April 17, 2015

Valuable Voices of Dissenting Directors in Homeowners Associations

Homeowners often acquire the impression that the HOA Board of Directors and property managers act in unison. However, there are often dissenting directors in homeowners associations. Homeowners seek changes to improve their community. Enough of her neighbors agree to get her elected at the annual meeting. Once they attend their first Board meeting as a director, they discover that the property manager is handling the day-to-day affairs of the association. The volunteer board only meets every so often. The majority of directors may find the property manager’s services and information acceptable. If the new director disagrees with a proposal, she is outvoted by the majority and perhaps informally by the property manager, association attorneys, etc. In the Hebrew Scriptures, the Lord spoke to the prophet Elijah not in an earthquake, hurricane, wind or fire, but in a “still small voice.” 1 Kings 19: 11-13. Dissenting directors in homeowners associations may feel sometimes like a still small voice in the wilderness. Even when it may not be immediately fruitful, small voices may nonetheless be influential voices. The rights to speech, due process and private property are related.

Homeowners frequently hear that they must support increase assessments and fines because the policies “protect property values.” However, the value of a home reflects, in part, the extent to which its use may be maximized by its residents. In my opinion, restrictive covenants can decrease the value of property. Where the covenants are reasonable and the association is well run, the benefits of membership may meet or exceed the “cost” of any restrictions and assessment liability. While potential buyers may notice the appearance of neighboring property, they make their decision primarily on the home on the market. For example, if a neighbor has peeling paint on her deck, that practically affects the value of that property and not its neighbors.

Some might object on the grounds that this reasoning is selfish and that really, “we are all in this together.” However, the individual property rights of one neighbor are precious to all neighbors. An assault to the rights of one threatens the rights of others similarly situated.

In a similar way, when dissenting voices on a Board of Directors represent a genuine concern about the governance of the association, they have great deliberative value even if they don’t carry a majority vote. In the association, the property manager and other advisors serve at the discretion of the board as represented by the majority. Association attorneys can be expected to be competent and professional, but they advocate for the legal entity. A dissenting director cannot reasonably expect the association’s advisors to provide her with independent counsel. So, what rights and responsibilities to dissenting directors have in a Condominium or HOA? Here are a few key considerations:

- Legal vs. Practical Power: While the majority (and by extension the professionals they retain) may enjoy the practical power of control, by law all directors have the same legal duties to the Association. Lawyers, lawmakers and judges usually describe this legal duty as “fiduciary.” Virginia Beach association lawyer Michael Inman explains the fiduciary duty of directors in a July 30, 2007 post on his Virginia Condominium & Homeowner’s Association Blog. He argues that a Board has a fiduciary duty to conduct debt collection against delinquent owners. However, the duty to conduct debt collection is not absolute. The board must not exceed its authority or neglect its other obligations. A director who does not enjoy practical control of the operations must understand her fiduciary duties in order to protect her voice. A director may also enjoy indemnification in the event of a civil lawsuit arising out of board action.

- Identify Potential Conflicts of Interest: A conflict of interest arises when a board member is called to vote on a matter where his personal interests and the interests of the association lead in opposite directions. For example, the director may be a principal for a company the association is considering doing business with, such as a property management company, construction contractor, pavement company, or other vendor. A director must be aware of how a vote on a potential resolution by her or other directors may give rise to a legal claim to undo the disputed transaction. However, the existence of a conflict of interest may nonetheless be acceptable under the circumstances. For example, the Virginia Nonstock Corporation Act provides “safe harbors” where the conflict of interest is disclosed to the board or the owners eligible to vote and they pass the resolution anyway or the transaction is deemed “fair” to the association at trial. The burden is on the director with the conflict of interest to properly disclose it.

- Owners’ Rights vs. Directors’ Rights: A director wears different hats. She is a director, an owner and probably also a resident or a landlord in the community. This presents unique circumstances not usually found in business or nonprofit boards. The director may leave board meetings and then go home in that same community. In a condominium, the director may rely upon the association’s employees for concierge services, HVAC maintenance, etc.

- Document Review Rights: Directors and owners have rights to review association financial statements and other documents as spelled out under Virginia law. Traditionally, a business would store these documents in paper files at its official address. As more and more information moves “on the cloud,” how a director or owner practically exercises her rights to review will evolve. Hopefully cloud computing will translate into convenient, transparent exercise of owners or directors rights to review financials and other documents to which they are entitled.

- Governance Issues: Virginia law and the bylaws impose obligations on the board of directors on how it may go about adopting legally effective resolutions. The board may be required to give notice of a meeting, achieve a quorum and record minutes and written resolutions. However, leadership may desire the flexibility of adopting resolutions without the necessity of an actual meeting. Formal governance requirements allow dissenting directors an opportunity to have their voices heard.

- Human Relationships: Even when leadership and managers disagree about major decisions and policies of the association, it’s important not to lose sight of the values of professionalism, respect and diplomacy. I recently participated in a continuing education seminar where a foreclosure attorney explained how important respect was in his practice. Although his job requires him to foreclose on commercial real estate supporting its owner’s livelihood, he reminds himself that these borrowers are also someone else’s family. Being a resilient advocate of the property rights of oneself and one’s neighbors requires civility. Ultimately, the best directors look at situations from the perspective of leadership.

In most situations, dissenting directors in homeowners associations will not need to retain independent legal counsel. However, if you are a director or committee member experiencing a legal dispute adverse to the association, contact a qualified attorney to protect your rights.

legal citation: Va. Code Section 13.1-871, Virginia Nonstock Corporation Act, Director Conflict of Interests.

photo credit: East Norriton Townhouses via photopin (license)(photo depicts homes in Pennsylvania and not matters discussed in this blog post)

March 18, 2015

Court Scrutinized Role of Foreclosure Law Firm Rating System

Successful law firms cultivate, among other things, professional referral sources and a reputation for responding to client needs. Can these best practices be taken too far? This topic came up in a federal court opinion issued in a class action lawsuit brought by home loan borrowers against Friedman & MacFadyen, a Richmond debt collection law firm and its foreclosure trustee affiliate.

On February 27, 2015, I wrote an entry about the Fair Debt Collection Practices Act claim in this case, Goodrow v. Friedman & MacFadyen. The law firm had a practice of sending letters to borrowers, threatening to file lawsuits. Later correspondence referred to lawsuits. However, the borrowers alleged in their class action that no such lawsuits were ever filed. The FDCPA claim sought money damages for the alleged False Representations. What would motivate a law firm to threaten to sue and later make references to non-existent suits if the goal was foreclosure? Another part of the judge’s opinion suggests an answer.

