litigation solution, trial experience counts.

- If an attorney prevails because he fails to communicate what he wants to say, then that is still a happy day for him, his law firm, and his client.

I sympathize for the class action plaintiffs lawyer. He showed opposing counsel respect by assuming that the jury would listen to the judicial admission and decide their verdict in accordance with the fact not in controversy. He also exhibited respect for the jurors, whom he assumed would draw the conclusion based on the arguments and weight of the evidence. He also respected the judge’s desire not to have yet another matter to quickly rule on.

This case illustrates that any system of justice administered by humans will run the risk of inscrutable results. A qualified trial attorney serves clients by managing these risks arising from unresolved legal disputes. This is accomplished through commitment to client service, zealously pursuing the clearest path to victory while exploring reasonable settlement opportunities.

This is Part One in a series of blog posts about the Minter v. Prosperity Mortgage, et al. case. Part Two is about certain challenges to credibility made in closing arguments.

Case Citations:

Minter v. Wells Fargo Bank, No. 07-3442 (Dist. Md. Aug. 28, 2013)(Nickerson, J.).

Minter v. Wells Fargo Bank, 762 F.3d 339 (4th Cir. 2014).

Photo Credit: Paul L Dineen via photopin cc