Fannie Mae and its loan servicers retained Friedman & MacFadyen and F&M Services, Inc., to collect on home loan debts by foreclosing on deeds of trusts in Virginia. The borrowers allege that this specific arrangement incentivized the law firm to complete foreclosures quickly and discouraged delays and loan modification workouts. In the foreclosure, the lender appointed F&M Services, Inc., as substitute trustee under the mortgage documents. A third-party, Lender Processing Services, Inc., played a significant role. LPS maintained a rating system for foreclosure law firms. Timely completion of matters timely would earn a firm a “green” rating. Mixed results earned a “yellow” designation. If matters got bogged down, a “red” rating could result in loss of future referrals (the opinion does not reference any colored cupcakes). This foreclosure law firm rating system played a key role in the facts of the case. LPS required the law firm to pay a referral fee for each case. At the end of each matter, Friedman & MacFayden filed a trustee’s accounting with the local Commissioner of Accounts. According to the plaintiffs, the $600.00 trustee’s commission listed on the accountings included an undisclosed referral disbursement to LPS.

The class action lawsuit accused the defendants of breaching their trustee’s duties in the foreclosures. The borrowers also alleged that the law firm engaged in impermissible “fee-splitting” with the non-lawyer referral company LPS. A foreclosure trustee is forbidden from purchasing the property at the sale. The Trustee’s own compensation is subject to review in the filed accounting. In foreclosure matters, courts in Virginia interpret a foreclosure trustee’s duties to include a duty to act impartially between the different parties who may be entitled to the property or disbursement of the proceeds of the sale, including the lender, borrower and new purchaser. Concurrent with such trustee duties, the defendants had their arrangement with Fannie Mae and LPS.

This is where the representations in the correspondence to the borrowers seem to fit in. If borrowers demanded loan modifications, made repeated inquiries, requested postponement or filed contesting lawsuits, then matters could be delayed. The law firm’s colored rating with LPS might be downgraded and cases might stop coming.

The law firm was not purchasing the properties itself in the sales at a discount. However, they were alleged to be financially benefiting from the disbursement of the proceeds of the sale in a manner not reflected in the trustee’s accounting statements. Further, any amount paid to LPS from the sale went neither to reduction of the outstanding loan amount or for allowable services in the conduct of the sale.

In considering the facts, the federal court denied the defendant’s motion to dismiss the borrowers’ Breach of Fiduciary Duty claim. The court found those claims to adequately state a legal claim that would potentially provide grounds for relief.

Whether a borrower has grounds to contest a real estate foreclosure action in court depends upon the facts and circumstances of each case. The Goodrow case illustrates how many of those circumstances may not be apparent from the face of the loan documents, correspondence or trustee’s accounting statements. If you have questions about the legality of actions taken in a foreclosure, contact a qualified attorney without delay.

case cite: Goodrow v. Friedman & MacFadyen, P.A., No. 3:11-cv-020 (E.D.Va. July 26, 2013).

(I would like to thank the generous staff member who brought in the cupcakes depicted on the featured image. They were delicious and great to photograph!)

March 12, 2015

Don’t Go it Alone on a Notice of Violation

By law, the homeowners govern mandatory property associations, whether for single-family homes or condominiums. They are roughly equivalent to the shareholders in a corporation. The property manager and employees answer to the board of directors, who in turn answers to the owners. Unfortunately, many homeowners have experiences where this structure seems turned upside down. The property managers, accountants and lawyers hired by the association explain to the board and the owners what to do.

Such a “role-reversal” occurs in circumstances where an association improperly accuses an owner of violating the rules and regulations. Homeowners are told that rules enforcement is necessary to “protect property values.” However, to a homeowner, loss of community privileges, limitation of the use of the property or payment of a fine decreases the practical value of their property. Associations sometimes take direct, unauthorized action without any due process. Usually, they begin the rule enforcement by sending a written notice of violation to the owner. This is the “opening salvo” in a process where an unassisted owner is likely at a disadvantage even when the facts and rules are favorable. Why? Associations pursue rule violations regularly. They usually hire experienced, capable community association lawyers. Property managers prepare to testify about the facts. The board members are often more familiar with the process than the other owners. It is important that owners don’t go it alone on a notice of violation.

Virginia law requires the association to follow established rules enforcement procedures:

- Complaint Made & Reviewed: Before any proceeding begins, another owner, a board member, manager or employee of the association must bring an allegation of a rule violation before the association leadership.

- Legal Grounds for Adverse Action: The General Assembly has not granted associations carte blanche authority to run their communities. Property associations do not have the broad powers of counties or cities. They only have the legal authority granted by law and properly adopted in the declarations, covenants and bylaws. Rules, regulations and resolutions must comply with these higher legal authorities. In substantial disputes, an owner is best served by consulting with an attorney who is familiar with community associations but doesn’t cater to them. Confirming the absence of legal authority requires knowing where to look, what to look for and what to do next. Each association has different documents that may affect an individual owner’s proceeding.

- Written Notice of Violation: Virginia law requires the board to send the owner a written notice of the alleged violation prior to taking any adverse action. The notice must give the owner a reasonable opportunity to correct the violation. Homeowners may need to consult with licensed contractor about the necessity or cost of any repairs that cannot be addressed on a DIY basis.

- Notice of Hearing: To continue the process, the Association must send the owner advance notice of any hearing, identifying actions that the association may decide to take. The owner is entitled to receive it at least 14 days before the hearing.

- Participation in the Hearing: Violation hearings are conducted before the Board of Directors or some other quasi-judicial body specified in the Association’s governing documents. What can a homeowner expect at the hearing? Shu Bartholomew, host of weekly radio show “On the Commons,” explains the importance of not going it alone: “The last thing a homeowner wants is to be sitting – alone – on one side of the table when 5-7-9 board members, managers, recording secretaries, attorneys, and every other Tom, Dick and Harry in a semi-official capacity on the HOA is on the other side of the table, accusing the owner of being in violation of something, that the HOA may not even have the authority to enforce. It is intimidating and a very clear picture of the imbalance of power in HOAs.” The owner should be prepared for this possibility. But owners can have a “team” too. Owners may be represented by legal counsel at the hearing. The General Assembly saw a need to pass legislation making this a statutory right. In addition to an attorney, the owners should consider inviting witnesses and supporters.

- Rules Enforcement Decision: The association must send the owner the hearing result in writing within 7 days of the hearing. The result may consist of monetary charges or suspension of privileges, such as the clubhouse, pool, gym, etc.

- Effect of Decision: Virginia law allows for unpaid fines assessed pursuant to this process, if valid, to be treated like an unsatisfied assessment against the owner’s property. The association may put a lien on the real estate. The suspension of privileges may continue until the matter is resolved.

Virginia property owners are entitled to due process in these association proceedings. An owner is best served by taking action to avoid an adverse decision. However, the internal decision-making process is not the end of the story. Owner’s rights can be defended by bringing legal action in local courts. If your association is working with a team to assess a fine, suspend your privileges or take any other action against your property rights, don’t go it alone.

Authorities:

Virginia Code Section 55-513 (Adoption and Enforcement of Rules)[Property Owners Association Act]

Photo Credit:

Diving. The Ascott Kuala Lumpur via photopin (license)(to illustrate a common area privilege. Does not depict a community association property in the U.S.)

March 4, 2015

Buying a Home Through Realtors Versus Foreclosure Sales

Recently a friend shared with me her interest in purchasing a home at a foreclosure auction. Many buyers look to foreclosures in the hope of finding a bargain. Foreclosure sales occur year-round. On the other hand, “conventional” sales through realtors follow a seasonal pattern. When the ice and snow melt and winter winds retreat northward, sellers start to put their homes on the market. In March, potential buyers call real estate agents and loan officers. The first crop of “For Sale” signs is a harbinger of spring. Experienced real estate professionals and investors know that finding the right foreclosure purchase is not as simple as reading an advertisement, showing up at the sale and making a bid. But is this option right at all for families seeking a place to live? Sometimes foreclosure investments do not work out well even for seasoned investors. Today’s blog post compares buying a home through realtors versus foreclosure sales in Virginia.

- Salespersons vs. Debt Collectors: Personal interaction defines shopping experiences. Real estate agents advertise the property through internet listings, brochures, signage and open houses. With the help of their own agent, potential buyers bid against each other. In a “conventional” property sale, the buyer’s interface is through these sales and marketing professionals. By contrast, debt collection attorneys lead foreclosures in Virginia. The lender retains the attorney to collect on the current owner’s home loan debt. Interested investors go to the front of the courthouse to bid on the property at the sale. In the sale, the debt collection attorney also acts as a trustee. In a previous blog post, wrote about a foreclosure trustee’s duty of impartiality. Buyers must consider the significant difference between doing business through salespersons vs. debt collectors.

- Motives of Current Owner: Real estate transfers through realtors are voluntary. Agents list properties because the sellers want them on the market. If a buyer thought that the seller might sue them after the closing, or refuse to move out, they would never make an offer in the first place. In foreclosure, the previous owners often refuse to leave willingly. The lender or buyer may need to evict them through court in order to get physical possession of the property. Frequently a borrower suffering a foreclosure files a lawsuit against the new owner, the bank or the foreclosure trustee to test the legal validity of the sale. Foreclosure sales have a substantially higher risk of litigation than “conventional” transactions through real estate agents. Investors can’t count on being handed the prior owner’s keys.

- The Condition of the Property: Real estate agents know that sales require exposing the property to the market through internet listings, disclosures, brochures, open houses, signs and home inspections. However, investigating the features and condition of a foreclosure property is a struggle. The trustee usually provides little more than the minimum amount of advertising and disclosures. There is not much of a budget for marketing. The foreclosure property likely needs repair. When homeowners struggle to pay their bills, they often stop making repairs before defaulting on mortgage payments. Most foreclosure properties require substantial renovation before they can be occupied again.

When people shop for a home to live in, usually they want a “turn-key” proposition. They don’t want to invest time and resources before moving in or renting it out. With so many challenges and uncertainties, who would seek to buy a home at a foreclosure sale in Virginia? Well, it’s all about one’s ability to manage risks. This is why often only the bank bids at the foreclosure sale. The only other bidders may be investors who specialize in distressed real estate. If you are one of these investors, or are interested in becoming one, add a qualified attorney to your “team” to assist with the real estate, litigation and construction aspects of managing these risks.

February 27, 2015

Legal Thriller Published in Foreclosure Notices to Borrowers?

On December 4, 2014, I wrote a blog post about a borrower who brought a lawsuit against her lender after the Richmond law firm that conducted the foreclosure went out of business. The federal judge denied the bank’s motion to dismiss the borrower’s claims based on a faulty loan default notice. In that post, I mentioned that the involved law firm, Friedman & MacFadyen, was the target of class action litigation arising out of their debt collection and foreclosure practices. Of the several bases to the class action, the only one that will be discussed here has to do with False Representation liability under the Fair Debt Collection Practices Act. The lawsuit accused Friedman & MacFadyen of sending correspondence to borrowers containing false threats of lawsuits followed by notices with references to court actions that had not been filed. Put another way, the class action claimed that there was a legal thriller published in foreclosure notices to borrowers.

Someone with legal training knows whether a lawsuit is pending. A case cannot proceed unless the party is properly served with a copy. If one knows where to look, one can search court records to verify whether someone is party to a pending lawsuit. But the process of determining this is not common public knowledge. In its opinion, the federal court discussed the alleged practices of the law firm. F&M initially wrote to the borrowers to tell them, among other things, that their, “loan[s][had] been referred to this office for legal action based on a default under the terms of your Mortgage/Deed of Trust and Note.” Later correspondence suggested that a lawsuit was pending or about to be filed. However, the law firm never intended to file a lawsuit against these borrowers. Virginia is a non-judicial foreclosure state. Foreclosures routinely occur here as a trustee transaction and not normally in a lawsuit. Later firm correspondence instructed the borrower on how to obtain “withdrawal” or “dismissal” of the “action.” F&M would refer to these matters as the name of the bank “v.” the name of the borrower, the way lawyers style a lawsuit.

People tend to take a dispute more seriously once a case is active before the court. A legal action does not exist until a party files it in writing with the court’s clerk. Attorneys know that the threat or current existence of a lawsuit causes negative emotions on the part of the defendant, such as anger, fear, anxiety, avoidance or aggression. However, there is a difference between candidly informing an opposing party that suit will be filed if the dispute cannot be resolved and the facts alleged about Friedman & MacFadyen. The opinion discusses allegations that the law firm was in a client relationship where it would be rewarded for foreclosing quickly, and less rewarded for negotiating loan modifications. If the borrowers had known that there were no pending lawsuits, they may have handled their situations differently. In essence, the class action suit accused the foreclosure law firm of putting fictional accounts of lawsuits in foreclosure correspondence with the goal of obtaining favorable responses by borrowers in light of how the law firm was rewarded by its client.

Lawsuits have value for collecting on debts. They also cost money the parties filing them. Once the lawsuit is actually filed, the party and its attorneys have obligations to the court. A fictional lawsuit, on the other hand, does not require anything to be prepared, no court fees to be paid, scheduling conferences to attend or any other responsibilities. The plaintiffs’ suit included a Fair Debt Collection Practices Act claim for False Representation for what might be described as “shadow litigation” issues. In a January 16, 2015 blog post, I discussed the basics of FDCPA False Representation claims, where a debt collector uses a false, deceptive or misleading representation to collect consumer debt. In denying F&M’s motion to dismiss the lawsuit, the court observed that it would construe the foreclosure correspondence collectively to determine any tendency to mislead the borrowers.

If you have received any foreclosure-related correspondence that references a lawsuit that you cannot verify, contact a qualified attorney to discuss defense of your right to be communicated fairly with regarding your property rights.

case cite: Goodrow v. Friedman & MacFadyen, P.A., No. 3:11-cv-020 (E.D. Va. July 26. 2013).

photo credit: 5525 Carr Street (22) via photopin (license)(does not depict any individuals or properties involved in the discussed class action suit)

February 20, 2015

The Basics of Civil Litigation Discovery

At some point after the filing of a lawsuit in Virginia Circuit Court, initial disputes over the sufficiency of the complaint are resolved. The parties are now on notice of their opponents’ claims and defenses. The process of getting to this point was the focus of my previous blog post. Contrary to what one sees on T.V. or movies, parties do not immediately proceed to going to trial. Instead, lawyers and their clients begin to prepare for trial in a period called “discovery.” Discovery involves finding out more facts about the case. This post provides an overview of the basics of civil litigation discovery, with a focus on its purposes and tools in real estate cases. Why is there such a lengthy process for this? Consider three purposes of discovery:

- Hoarding. Preventing one side or another from “hoarding” documents and information about the case to the unfair detriment of others. For example, in a case between different homeowners’ association factions over control of the board of directors, whoever happens to have access to the minutes, resolutions, notices, amendments, etc., kept by the association must provide them to the other.

- Surprises. Lawyers, as a lot, are attracted to springing surprises on their opponents at trial. However, it may be contrary to the principles of justice for one side to hand the other a large stack of documents they have never seen before during the trial and expect the witness questioning to be meaningful. Discovery can mitigate unfair surprise.

- Effectiveness of Trial. The public places greater confidence in trial results that are based on documents and facts rather than the decisions made in the absence of existing evidence.

The methods of discovery are more formal than the fact gathering conducted outside of litigation. Informal investigation includes researching the documents and information within one’s control, talking to friendly witnesses, checking what is publicly available or that one’s bank can provide. Usually this doesn’t answer all questions. So what are the available forms of civil discovery? There are quite a few. The most useful in real estate and construction cases in Virginia circuit court are:

- Document Requests. The rules allow a party to request in writing an opponent’s documents. A party seeking production of documents must send a written request. The responding party then has 21 days in which to respond as to documents within their possession, custody or control. In large cases it usually takes significantly longer than 21 days to resolve a document request. Reviewing the relevant documents of one’s opponent is a central element of trial preparation. Contracts and other documents created before the dispute cannot, absent forgery, be changed to adapt to someone’s current story. When the judge or jury goes to make determinations of facts, the credibility of the parties and the key documents carry great weight. If a party fails to produce a document requested in discovery, they are not normally allowed to use it as an exhibit at trial. The documents of a third-party can be requested by serving them with a subpoena duces tecum.

- Interrogatories. Information sought may not necessarily be reflected in a document. In discovery, a party may submit written interrogatories to another party, seeking answers to specific questions. For example, a party may inquire into the factual support for their opponent’s claims or defenses. Parties usually ask for disclosure of all persons having knowledge about the facts of the case. Interrogatories are also a good tool for finding out about expert testimony that one’s opponent may present at trial. The answering party must respond within 21 days. The answers must be signed by a party under oath or affirmation.

- Requests for Admissions. Last August, I posted an article about the role of a party’s admissions in a federal trial in Maryland. In that case, a lawyer made an oral admission in a closing argument. His opponent did not make a motion to have the admission deemed binding before the jury went to deliberate. The jury made a decision contrary to the admission. The jury verdict ignoring the admission survived post-trial motions and appeal. Party admissions can be requested in discovery before they come out at trial. Parties are entitled to submit to the opponent formal, written requests for admission. The 21 day deadline applies here as well. Admitted responses are binding. These can be useful for resolving uncontested matters so that the trial can focus on what’s disputed.

- Depositions. How will a party or witness react to a line of questions at trial? Does a party or witness know something that can be useful to preparing one’s own case? In discovery, a party may take oral depositions of parties, experts or other witnesses. The deposition usually occurs at a law office. The parties, the lawyers and the witness meet in a conference room with a court reporter. The court reporter places the witness under oath, and then records all of the lawyers’ questions, objections and witness answers. Depositions of parties and experts are an important part of pretrial discovery in large cases.

- View of Real Estate. In many real estate or construction cases, the most significant piece of evidence is the building or land itself. If ordered, the jury travels to the property to view it as evidence. More commonly, the appearance of property is put into evidence by photographs or video. A party not in possession or control of the real estate is entitled to view it. This can be an effective way of expanding one’s knowledge about the case.

Not all of these tools will need to be employed in every case. In addition to these forms of discovery, there are common areas where parties dispute over whether the discovery has been properly sought or provided. These are usually the subject of objections and motions:

- Relevance. Discovery cannot be used to explore any and every topic. The requests must explore relevant, admissible evidence or information that is reasonably calculated to lead to admissible evidence. Although not unlimited, the scope of discovery is broad.

- Confidentiality. A party may have confidentiality concerns about turning over documents or information. These concerns can be addressed by a protective order regulating the use and disposition of confidential documents or other information.

- Privileges to Withhold. Frequently attorneys will interpose objections to discovery requests. One justification for withholding documents is the attorney-client privilege. Communications between an attorney and his client are not subject to discovery. Despite the apparent simplicity of this concept, disputes over assertion of the attorney-client privilege are a frequent source of discovery disputes. There are other privilege and objections that are applicable in certain situations.

- Spoliation. In the age of computers, e-mails, text messages, computer files and other electronic data are easily created and easily deleted. Once litigation is threatened or pending, parties and witnesses should take action to preserve evidence, including electronically stored information for potential use in the lawsuit.

- Motions to Compel. Lawyers must make reasonable efforts to resolve disputes over the legitimacy of objections, the sufficiency of responses and other discovery disputes without putting it before a judge. When disputes cannot be resolved, typically one party will bring a motion to compel discovery against the other.

- Sanctions. The failure to obey discovery orders can subject a party to a variety of sanctions, including awards of attorney’s fees, dismissal of claims or defenses, exclusion of witnesses and other punishments.

By better understanding the basics of civil litigation discovery, one can adopt strategies that make better use of time, energy and resources pre-trial. Implementing discovery strategies proper to the needs and circumstances of the case pave the way towards a favorable result.

February 12, 2015

The Beginning of a Virginia Circuit Court Case

Many people will never be party to a lawsuit that goes to trial. For those that do, the first time may be the only time. Being a party to a Virginia circuit court civil case requires significant time, focus and resources for what may be several months or longer. What should a party expect from the beginning of a Virginia circuit court case? Because of the commitment required, parties to a lawsuit should familiarize themselves with the basics. This article is the first installment in a series providing a basic overview of Virginia circuit court civil cases. While the circumstances and details of each case are unique, the rules of court provide a basic outline of what to expect.

Pre-Lawsuit Negotiations: Before a lawsuit is filed, the parties and their attorneys usually communicate in efforts to achieve desired results without the necessity of a lawsuit. They exchange emails, demand letters, settlement offers and other correspondence articulating their interests, position and requirements. Why engage in this process if there already are grounds for a lawsuit? In the facts of many cases, there is a reasonable likelihood that the case can be settled without the necessity of filing suit. Not every case that ought to settle in fact resolves without filing suit. However, once suit is filed, the parties will be required to conduct the case in addition to engaging in any desired settlement negotiations. Often it is worthwhile to first see if things can be negotiated.

Filing the Complaint: If settlement negotiations don’t work, a party’s first step towards obtaining a judgment may be to file a complaint at the circuit court clerk’s office. In real estate and construction cases, this is usually done at the courthouse for the city or county where the property is located. Most real estate or construction cases are brought in Circuit Court. However, if the amount in controversy is $25,000.00 or less, the case will probably be brought in General District Court. Alternatively, some cases are brought in federal court.

To begin the case properly, the plaintiff’s best interests are served by investigating and analyzing the case with the lawyer. The complaint should include the proper parties with their correct names. The claims (e.g., breach of contract, breach of warranty, fraud, etc.) should be carefully considered and supported by sufficient factual allegations. The remedies (e.g., money judgment, declaration of rights, etc.) requested to the Court should be clear and supported by the claims. The parties defending the lawsuit can be expected to attack the complaint in whatever way they can. Making the complaint as strong as reasonably possible positions the plaintiff to have a greater likelihood of obtaining a favorable result in court or settlement. The plaintiff normally bears the burden of proof for the claims in the complaint. Parties should avoid simply putting some allegations together that merely forces the other side to respond. Time and focus spent on the complaint may prevent more time unnecessarily being spent strengthening or disputing over a claim later.

Service of Process: A lawsuit cannot proceed unless the defendants are formally put on notice. Normally this consists of having a sheriff’s deputy or private process server going out to each defendant’s house to serve them. There are several alternatives to direct hand delivery of the complaint on the defendant that may apply. Usually it takes a few days for the court personnel to process the paperwork. If the lawyers for the parties are already introduced, often the attorney will provide the defendants with a courtesy copy of the complaint before it is served.

Defendant’s Initial Response: Once the defendant is served, he normally has 21 days in which to respond. Failure to respond in a timely manner or obtain an extension can result in that party falling into default. Falling into default can result in significant waiver of rights to defend the lawsuit and possible entry of default judgment. Usually, defendants respond initially to complaints by filing a “demurrer” or some other motion designed to have the lawsuit dismissed. In the Virginia circuit courts, defendants often make substantial efforts in these early demurrers and motions. Unlike some other states, the defendant’s ability to get a case dismissed on a later pre-trial motion is limited in Virginia state courts. Since the plaintiff bears the burden of proving the allegations and generally upholding the legitimacy of the lawsuit, there are many possible grounds for a defendant to seek dismissal. What is a demurrer? At this stage the defendant usually cannot successfully challenge the truth of the facts asserted in the complaint. Instead, the demurrers typically argue that, for whatever reason, the complaint is not legally sufficient and must be revised or abandoned. For example, a plaintiff may allege various forms of wrongdoing and damages suffered. However, if a claim fails to properly articulate a causal connection between the wrongful conduct and the damages suffered, the defendant will probably argue that it is not legally sufficient. The demurrer or motion to dismiss may require a court hearing where the attorneys will argue before a judge over the sufficiency of the lawsuit. The parties themselves are usually not required to attend these hearings but may do so if they wish.

Defendant’s Answer and Affirmative Defenses: At the end of this initial motions practice phase, the defendants are usually left with claims that have survived and must be responded to directly. This is done by filing an answer containing numbered paragraphs responding directly to those in the complaint as admitted, denied or whatever other response is appropriate. In the same document, the defendants will also identify their affirmative defenses. For example, the defendant may assert fraud, that the plaintiff waived her rights by taking too long to file suit, or other defenses. Some affirmative defenses must be put with the answer to avoid being waived.

Additional Claims: A defendant may have a claim against the plaintiff, another defendant or a third party that may be related to the facts of the case. This initial response phase is the normal time for such claims to be asserted. A counter-claim, cross-claim or claim against a third party is in many respects treated like a separate lawsuit that will go to trial with the initial lawsuit because of the common factual issues.

Scheduling Orders and Trial Dates: Around this time the court will set the trial date. A party should provide her attorney with dates to avoid (vacation, travel, etc.) for trial. Additionally the attorney and client will discuss whether a trial by or without a jury should be requested. When the attorneys set the case for trial, the court may enter a scheduling order setting certain deadlines for the progress of the case. Once the trial date is set, the attorneys, parties and witnesses should reserve the trial dates on their calendars.

There is a lot of activity that goes on in a Virginia circuit court case before the parties give their own personal testimony. In the next installment in this series, I will provide an overview for the discovery process, where each side requests testimony, property viewings, documents and information from their opponents and third parties. The facts and circumstances of each case are different and may require additional procedures or other variations from the outline provided above. If you have a real estate or construction claim against another party, discuss the matter with a qualified attorney to avoid unnecessary waiver of any rights. If you have been made a defendant to a lawsuit, consult with an attorney admitted to practice before the court where the suit is filed to avoid falling into default or other waiver of rights.

February 5, 2015

Association Rule Enforcement and Homeowner Rights

A property association’s board of directors has the controversial power to issue and enforce fines against its members for rule violations. When an owner receives a threatening notice from the association, it is not always clear what options are available other than to simply obey the demand. This blog post summarizes the process of association rule enforcement and homeowner rights to protect their interests.

When an investor creates a new condominium, townhouse or detached single family home development, he usually makes them subject to covenants to be enforced by an association. The investor files covenants in the county land records, placing all future purchasers on notice that owners of homes in the development are subject to the covenants, bylaws, rules and regulations of the association. Virginia courts interpret the legal relationship between the association and the owner like a contract. There is a hierarchy of authorities defining the respective rights of the associations and owners:

- State Law. An Association must follow the Condominium Act or the Property Owners Association Act. The covenants, rules and regulations may not contradict state law except where those statutes may allow variance from their provisions.

- Association Instruments Recorded in Land Records. This means declarations, covenants, bylaws, amendments, etc. These documents control the governance of the association and its powers to adopt rules and fine owners.

- Resolutions, Rules and Regulations. State law and the covenants and bylaws set out the association’s powers to adopt rules. The rules and regulations are subject to both state law and also the recorded covenants and bylaws. The power to adopt and enforce rules is held by the board of directors, who answer (at least on paper) to the owners in exercise of their own voting rights. Sometimes it can be difficult for an owner to determine which documents are formally adopted rules and which are “policy documents” published by some individual with the intent that the owners follow them but that don’t carry the authority of a formal rule. This is why the minutes and resolutions of the board are important.

The laws, land records and resolutions are all separate, sometimes contradictory documents that speak to an association’s board of director’s authority to fine owners. The board’s notices of an alleged rule violation can be confusing. When threatened with a fine, what strategies are effective for a homeowner to protect her rights? The facts and circumstances of each case are different, but three strategies may be applied in a variety of situations:

- Keep Property Records. A homeowner should maintain files (either in a paper filing system or on a computer) of documents from the purchase of the home and all association documents such as covenants, rules, regulations, resolutions or correspondence from the property manager or board members. In the event of a dispute, these files may be necessary to support the homeowner’s position. Also keep records of all estimates, contracts, purchase orders, invoices, payments for all repairs and maintenance to the property. In general, homeowners who keep good files tend to have fewer legal disputes and resolve them more easily and favorably than those who don’t.

- Build Rapport with Neighbors. Whenever possible, have as good relations with one’s neighbors as possible given the personalities involved. Amicable relationships create mutually beneficial alliances (This does not necessarily require being BFF’s). However, association representatives may try to convince a homeowner that they are letting their neighbors down by not obeying a violation notice. However, a friendly relationship with others subject to the same covenants and rules can serve as a reminder that one’s neighbors usually are not crazy about the rules enforcement either.

- Promptly and Politely Assert Rights. Upon receipt of a notice of rule violation, many homeowners are often tempted to ignore it. If it is not reasonable or easy to understand, is it really a threat? Unfortunately, notices are usually followed by a notice for a hearing where a fine may be determined. The owner is entitled to be present at this hearing and be represented by an attorney, if desired. After that, the association may attempt record a lien in land records, file a lawsuit at the courthouse, or both. A homeowner’s rights are easier to defend earlier in the process than after something adverse happens. board directors or property managers may tell an owner that they must comply with the notice of rule violation in order to “protect the property values” in the Association. However, home buyers rarely ever compare the rules and regulations with the appearances of the homes when they are conducting their home buying process. An association covenant that a home is encumbered with does not improve its value. In fact, it represents a future liability in the form of monthly assessments.

If you are a homeowner and you are unsure whether your association is properly conducting its rule enforcement proceeding against you, promptly contact a qualified attorney to protect your rights.

January 29, 2015

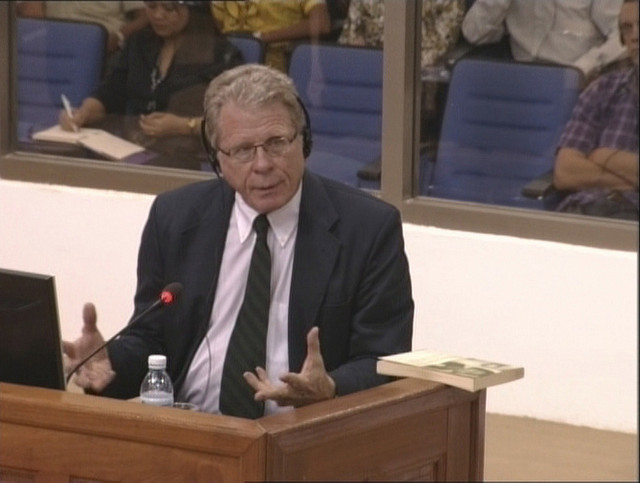

New Book Review: The Articulate Witness

One of the duties of a litigator is to prepare the client to testify at a deposition, mediation, hearing or trial. Clear, credible and cogent testimony puts the party in the best position to prevail. While judges, arbitrators and juries want to see the contracts and key documents, they also want to hear directly from the parties whose dispute is before the court.

Experienced trial attorneys know what to expect of themselves and their witnesses from the facts of the case. When it comes to public speaking, witness preparation typically includes discussion of the disputed facts and legal arguments in the case. While an attorney may not tell the client or witness what to say, he may ask practice examination questions. Witnesses quickly learn that courtroom or deposition testimony differs from ordinary conversation or interviews. A witness may have little or no public speaking training or experience. There may not be time for a witness to gain valuable experience in Toastmasters International or other activities to practice speaking skills. So how can a witness prepare herself to give effective testimony in her own case?

This month, Brian K. Johnson and Marsha Hunter published a new book, “The Articulate Witness: An Illustrated Guide to Testifying Confidently Under Oath.” This edition is available in print or e-book format. Johnson & Hunter are consultants who train attorneys for a variety of public speaking settings. I have read one of their other books and attended one of their seminars. “The Articulate Witness” is useful to parties and witnesses seeking an overview of the legal testimonial process. It is a valuable resource for attorneys and law students seeking insights in how to better prepare their clients to testify. Professional experts evaluating their own habits and skills would benefit as well. The book is a breezy 50 pages with copious illustrations. I finished it riding on the D.C. Metro between the Judiciary Square & West Falls Church stations. The book focuses on the mechanics of speaking confidently in litigation situations, including cross-examination. The book would be useful to a witness when they first know that a deposition, hearing, trial, etc. will occur. It is not a good book to read the evening before the big day. The reader may desire to practice some of the exercises or discuss them with the attorney beforehand. The book is not a proper substitute for trial preparation with one’s attorney.

A common mistaken belief is that public speaking involves only expressing one’s thoughts using one’s voice. Johnson & Hunter do a great job of showing how it is also a “physical” activity, involving posture, gestures, handling exhibit documents, facial expression and eye contact.

“The Articulate Witness” is an excellent reference for witnesses,attorneys, experts or any other person whose profession or circumstances require him to speak in a legal proceeding. Mastery of the facts and laws is not sufficient. One must be prepared to cogently communicate one’s position to others.

photo credit: Extraordinary Chambers in the Courts of Cambodia via photopin cc

January 21, 2015

Sweet Home Chicago: Are Association Property Managers Debt Collectors?

A few days ago, Virginia state senator Chap Peterson introduced new Homeowner Bill of Rights legislation in the 2015 General Assembly. The proposal sets out certain rights of property owners in HOA and condominium communities. For example, SB1008 recites a owner’s right to due process in the association’s rule violation decision-making. I anticipate political debate on whether SB1008 simply restates existing legal protections or contributes to them. Regardless, the introduction of this bill illustrates that rule violations are a hot item in association matters. Who collects on association rule violations? Boards in most associations are comprised of unpaid volunteers. Most of an association’s day-to-day work is done by property managers hired by the board.

Federal Debt Collection Laws.

Generally, the Fair Debt Collection Practices Act (“FDCPA”) protects consumers from abusive debt-collection practices. This Act does more than provide defenses in collection lawsuits or authorize a federal agency to take regulatory action. If debt collection businesses, including law firms, violate the FDCPA, they may be liable in an independent lawsuit. Under the FDCPA, it is easier for debtors to sue collectors for false or misleading statements in correspondence. The Act also requires certain notices in correspondence, such as notifying the consumer of their right to seek verification of the debt. In my previous blog post, I provided some examples of this in the foreclosure context. Where the facts and circumstances allow, class action lawsuits may be brought for FDCPA violations. Broad application of the FDCPA against association property managers would force them to change many of their practices. For example, the Act examines whether a notice would be materially confusing to the least sophisticated consumer. Are association property managers debt collectors for purposes of the FDCPA?

Welnowska v. Westward Management, Inc.

A 2014 court case illustrates the current limitations in applying the FDCPA to association property managers. Anna Welnowska & Jerzy Sendorek owned a residential condominium unit in the Madison Manor 2 Condominium Association in Chicago, Illinois. In July 2012, Madison Manor hired Westward Management, Inc., as its “full service” property manager. Part of Westward’s duties was collection of assessments and fines. Westward mailed collections letters to Welnowska & Sendorek in the name of Madison Manor. The owners disputed the charges. Madison Manor filed a lawsuit seeking a judgment for the unpaid sums and eviction of the owners.

In August 2013, Welnowska’s & Sendorek’s attorneys filed a FDCPA lawsuit against Westward in federal court. The manager filed a motion to dismiss, arguing that it is not a “debt collector.” The FDCPA has an exception for collections activity that is “incidental to a bona fide fiduciary obligation.” 15 U.S.C. Sect. 1692a(6)(F). A fiduciary is someone, such as a trustee or corporate director, who owes a high standard of care in managing someone else’s money or property.

Westward argued that its debt collection activity was only one of many duties it had to the association. The owners argued that this exception did not apply because the debt collection was central to the fiduciary obligation, not incidental. In his July 24, 2014 decision, Judge Edmond Chang rejected the owners’ argument on the grounds that Westward had numerous non-financial, managerial obligations to the association.

Alternatively, the owners argued that the debt collection activity was entirely outside the scope of Westward’s Management Agreement with the association and thus was not “incidental to” the fiduciary obligation. This written agreement specifically excluded collection on delinquent assessments and charges except for FDCPA notices. Westward separately billed the association for the collections activity at issue in the case.

The Court found that if Westward indeed acted outside the scope of the Management Agreement, the incidental-to-a-fiduciary-obligation exception would not apply. This case illustrates why an association’s property manager does not enjoy “automatic” exception from the FDCPA. In each case where the manager asserts this defense, courts will review the Management Agreement and related facts and determine: (a) whether the FDCPA would apply absent the exception; (b) if the manager has a fiduciary obligation to the association; (c) the nature and scope of that fiduciary obligation; and (d) the relationship between the debt collection activity in the case and that fiduciary obligation. The Westward case demonstrates the challenges to homeowners in bringing a successful FDCPA claim against a property manager.

Fiduciary Duties.

Westward sought refuge from the FDCPA under the “fiduciary” exception. Most service providers try to avoid designation as a fiduciary. Fiduciaries owe strict duties to their beneficiaries. If the court deems that there is more than one beneficiary, the court may apply a duty to the fiduciary to act impartially between them. A fiduciary may be liable to a beneficiary for a claim for Breach of Fiduciary Duty. Over the years, the General Assembly has enacted legislation imposing special duties on other types of fiduciaries, such as trustees in foreclosures and estates.

Foreclosure Trustee as Debt Collectors.

Just because a debt collector is a fiduciary doesn’t mean that he is excepted from FDCPA compliance. For example, the FDCPA applies when lawyer debt collectors act as trustees in residential foreclosures where the communications include a demand for payment. Courts have found that a debt collection attorney’s activity as a foreclosure trustee isn’t incidental to the fiduciary obligation; it is central to it. The foreclosure trustee debt collector must refrain from continuing foreclosure proceedings or litigation activity until the debt verification requirements are met. In a foreclosure sale, the debt collection attorney obtains cash applied in satisfaction of the debt. A foreclosure trustee has fiduciary obligations that go beyond merely collecting the purchase price. A foreclosure trustee has a broad set of duties under the loan documents to prepare for the sale, conduct it, and disburse the proceeds properly. While association property managers and foreclosure trustees are different types of fiduciaries, in both examples the professional has a broad set of obligations impacting more than one party.

Whether debt collection activity conducted by an association’s manager is non-abusive or “incidental to a fiduciary obligation” requires independent analysis in each case. Boards, homeowners and property managers must familiarize themselves with debt collection laws and the management agreement to determine whether the manager must comply with the strict standards of the FDCPA. If an association’s property manager is engaging in improper collections activity against you, contact a qualified attorney to discuss your rights.

Cases:

Welnowska v. Westward Management, Inc., No. 13C06244 (N.D.Ill. July 24, 2014)

Townsend v. Fed. Nat’l. Mortg. Ass’n, 923 F. Supp. 2d 828 (W.D.Va. 2013)

Photo credit (does not depict property discussed):

January 16, 2015

Federal Regulation of Nonjudicial Residential Foreclosure

Foreclosure of residential real estate is traditionally based on state law and agreements between the borrower and lender in the loan documents themselves. Each state has its own rules governing whether foreclosure should occur in or out of a court proceeding. In Virginia, the vast majority of foreclosures occur in bank-appointed trustee’s sales. State and federal courts review and supervise this activity through lawsuits brought by one or more of the parties, usually borrowers seeking to set aside trustee’s sales. However, they resist efforts to transform the foreclosure process into a judicial one, ruling on various motions brought early in cases.

The mortgage crisis is a national concern involving federal policies promoting home ownership. Is there a federal regulation of nonjudicial residential foreclosure? Through supervision of the mortgage giants Fannie Mae, Freddie Mac, and other administrative programs, the federal government is invested in the mortgage origination process. In some cases, a federal agency takes direct title to distressed home loans or the foreclosed real estate itself. I have written about some of those cases in the past few months. For example, Fannie Mae and Freddie Mac enjoy property recording tax exemptions. Also, in states like Nevada that allow homeowners associations to foreclose, government agencies find themselves in title litigation when properties are assigned to them pursuant to the terms of federal mortgage programs. In the event of default of a loan tied to a federal program, the government may find its interests aligned more on the creditor’s side.

Foreclosure is one of many remedies available to lenders to collect on defaulted home loan debt. For over 30 years, Congress has come to the aid of consumers in debt collection matters. In 1977, Congress enacted the Fair Debt Collections Practices Act to curb abusive practices by the debt collection industry against consumers. The FDCPA also has the effect of benefiting non-abusive debt collectors harmed by violating competitors. Since its enactment, Congress and the federal courts have clarified the FDCPA’s role in regulating debt collection law firms’ activity obtaining foreclosure sales and deficiency money judgments. Since an attorney’s sale of distressed Virginia real estate in a trustee’s auction is an activity outside of the traditional perception of debt collection, the role of the FDCPA in foreclosure practice has been relatively unclear until the past few years, when a slew of foreclosure contest lawsuits have tested the utility of the statute.

The FDCPA applies to lawyers collecting on home loan debts, not just non-attorney debt collection agencies. Federal courts in Virginia have recognized that the Act also applies when lawyer debt collectors act as trustees in residential foreclosures where the notices include a demand for payment. These consumer protection laws regulate, among other things, the communications between the debt collector and the consumer. In order to conduct a foreclosure practice, the attorney must send notices to the borrower. The FDCPA may provide independent causes of action against the attorney found to have engaged in abusive practices. FDCPA issues thus pervade residential foreclosure matters. Consumers, lenders, and their attorneys must be aware of how this Act affects a contested foreclosure matter. There are many ways the FDCPA may be violated in a foreclosure matter, including the following:

False Representations. Under ordinary circumstances, it is difficult for a party to prove that they are entitled to relief because their opponent is allegedly lying, cheating or stealing. These are weighty accusations; the standard for proof is high, and the defenses are many. In 15 U.S.C. § 1692e, the FDCPA changes the rules of the game in the consumer debt collection context. The consumer doesn’t need to prove that he was actually deceived by the misleading communication. Instead, the consumer must show that false representations in a debt collection communication materially affects a consumer’ ability to make intelligent decisions with respect to the alleged debt. The courts apply a “least sophisticated consumer” standard to alleged false representations. This tends to prevent application of 20/20 hindsight in the interpretation of correspondence. The court will consider whether the correspondence is susceptible to more than one interpretation, one of which is misleading. Between the FDCPA, the Deed of Trust and state law, the debt collection law firm and attorney foreclosure trustee have multiple compliance obligations in preparing correspondence to the borrower.

Validation Notices. The FDCPA goes beyond prohibiting false representations. In 15 U.S.C. § 1692g, Congress mandates that disclosures be put into debt collection correspondence. In nonjudicial foreclosure, notices to the borrower are an essential element of the process. The initial communication must contain several messages, including, but not limited to:

[A] statement that if the consumer notifies the debt collector in writing within the thirty-day period that the debt, or any portion thereof, is disputed, the debt collector will obtain verification of the debt or a copy of a judgment against the consumer and a copy of such verification or judgment will be mailed to the consumer by the debt collector[.]

If the debtor asks for verification of the debt, the collector must cease all collections activity until the verification is made. This not only means ceasing telephone calls, letters and collections lawsuits; it also includes the nonjudicial foreclosure activity.

Since foreclosures are typically conducted by law firms that exclusively pursue debt collection activity, these provisions of the FDCPA have served as the basis for class action lawsuits. Through the FDCPA, the federal government is heavily involved in regulation of nonjudicial, residential foreclosures. Borrowers, banks and their attorneys must be cognizant of the government’s role as regulator of collection of home loans and sometimes as assignee of mortgage debt or foreclosed real estate. Ironically, consumer protection attorneys are litigating FDCPA claims in federal courts against attorneys for their debt collection work on behalf of federally subsidized mortgage giants.

Case: Townsend v. Fed. Nat’l. Mortg. Ass’n, 923 F. Supp. 2d 828 (W.D.Va. 2013).

Photo Credit: taberandrew via photopin cc (to my knowledge, this property is not the subject of the cases referenced herein or any other foreclosure or debt collection proceeding)

January 8, 2015

Attempt to Relitigate Foreclosure in Bankruptcy Sanctioned by Judge

In Virginia, borrowers have several options of where to bring a legal challenge to a foreclosure trustee’s sale. The shortest commute is usually the Virginia circuit court for the city or county where the property is located. Alternatively, the facts may allow suit to be brought in a federal district courthouses. Another common venue is federal bankruptcy court.

On June 18, 2014, I posted an article about a borrower, Rachel Ulrey, who managed to keep her foreclosed real estate because the lender, SunTrust Bank, failed to object to the plan in time. Ulrey’s case is a cautionary tale to lenders. Other cases show why borrowers cannot rely on lender inattention as a legal strategy. On November 12, 2014, U.S. Bankruptcy Judge Kevin Huennenkens issued an opinion illustrating why parties and their attorneys may not bring the same claim in bankruptcy court after they fail to achieve their desired result in a Virginia state court. The borrower and his attorney found their attempt to relitigate foreclosure in bankruptcy sanctioned by the judge.

Michael Pintz owned property in Sussex County, Virginia, in the name of Michael’s Enterprises of Virginia, Inc. In June 2008, he took out a $200,000 mortgage from Branch Banking & Trust. After he defaulted on payment, BB&T obtained a money judgment in Hanover Circuit Court. When BB&T sent Michael’s Enterprises a Notice of Foreclosure, he filed a request in Sussex Circuit Court to block the threatened sale. That court denied the motion. BB&T later purchased the property at a November 2013 Trustee’s Sale. In February 2014, Michael’s Enterprises filed for Chapter 11 reorganization in the U.S. Bankruptcy Court. The petition claimed the Sussex property as an asset of the corporation.

You may be wondering whether bankruptcy petitions can be used this way. When a court finds that someone filed something for an improper purpose, it may award litigation sanctions. State and federal courts in Virginia have similar rules prohibiting parties and their attorneys from advancing legal claims and defenses for improper purposes and not to vindicate the rights described in the court filing. Improper purposes include but are not limited to harassment, unnecessary delay or needless increase in the cost of litigation.

BB&T brought a Motion for Sanctions for Violation of Bankruptcy Rule 9011. The Bankruptcy Court initially deferred BB&T’s request for sanctions. Judge Huennenkens gave Michael’s Enterprises an opportunity to submit a proper bankruptcy reorganization plan before ruling on the sanctions request. The conditions imposed were not met. In October 2014, the bankruptcy court dismissed Michael’s Enterprises’ petition.

The court granted the lender’s renewed motion for sanctions. Judge Huennenkens observed that Michael’s Enterprises had had an opportunity in Virginia state court to litigate the same objectives sought in the bankruptcy petition. The court saw the new lawsuit as an attempt to attack the Virginia court’s decision and the nonjudicial foreclosure. The bankruptcy opinion doesn’t mention this, but if a party believes that a trial court made an erroneous decision, their recourse is to file a motion to reconsider and/or appeal it to the Supreme Court of Virginia. A bankruptcy court may be able to discharge or reorganize debts reduced to court judgments. However, they usually do not allow parties a do-over of unfavorable results of a state court case. Michael’s failure to present a proper reorganization plan in the face of a sanctions request made a poor impression. Judge Huennenkens found the case to be for an improper purpose and awarded BB&T $10,000 in sanctions against Michael’s Enterprises, Michael Pintz, individually, and his attorney. As of the date of this blog post, this result is currently on appeal before the U.S. District Court for the Eastern District of Virginia.

A common mistaken belief about litigation sanctions is that they are proper whenever a party or attorney loses in court. However, it is common for borrowers in foreclosure contest lawsuits have their cases dismissed on the merits or procedural grounds. Usually, the cases are brought as good faith attempts to obtain relief on the facts and circumstances of the foreclosure proceedings. In Michael’s Enterprises, however, the record of the state court actions together with the absence of a reorganization plan added up to an award of attorney’s fees, not only against the property owner but also its sole shareholder and the attorney. The facts of each case are different and require investigation and research before employing a legal strategy.

Case Citation: Branch Banking & Trust Co. v. Michael’s Enterprises of Virginia, Inc., et al, No. 14-30611-KRH (Bankr. E.D. Va. Nov. 12, 2014).

Photo Credit: taberandrew via photopin cc